#Nasdaq #Dax As the latest company to discover “accounting errors”, Saatchi share price has plummeted and prompted a few emails. One puzzle has been finally answered, the reason why large corporate accountants seem to change their names? After all, being associated with a major ‘oops’ certainly justifies a swift adjustment of identification. The current acronyms investigating Saatchi, PwC, were brought in once the previous acronym KPMG were dismissed.

Perhaps someone at KPMG shall now suggest the company use their full name in future, to dissociate themselves from the Saachi debacle. After all, Price Waterhouse Coopers successfully left a few scandals behind with their rebranding… All joking aside, there are currently just 4 true international auditors, 3 of which are UK based with KPMG being Netherlands. Corporate bodies are not spoiled for choice, when choosing their auditors.

The writer should perhaps admit to grinding an axe, once paying a large tax sum which could have been substantially reduced, blissfully unaware corporate accountants (mentioned previously) were treating his personal tax liability as “small fry”. Twenty years later, it still irritates.

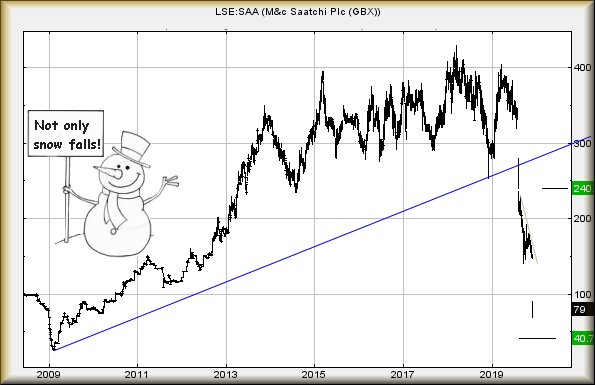

Saatchi share price movements, while dire, appear to be provoking discussion about a possible takeover attempts anytime now. From our viewpoint, the share has not yet reached bottom as it appears on track for 40p. Certainly, we would expect a bounce around such a level, if only due to it being impossible to calculate below such a point. To get out of trouble, any miracle rebound needs exceed 161p currently, visually an impossible task without the presence of game changing news.

We suspect, quite strongly, this shall prove worth keeping a close eye on in the days/weeks ahead. While the low on the 4th of 69p was certainly “close” to our 40p calculation, from an immediate perspective below 69p should initially target 63p as “last chance saloon”. If 63p breaks, a journey down to the 40p level looks inevitable.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:43:01PM |

BRENT |

62.89 |

Success | ||||||||

|

11:02:16PM |

GOLD |

1475.41 | |||||||||

|

11:04:07PM |

FTSE |

7196.15 | |||||||||

|

11:06:35PM |

FRANCE |

5808.8 |

Success | ||||||||

|

11:09:21PM |

GERMANY |

13155.74 |

13022 |

12964.5 |

12895 |

13088 |

13174 |

13208.25 |

13249 |

13098 |

‘cess |

|

11:11:09PM |

US500 |

3111.42 |

‘cess | ||||||||

|

11:14:08PM |

DOW |

27653.6 |

Success | ||||||||

|

11:16:24PM |

NASDAQ |

8298.07 |

‘cess | ||||||||

|

11:18:48PM |

JAPAN |

23355 |

23172 |

23119.5 |

23033 |

23313 |

23379 |

23416 |

23591 |

23236 |