#FTSE #Gold

Here in Argyll, Scotland, there’s something assuring when yachts start to appear at their moorings outside on the sea. The last few years of lockdowns almost felt the absence of boats was like the first buds of spring missing but this week has seen a new vessel every day. Will the FTSE ever show signs of sprouting into a new era?

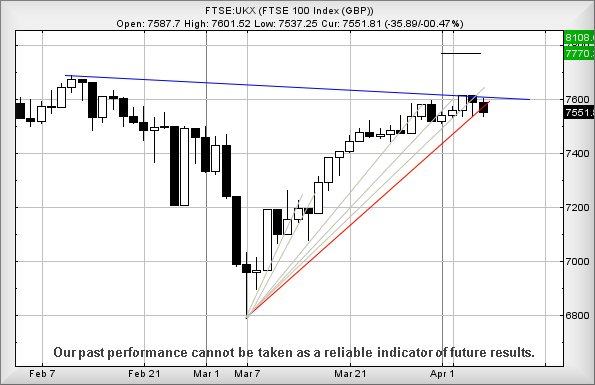

FTSE Bigger Picture Okay, it’s an exceedingly tenuous excuse to justify a moorings snapshot at (an absolutely freezing) dusk tonight but despite the FTSE proving less than flamboyant recently, market movements during March are giving some hope the index may indeed bud this spring. Firstly, there’s the issue of the pre-Russia high of 7,500 points.

The market has challenged and exceeded this high repeatedly since the 3rd week of March. This tends suggest the market is poised, simply awaiting good news to exhibit some decent acceleration. From a Big Picture perspective, we continue to show the 8,100 point level as exerting an attraction to the index.

Also, when we review the uptrend since the Russia low of March 7th, on every occasion the market broke its immediate uptrend, the market also nudged higher than the level of trend break within a couple of sessions. In addition to telling us the previous uptrend was “tosh”, it also implies hidden strength. Trading around 7,543 points at time of writing, the index only need better 7,565 to signal any immediate reversals should prove short lived and further uphill nudges are expected. Perhaps importantly, any nod in the right direction now exceeding 7,615 should probably be taken seriously, implying a cycle to 7,770 with secondary, if bettered, at 8,100, is commencing.

FTSE Nearer Term From a near term perspective, the crazy situation remains of us hoping for the best, every time the FTSE does its worst. In reality, everything doubtless depends on the Russia/Ukraine situation but a near term scenario, allowing weakness below 7,536 to make an attack on 7,518 calculate as possible, risks presenting early warning, if any real trouble is coming. Our secondary calculation, should 7,518 break, works out at 7,468 points and hopefully a rebound.

Our converse scenario for gains is proving a little difficult to suggest. The first week of April has seen the market perform in a strange manner, almost as if the Blue downtrend on the chart below is actually a hard and fast rule, something the UK index is prohibited from crossing. The immediate situation presents a scenario, where above 7,583 points is supposed to inspire movement to an initial 7,618 points. If bettered, our secondary is at 7,631 points. Neither ambition is particularly stunning but as both targets come with the implication of a break above Blue, we’re lacking confidence. Unless, of course, something perceived as positive happens with Russia, in which case any near term movements should rapidly be overwhelmed by the bigger picture taking over.

Ripple (XRPUSD)

The last year has seen Ripple behaving in a quite boring fashion but equally, managing to avoid some of the major pratfalls experienced by popular Crypto’s. However, as the chart shows, this is approaching a crisis level, a point where traders will make assumptions should it exceed the Blue downtrend, something which has been quite neatly defined since the start of 2021.

Keeping with the maritime theme, if Ripple decides to make waves and exceed just 0.91, we can calculate the potential of rapid acceleration up to 1.17 next with secondary, if bettered, at a longer term 1.44 and a challenge against the long term downtrend which dates back to 2018.

The market would require travel below 0.63 to give cause for alarm, breaking Red and suggesting an unpleasant bottom target at 0.40.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:46:16PM | BRENT | 101.18 | 98.2 | 95.745 | 101.65 | 103.3 | 104.635 | 101.74 | Shambles | ||

| 10:47:53PM | GOLD | 1932.04 | 1920 | 1917 | 1928 | 1938 | 1942 | 1929 | |||

| 10:50:04PM | FTSE | 7605.2 | 7531 | 7503 | 7576 | 7614 | 7621 | 7580 | ‘cess | ||

| 10:53:12PM | FRANCE | 6522 | 6428 | 6387 | 6527 | 6588 | 6623 | 6499 | |||

| 11:06:03PM | GERMANY | 14200 | 14032 | 13943 | 14148 | 14318 | 14338 | 14190 | ‘cess | ||

| 11:08:01PM | US500 | 4501.37 | 4448 | 4424 | 4482 | 4520 | 4532 | 4484 | |||

| 11:10:00PM | DOW | 34584 | 34170 | 34139 | 34460 | 34700 | 34788 | 34481 | |||

| 11:12:12PM | NASDAQ | 14537 | 14314 | 14235 | 14514 | 14621 | 14713 | 14462 | ‘cess | ||

| 11:14:45PM | JAPAN | 27042 | 26790 | 26522 | 27080 | 27242 | 27421 | 27004 | ‘cess |

