#CAC40 #SP500 Sometimes, passengers in an aircraft experience an awful moment on the ground, waiting to disembark. An announcement says there will be a delay “of just a few minutes” and seasoned travellers know what that really means. Today, Tuesday, passengers in TCG’s share price disaster (prior successful report link) must have felt a similar emotion, the price looking like it was about to recover, then a “gotcha suckers” drop!

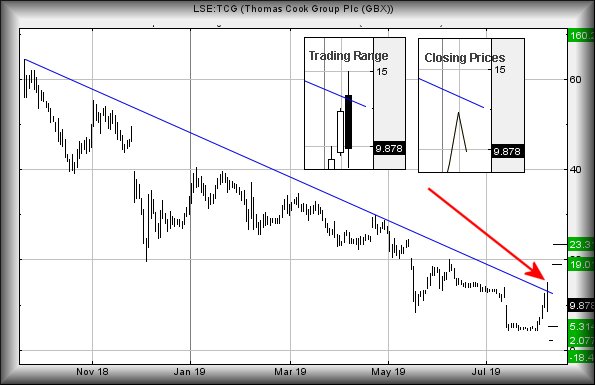

Over the years, we’ve warned repeatedly about the dangers of opening second spikes in a share. These price movements can run in either direction but our rule of thumb is of a spike down signalling a coming upward movement. Obviously, the converse is true for a spike up. TCG was spiked to 15p, curiously NOT in the opening second but rather, twelve minutes after the market opened. While perhaps this indicates a change in market strategy (as we’ve seen this a few times in the last month) but regardless, the effect was pretty dire and allows Thomas Cook to experience a trading range of 65.08% for Tuesday. It was virtually impossible to allocate a sensible stop loss, regardless of which direction you thought it was going and perhaps this was the markets idea.

We’ve a bit of in-house mumbo jumbo now warning of danger, if Thomas Cook somehow makes it below 7.65p. Apparently, this will be a bad thing and calculates with the potential of travel down to an initial 5.3p. If broken, secondary is at 2p and hopefully bottom. Ultimate bottom is MINUS 18p (not possible).

However, for now I suspect holders of TCG are simply stuck on board, awaiting something positive happening. Price movements on the 6th August did suggest a holding pattern was being employed. If this is indeed the case, anything now exceeding 13.6p is liable to prove useful, bettering the BLUE downtrend and calculating with the potential of 19p next. If bettered, our secondary is at 23.3p and an almost certain hesitation in the recovery cycle.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:57:00PM |

BRENT |

58.49 |

‘cess | ||||||||

|

10:10:16PM |

GOLD |

1475.06 | |||||||||

|

10:12:41PM |

FTSE |

7206.66 | |||||||||

|

10:14:53PM |

FRANCE |

5267.7 |

5228 |

5208.5 |

5179 |

5287 |

5298 |

5319.5 |

5364 |

5243 |

Success |

|

10:28:35PM |

GERMANY |

11629 | |||||||||

|

10:31:09PM |

US500 |

2877.27 |

2830 |

2808 |

2782 |

2861 |

2889 |

2901 |

2925 |

2830 |

‘cess |

|

10:33:35PM |

DOW |

25966 |

Success | ||||||||

|

10:35:44PM |

NASDAQ |

7514.12 |

‘cess | ||||||||

|

10:37:35PM |

JAPAN |

20635 |

Success |