#FTSE #Gold

Our doom laden outlook against Wall St appeared to strike a few chords, so we guess quite a few folk want to know how bad things could get for the FTSE too, if everything starts to go (even more) horribly wrong with the world. To judge by the number of shares needing updated daily, volatility is currently the name of the game, so perhaps it shall not prove silly to run the numbers against a Big Picture reversal risk.

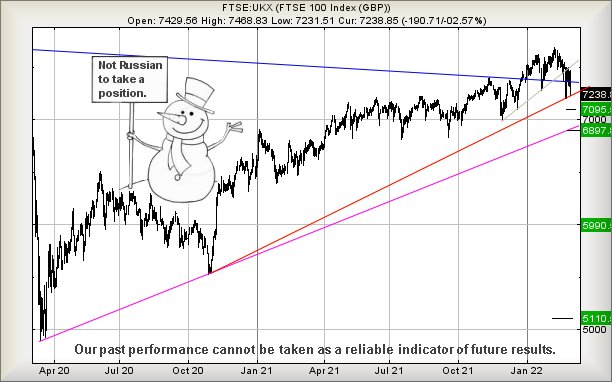

There is a detail worthy of attention currently. It appears, if we pencil in a trend line since October 2020, the UK stock market has carefully adhered to this Red line, needing close today below 7,228 points to indicate the trend failing. However, if the market intends continue its game of chicken with this historic uptrend, there appears a chance today (Friday) should experience some gains.

In fact, if we opt to play safe, below 7,204 (the previous two lows) looks like singing a song of misery, capable of provoking a reversal cycle to an initial 7,095 with secondary, if broken, at 6,897 points. This secondary target is an issue, taking the FTSE marginally below the uptrend since the pandemic low of 2020 and this risks being a serious Red Flag, ensuring the UK is trading in a zone where “bottom” risks being discovered down around 6,000 points. However, it’s important to remember despite an awful week, calamity has not been triggered yet and we’re essentially just playing with numeric potentials.

As for the FTSE near term as opposed to the above Big Picture, there’s a bit of an argument anticipating some FTSE gains. At present, the UK index needs trade above 7,280 to suggest a gap upward at the open should be treated with respect. Such a trigger level allegedly allows for gains toward an initial 7,322 points. If bettered, our secondary calculation brings 7,380 to the table. The tightest stop looks wide at 7,230 points.

Our converse reversal scenario suggests near term movement below 7,230 risks promoting reversal to an initial 7,161 points. If broken, our secondary works out at 7,107 points.

Have a good weekend. Only 2 weeks until the next Formula 1 race, sadly without the entertainment on a Russian driver this year.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:27:02PM | BRENT | 110.07 | 109.12 | 107.78 | 112.3 | 119.3 | 120.865 | 113.6 | ‘cess | ||

| 10:28:44PM | GOLD | 1937.11 | 1921 | 1915 | 1932 | 1942 | 1951 | 1923 | |||

| 10:32:53PM | FTSE | 7257.08 | 7222 | 7207 | 7272 | 7275 | 7315 | 7243 | Success | ||

| 10:37:27PM | FRANCE | 6352 | 6309 | 6278 | 6397 | 6460 | 6482 | 6380 | ‘cess | ||

| 10:44:35PM | GERMANY | 13685.97 | 13598 | 13503 | 13735 | 13799 | 13844 | 13640 | |||

| 10:48:10PM | US500 | 4369.95 | 4343 | 4323 | 4371 | 4424 | 4461 | 4370 | |||

| 10:52:40PM | DOW | 33832.3 | 33661 | 33604 | 33877 | 34186 | 34294 | 33870 | |||

| 10:55:03PM | NASDAQ | 14067 | 13960 | 13841 | 14146 | 14400 | 14544 | 14176 | ‘cess | ||

| 10:56:51PM | JAPAN | 26354 | 26273 | 26071 | 26438 | 26732 | 26925 | 26493 |

3/03/2022 FTSE Closed at 7238 points. Change of -2.57%. Total value traded through LSE was: £ 7,753,530,217 a change of -3.98%

2/03/2022 FTSE Closed at 7429 points. Change of 1.35%. Total value traded through LSE was: £ 8,074,541,610 a change of -5.31%

1/03/2022 FTSE Closed at 7330 points. Change of -1.72%. Total value traded through LSE was: £ 8,527,347,509 a change of -15.97%

28/02/2022 FTSE Closed at 7458 points. Change of -0.41%. Total value traded through LSE was: £ 10,147,661,297 a change of 20.2%

25/02/2022 FTSE Closed at 7489 points. Change of 3.91%. Total value traded through LSE was: £ 8,442,124,681 a change of -14.64%

24/02/2022 FTSE Closed at 7207 points. Change of -3.88%. Total value traded through LSE was: £ 9,889,574,342 a change of 64.76%

