#CAC40 #DOW It was amusing, seeing the UK stock market celebrate the resignation of Ruth Davidson (their “leader” in Scotland) with a fairly substantial upward day. Her main claim to fame was eradicating the word “Conservative” from leaflets, replacing it with the silly ‘Ruth Davidsons Party’. Vote share didn’t change, even slightly, and the Conservatives remained languishing in the gutter, out of power in Scotland since 1955. Somehow, the media never mention that detail. Then again, perhaps the UK market rise was influenced by Trump and his stance against China as he once again made a tariff threat, trashed the markets, allegedly rescinded the threat, and markets were happy again.

Or are they?

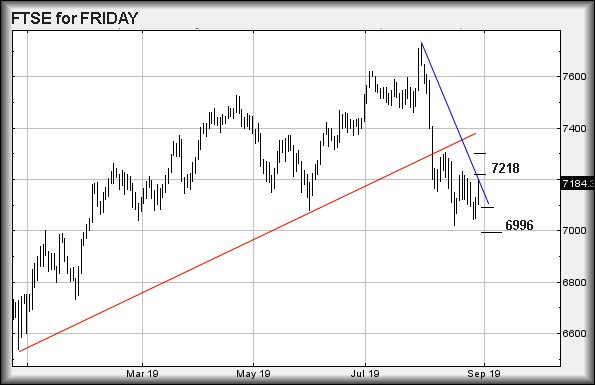

The FTSE experienced a flamboyant day by any standards but we’re concerned it did not exceed 7,200 points. The high of the day proved to be 7,199 and while market futures hit out initial lunchtime projection pretty exactly, we were not filled with confidence, instead worrying the FTSE was simply going through the motions in sympathy to other world markets. Basically, we would have expected better on the day. We mentioned recently our rule of thumb, where an initial surge exceeding a target gives a pretty solid clue for what’s coming next. While the FTSE matched our target on the initial surge, it failed to better it. Even FTSE futures, normally gifted with excess, only achieved 7200.08 on the initial surge to target.

We’re therefore not bursting with optimism for Friday.

Movement on the FTSE above 7,201 should reach a boring sounding 7,218 points. If exceeded, life becomes more interesting as the secondary calculates at an amazing 7,301 points! Visually, we would expect some hesitation around the 7,237 mark, due to the presence of prior highs recently.

If triggered, the very tightest stop is at 7,163 points but realistically, we’d prefer wider at 7,144 points – or even 7,126 if embracing true paranoia.

What happens if the FTSE breaks below 7,126 points? The next bit requires a stop level at 7,190 points.

Initially, we’re calculating the potential of reversal to an initial 7,089 points. At this point, it gets nasty as any break below this level risks a longer term cycle down to 6,996 points.

Importantly, we’re at the end of a month and things tend finish with a flourish.

It’s the Belgian GP this weekend, welcome relief from the chaos which is apparently the UK.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:33:38PM |

BRENT |

60.41 | |||||||||

|

10:35:19PM |

GOLD |

1528.43 |

Sorry | ||||||||

|

10:44:19PM |

FTSE |

7189 |

Success | ||||||||

|

10:48:13PM |

FRANCE |

5448 |

5396 |

5386.5 |

5362 |

5440 |

5460 |

5479 |

5525 |

5397 |

Success |

|

10:49:58PM |

GERMANY |

11859 |

Success | ||||||||

|

10:56:54PM |

US500 |

2923.87 |

Success | ||||||||

|

10:59:07PM |

DOW |

26359 |

26145 |

26061.5 |

25945 |

26346 |

26411 |

26496.5 |

26659 |

26240 |

Success |

|

11:01:23PM |

NASDAQ |

7702 |

Success | ||||||||

|

11:03:29PM |

JAPAN |

20676 |

Success |