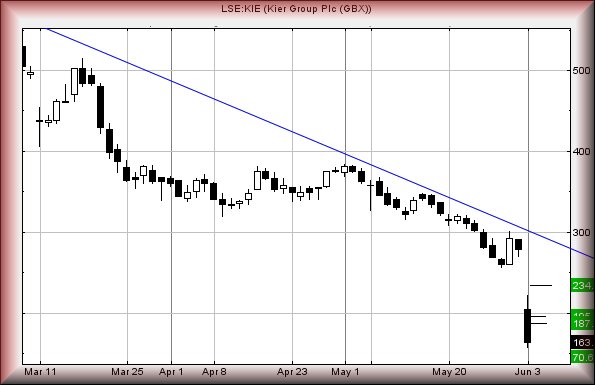

#Gold #SP500 We received a few emails, asking if Kier was at “bottom” following the thrashing their share price received. We suspect last months news of their Finance Director “stepping down” should have provided sufficient warning something was brewing but a minus 41% day was not fun to watch.

Amazingly, there is a chance it has indeed bottomed at 157p and we’d normally hope for a bounce at this level. There is one important warning worthy of consideration and it’s fairly simple. If, for any reason, the price now CLOSES below 157p, we can calculate 70p with some bottoming potentials. And that’s it. Anything else produced now is prefaced with a minus sign.

In normal circumstances, we’d hope 157p shall indeed produce some sort of rebound and anything now continuing above 176.5p calculates with an initial target at 187p. If exceeded, our secondary comes in at 195p. Only in the event of 195p being exceeded dare we start to suspect a rebound shall prove genuine as a surge to 234p becomes possible.

Instead, our suspicion is of 157p being used as “bottom” in the days ahead, essentially permitting the price to bounce around for a while within the 157 to 195 range. By any standards, this looks a fairly useful trading range. But do remember, below 157p and our last chance saloon calculates at 70p.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:44:49PM |

BRENT |

60.65 | |||||||||

|

9:47:36PM |

GOLD |

1325.18 |

1315 |

1311.5 |

1306 |

1322 |

1329 |

1333 |

1337 |

1317 |

Success |

|

9:51:28PM |

FTSE |

7181.49 |

‘cess | ||||||||

|

9:54:52PM |

FRANCE |

5212 |

‘cess | ||||||||

|

9:57:37PM |

GERMANY |

11781 |

‘cess | ||||||||

|

10:00:50PM |

US500 |

2753.47 |

2728 |

2719.5 |

2705 |

2756 |

2759 |

2770 |

2784 |

2730 |

Success |

|

10:03:34PM |

DOW |

24913.3 |

‘cess | ||||||||

|

10:14:41PM |

NASDAQ |

7007 |

Success | ||||||||

|

10:17:06PM |

JAPAN |

20466 |