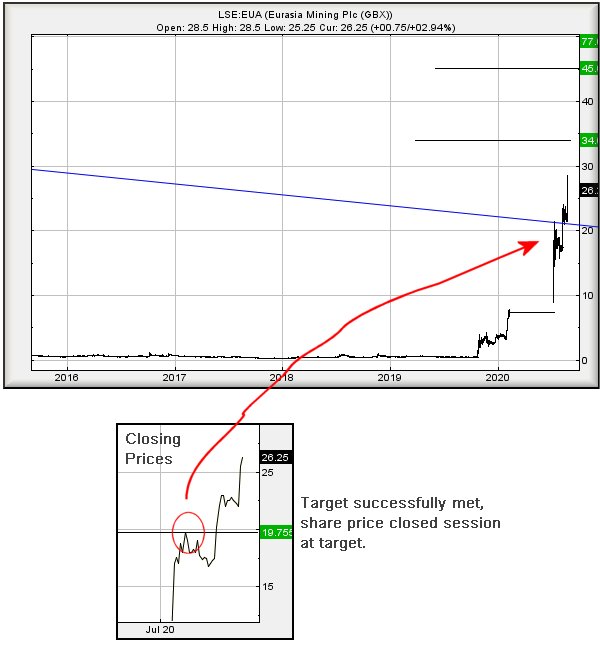

#FTSE #SP500 Every now and them, someone will write “you cannot chart or analyse AIM shares”, neatly ignoring a plethora of evidence to the contrary. Eurasia, which we reviewed it in February, is a case in point as we pointed out 19.75p as a major target level for the future.

The inset on the chart below speaks volumes, rather more eloquently than self proclaimed internet chatroom experts. On July 17th, 5 months following our report at the start of the year, prior to the share price facing suspension and a global pandemic, the price opted to close at our “major target level”. From our perspective, this was a pretty big deal, confirming we’d been mapping the correct trend and also, giving considerable hope for the future if the share price next managed close above our target level.

Thankfully, in the period since, the share has behaved pretty well according to our rulebook, now giving quite considerable hope for the longer term. Hopefully this platinum and gold producer manage to avoid blotting their copy book and continue to enjoy the benefits of metal prices surging to record high levels in a period where reduced fuel costs make extraction and processing an advantageous exercise.

Movement now above 28.5p, the most recent high, calculates with a further growth potential to an initial 34p. Movement above this level should be capable of considerable excitement, our secondary working out at a longer term 45p. Only in the event of closure above 45p dare we mention a further attraction from a distant looking 77p.

The share price currently needs close below Blue on the chart, a downtrend dating back 20 years, before we’d suggest panic. At present, this level is at 21p and there are some quite painful implications with such a move, basically taking the first step on a slippery slope to a meltdown ultimate bottom of 5p. At present, nothing warns of this danger.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:14:05PM | BRENT | 46.42 | ‘cess | ||||||||

| 10:21:51PM | GOLD | 1928.68 | ‘cess | ||||||||

| 10:25:12PM | FTSE | 6055 | 6012 | 5983 | 5907 | 6055 | 6115 | 6123 | 6150 | 6080 | Shambles |

| 11:00:09PM | FRANCE | 5017 | Success | ||||||||

| 11:01:47PM | GERMANY | 13102 | ‘cess | ||||||||

| 11:03:52PM | US500 | 3447 | 3424 | 3416 | 3404 | 3437 | 3452 | 3458.5 | 3470 | 3438 | Success |

| 11:05:42PM | DOW | 28247 | ‘cess | ||||||||

| 11:08:26PM | NASDAQ | 11739 | Sorry | ||||||||

| 11:10:07PM | JAPAN | 23308 | Success |