#Dax #SP500 We remain confused at the debate as to whether the UK should exit the Eurovision Song Contest. Political manoeuvres making the stock market difficult to read, a media similarly confused as to their stance, and a distinct problem with the FTSE at roughly 7442.915 points all conspire to make this Brexit nonsense chaotic.

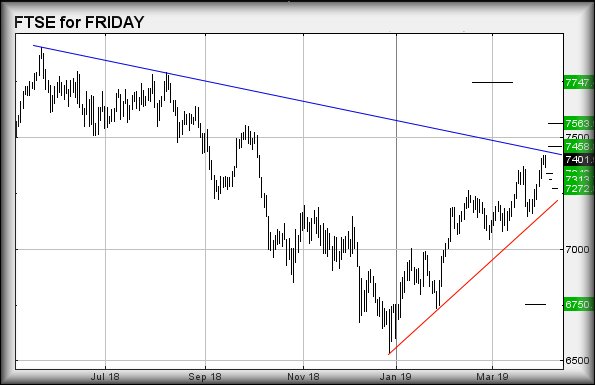

The only thing we’re inclined to take seriously is our 7442 level, this important point in history delineated by BLUE on the chart below. Apparently, the FTSE faces a 300 point rise should the UK market ever stumble above such a point. It’s also worth pointing out the FTSE has experienced an 800 point rise so far this year, a 12.25 gain which is quite at odds with all the predictions of doom.

If the market makes it above 7442, we anticipate a further 300 point gain for the market.

Near term it’s a different story as there’s a risk of weakness establishing. Below 7367 looks capable of reversal to an initial 7340. If broken, our secondary calculates down at 7313 points. Neither reversal ambition presents a real worry as the RED uptrend is presently at 7143 points. But to be honest, we’d have raised eyebrows should anything permit 7313 to break as it will tend suggest weakness becoming established.

Surprisingly, if we ignore the BLUE trend line (presently 7442), the immediate calculation suggests above 7420 should generate lift to 7458 near term. If bettered, secondary is a rather more useful 7563. We have our doubts, especially as the market appears to be giving the BLUE downtrend a body swerve at present, signalling we’re not the only folk with coloured crayons!

We remain suspicious the index will continue oscillate between RED and BLUE until such time someone raised a white flag and surrenders over the Brexit issue, finally allowing direction to make itself known.