7/04/2022 FTSE Closed at 7551 points. Change of -0.47%. Total value traded through LSE was: £ 6,503,801,029 a change of -11.79%

6/04/2022 FTSE Closed at 7587 points. Change of -0.34%. Total value traded through LSE was: £ 7,373,306,998 a change of -8.37%

5/04/2022 FTSE Closed at 7613 points. Change of 0.73%. Total value traded through LSE was: £ 8,046,795,473 a change of 61.76%

4/04/2022 FTSE Closed at 7558 points. Change of 0.28%. Total value traded through LSE was: £ 4,974,492,195 a change of -8.16%

1/04/2022 FTSE Closed at 7537 points. Change of 0.29%. Total value traded through LSE was: £ 5,416,602,044 a change of -16.69%

31/03/2022 FTSE Closed at 7515 points. Change of -0.83%. Total value traded through LSE was: £ 6,501,691,261 a change of -12.58%

30/03/2022 FTSE Closed at 7578 points. Change of 0.54%. Total value traded through LSE was: £ 7,437,044,011 a change of -7.97%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:DGE Diageo** **LSE:HSBA HSBC** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:PHP Primary Health** **LSE:TRN The Trainline** **

********

Updated charts published on : Aston Martin, Avacta, Astrazeneca, Barclays, British Telecom, Caspian, Diageo, HSBC, Intertek, National Glib, Omega Diags, Primary Health, The Trainline,

LSE:AML Aston Martin Close Mid-Price: 879.4 Percentage Change: -2.64% Day High: 936.6 Day Low: 872.6

If recent price movements are anything to go by, AML are due a dodgy weeke ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 89 Percentage Change: + 28.99% Day High: 89.5 Day Low: 67.5

Target met. Continued trades against AVCT with a mid-price ABOVE 89.5 sho ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 10668 Percentage Change: + 1.97% Day High: 10680 Day Low: 10526

Target met. In the event of Astrazeneca enjoying further trades beyond 10 ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 140.58 Percentage Change: -1.93% Day High: 145.1 Day Low: 140.06

Target met. In the event Barclays experiences weakness below 140.06 it ca ……..

</p

View Previous Barclays & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 188.45 Percentage Change: + 1.24% Day High: 191.1 Day Low: 185.45

Continued trades against BT.A with a mid-price ABOVE 191.1 should improve ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.15 Percentage Change: -19.23% Day High: 3.9 Day Low: 3.1

If Caspian experiences continued weakness below 3.1, it will invariably l ……..

</p

View Previous Caspian & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 3994 Percentage Change: -0.42% Day High: 4067 Day Low: 3982.5

Continued trades against DGE with a mid-price ABOVE 4067 should improve t ……..

</p

View Previous Diageo & Big Picture ***

LSE:HSBA HSBC Close Mid-Price: 521.4 Percentage Change: -0.53% Day High: 527.9 Day Low: 520.4

Increasingly it feels like a matter of patience for HSBA, the price now ne ……..

</p

View Previous HSBC & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 5314 Percentage Change: -0.56% Day High: 5360 Day Low: 5288

Further movement against Intertek ABOVE 5360 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1216 Percentage Change: -0.45% Day High: 1235 Day Low: 1213

Target met. All National Glib needs are mid-price trades ABOVE 1235 to im ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 5.15 Percentage Change: -8.04% Day High: 5.75 Day Low: 4.9

Continued trades against ODX with a mid-price ABOVE 5.75 should improve t ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 151.3 Percentage Change: + 0.27% Day High: 152.2 Day Low: 150.2

All Primary Health needs are mid-price trades ABOVE 152.2 to improve acce ……..

</p

View Previous Primary Health & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 279.1 Percentage Change: + 0.50% Day High: 288.3 Day Low: 266.3

Continued trades against TRN with a mid-price ABOVE 288.3 should improve ……..

</p

View Previous The Trainline & Big Picture ***