#FTSE #Nasdaq News of one time footballer, David Beckham, entering the drug trade should probably not be a surprise. From personal experience, use of CBD oil during 2018 provided amazing levels of pain relief, right up until the point the UK Govt stepped in. Despite the product being totally incapable of giving a cannabis “high”, regulations were changed to make it virtually impossible to purchase. Instead, converts could only purchase fake CBD oil from health food stores, a product derived from the hemp plant with absolutely no medical benefits.

The period since 2018 saw the launch of several cannabis focussed listings in Canada and the USA, virtually all of which followed similar share price trajectories with incredible highs when the market took their first breath, followed by incredible lows when the markets realised their was some distance to go in terms of regulation. Cellular Goods Plc (LSE:CBX), a UK listing, appear to be taking advantage of proposed changes to FCA rules, allowing companies to list on the UK stock market if their products have a medical application.

In one respect, Cellular Goods differ from other companies in the field. Their products are synthetic and products in a lab, rather spoiling the illusion the Beckhams will establish cannabis farms in their extensive attic space. It’s interesting the company website suggests focus on beauty and skincare first, then athletic recovery products and this, doubtless, is where the medical application can be found.

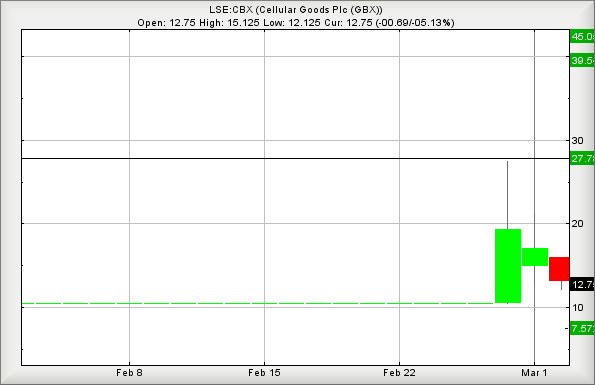

Cellular Goods listing is effectively only three sessions old. If we opt to review the course plotted by Tilray on the Nasdaq or Canopy Growth, the initial launch saw the share price flutter downhill and only once the earliest high was exceeded thereafter, things became very interesting. For Tilray, this meant an eventual rise from 34 dollars to 300 dollars two months later. Then it fell off a cliff. For Canopy Growth, we saw a rise from 25 dollars to 56 dollars. Then it also fell off a (smaller) cliff.

Should Cellular Goods intend a similar route, it’s fairly key the price find sufficient excuse to trade above 27.5p. At present, this looks visually improbable. Currently trading at 12.75p, the share need only fall below 11.25p to doubtless discover a bottom around 7.5p. For the brave, if such a level appears, it will doubtless serve as an ideal entry point for a punt for the longer term.

If we review the first few days trading, the share price needs exceed 16.75p currently, a movement theoretically capable of 27.75p and a nudge above its initial high price. As a result, we can calculate a secondary potential of 39p. The price would need trade above 45p to enter a brave new world, where the sky is the limit.

Do remember, Canadian and US cannabis prices, while doing extremely well in the months following launch, all tend to come off their highs quite brutally.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:30:58PM | BRENT | 62.51 | |||||||||

| 10:32:27PM | GOLD | 1738.72 | |||||||||

| 10:34:29PM | FTSE | 6634.62 | 6550 | 6529 | 6482 | 6598 | 6670 | 6698 | 6780 | 6605 | ‘cess |

| 10:37:44PM | FRANCE | 5811 | |||||||||

| 10:40:23PM | GERMANY | 14037 | |||||||||

| 10:43:11PM | US500 | 3869.59 | |||||||||

| 10:45:01PM | DOW | 31425.4 | |||||||||

| 10:46:47PM | NASDAQ | 13064.92 | 13048 | 12980 | 12863 | 13192 | 13331 | 13444.5 | 13580 | 13189 | |

| 10:48:14PM | JAPAN | 29444 | ‘cess |