#Nasdaq #Sp500 #FTSE As we crawl, remorselessly into the jaws of Xmas, the market has already entered “dozy mode”. This is the period of hiatus, when the grown ups have left the building, leaving a bunch of unpaid interns <joke> to man the markets keyboards. The puzzle, usually this boring bit starts on the 24th with a “surprise” flurry of activity 15 minutes before the market closes for the holiday.

All kidding aside, we’re genuinely puzzled at the lack of activity in prices. Financial volumes traded through London have been quite literally record breaking for 2019, since the General Election result was declared. Common sense alone should indicate fireworks but the reality has been somewhat sluggish. Perhaps tomorrow, Friday, the dreaded 3rd Friday of the month and clearing day, shall prove capable of igniting some interest at 10.15am.

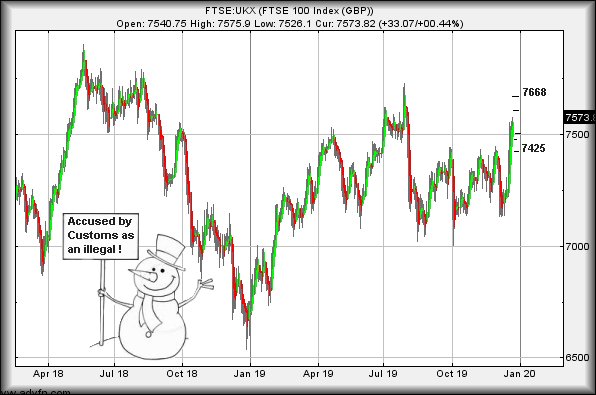

At present, the FTSE certainly appears poised for some action as movement now above 7577 points (we are talking about the FTSE, not after hours futures) looks very capable of a surge upward to an initial 7607 points. If exceeded, our secondary calculation is at 7668 points. If triggered, visually the tightest stop should be 7500 but, to be real, 7530 should suffice if the market plays by the rules.

The surprising thing since the Conservative victory in England comes from our Big Picture calculation, this now firmly promoting 7750 as a danger level when the market almost must should experience some volatility.

To suggest concern, the index needs fail below 7526, this looking capable of triggering reversal to an initial 7504 points. If broken, secondary comes in at 7476 points though, if some grotty news breaks, it could quickly crash down to 7425 points.

We’re only giving the down criteria as a sort of CYA exercise as the FTSE appears to be enjoying some strong upward forces, for the present. Perhaps this is one of these “Santa Rally” things!

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:46:43PM |

BRENT |

66.08 |

65.56 |

65.265 |

66.09 |

66.3 |

66.59 |

65.84 |

‘cess | ||

|

10:49:05PM |

GOLD |

1478.68 |

1473 |

1471 |

1477 |

1481.6 |

1483.5 |

1477 | |||

|

10:52:45PM |

FTSE |

7572.6 |

7523 |

7513.5 |

7574 |

7586 |

7604.75 |

7522 |

Success | ||

|

10:54:36PM |

FRANCE |

5969 |

5941 |

5937 |

5980 |

5975 |

5980 |

5955 |

Shambles | ||

|

10:57:01PM |

GERMANY |

13228 |

13139 |

13093 |

12340 |

13251 |

13287.5 |

13152 |

‘cess | ||

|

10:59:15PM |

US500 |

3207.5 |

3189 |

3182 |

3199 |

3209 |

3212.5 |

3187 |

Success | ||

|

11:01:22PM |

DOW |

28393 |

28235 |

28173 |

28317 |

28396 |

28411 |

28251 |

Success | ||

|

11:03:41PM |

NASDAQ |

8645.9 |

8562 |

8538 |

8630 |

8652 |

8676.25 |

8556 |

Success | ||

|

11:07:00PM |

JAPAN |

23848 |

23793 |

23693 |

23930 |

23931 |

23959.5 |

23800 |

‘cess |