23/02/2022 FTSE Closed at 7498 points. Change of 0.05%. Total value traded through LSE was: £ 6,002,308,781 a change of -10.52%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AVCT Avacta** **LSE:BARC Barclays** **LSE:CAR Carclo** **LSE:CPI Capita** **LSE:DARK Darktrace Plc** **LSE:FGP Firstgroup** **LSE:GLEN Glencore Xstra** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:IPF International Personal Finance** **LSE:ITV ITV** **LSE:MKS Marks and Spencer** **LSE:OPG OPG Power Ventures** **LSE:POG Petrop etc** **LSE:POLY Polymetal** **LSE:RMG Royal Mail** **LSE:SBRY Sainsbury** **LSE:SDY Speedyhire** **LSE:TRN The Trainline** **LSE:TW. Taylor Wimpey** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aston Martin, Asos, Avacta, Barclays, Carclo, Capita, Darktrace Plc, Firstgroup, Glencore Xstra, Hargreaves Lansdown, IG Group, International Personal Finance, ITV, Marks and Spencer, OPG Power Ventures, Petrop etc, Polymetal, Royal Mail, Sainsbury, Speedyhire, The Trainline, Taylor Wimpey, Zoo Digital,

LSE:AML Aston Martin Close Mid-Price: 857.2 Percentage Change: -8.59% Day High: 962.6 Day Low: 862

Target met. Continued weakness against AML taking the price below 862 cal ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 1616 Percentage Change: -10.30% Day High: 1800 Day Low: 1607.5

Target met. Weakness on Asos below 1607.5 will invariably lead to 1527 wi ……..

</p

View Previous Asos & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 41.4 Percentage Change: -5.91% Day High: 46 Day Low: 41.25

Continued weakness against AVCT taking the price below 41.25 calculates a ……..

</p

View Previous Avacta & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 168.94 Percentage Change: -4.53% Day High: 174.88 Day Low: 168.28

In the event Barclays experiences weakness below 168.28 it calculates wit ……..

</p

View Previous Barclays & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 24.5 Percentage Change: -13.73% Day High: 26.1 Day Low: 24.9

Target met. Weakness on Carclo below 24.9 will invariably lead to 22p wit ……..

</p

View Previous Carclo & Big Picture ***

LSE:CPI Capita Close Mid-Price: 24.69 Percentage Change: -5.87% Day High: 26.5 Day Low: 24.41

Target met. In the event Capita experiences weakness below 24.41 it calcu ……..

</p

View Previous Capita & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 511.5 Percentage Change: + 11.20% Day High: 553 Day Low: 504

Target met. Further movement against Darktrace Plc ABOVE 553 should impro ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 94.6 Percentage Change: -3.57% Day High: 98.7 Day Low: 93.5

Continued weakness against FGP taking the price below 93.5 calculates as ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 476.5 Percentage Change: + 5.28% Day High: 484.6 Day Low: 467.6

Target met. Continued trades against GLEN with a mid-price ABOVE 484.6 sh ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 995.6 Percentage Change: -6.60% Day High: 1055.5 Day Low: 996.6

If Hargreaves Lansdown experiences continued weakness below 996.6, it wil ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 737 Percentage Change: -3.97% Day High: 772 Day Low: 741

If IG Group experiences continued weakness below 741, it will invariably ……..

</p

View Previous IG Group & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 108 Percentage Change: -1.82% Day High: 113 Day Low: 108.6

Continued weakness against IPF taking the price below 108.6 calculates as ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITV ITV Close Mid-Price: 80.22 Percentage Change: -27.50% Day High: 104.45 Day Low: 80.92

Target met. In the event ITV experiences weakness below 80.92 it calculat ……..

</p

View Previous ITV & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 162.8 Percentage Change: -1.90% Day High: 168.05 Day Low: 162.55

If Marks and Spencer experiences continued weakness below 162.55, it will ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 7.65 Percentage Change: -3.16% Day High: 7.85 Day Low: 7.65

In the event OPG Power Ventures experiences weakness below 7.65 it calcul ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:POG Petrop etc Close Mid-Price: 1.8 Percentage Change: -10.00% Day High: 2.58 Day Low: 1.84

If Petrop etc experiences continued weakness below 1.84, it will invariab ……..

</p

View Previous Petrop etc & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 177.6 Percentage Change: -42.13% Day High: 269.8 Day Low: 166.3

Target Met. This is really bad as the share is effectively trading in “sub ……..

</p

View Previous Polymetal & Big Picture ***

LSE:RMG Royal Mail. Close Mid-Price: 361 Percentage Change: + 0.56% Day High: 370.7 Day Low: 353.9

Target met. In the event Royal Mail experiences weakness below 353.9 it c ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 252.4 Percentage Change: -2.92% Day High: 258.8 Day Low: 253.3

Continued weakness against SBRY taking the price below 253.3 calculates a ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SDY Speedyhire Close Mid-Price: 50.4 Percentage Change: -2.70% Day High: 52.2 Day Low: 50.8

If Speedyhire experiences continued weakness below 50.8, it will invariab ……..

</p

View Previous Speedyhire & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 176.4 Percentage Change: -8.17% Day High: 191.3 Day Low: 172.5

Weakness on The Trainline below 172.5 will invariably lead to 164 with se ……..

</p

View Previous The Trainline & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 138.55 Percentage Change: -4.02% Day High: 149.15 Day Low: 138.55

Target met. In the event Taylor Wimpey experiences weakness below 138.55 ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 107.5 Percentage Change: -3.15% Day High: 111 Day Low: 107.5

If Zoo Digital experiences continued weakness below 107.5, it will invari ……..

</p

View Previous Zoo Digital & Big Picture ***