#Brent #Dax

Perhaps it will prove silly attempting to use a UK retail bank to gauge how things are going in the world but Natwest is currently offering itself as a remarkable barometer! When we reviewed the share three weeks ago, it hit our initial reversal target of 191p but critically, failed to close below this level. There’s a fair chance this suggestion of strength shall prove a big deal.

We often bang on about how important it can be for a price to exceed a level of “trend break”, effectively broadcasting the previous trend can no longer be relied upon and instead, suggesting a new trend has commenced. Natwest is on the edge of such a momentous occasion, requiring above 231p to give the first glimmer of hope for a future. Apparently this risks triggering a movement to an initial 236p with our longer term secondary, if bettered, coming along at 260p. In an ideal world, we would demand the share actually close a session above 231p before investing in a party popper, especially as the secondary of 260p has the potential to be seriously important for the longer term.

The chart below shows, relatively clearly, the reason for our (vague) optimism. By achieving the 260p ambition, this would take the banks share price above its highest level of 2022, also giving the share price a chance to close a session around the level which defined the long term downtrend (Blue) from as far back as 2007. Price moves such as this will tend make a Big Picture potential for a future at 332p a viable hope.

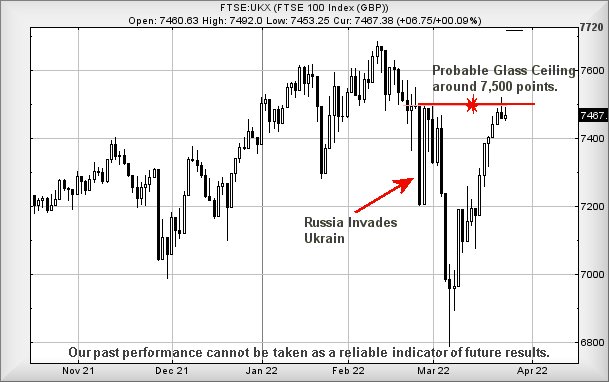

Obviously, all that’s needed will be for Covid to remain invisible, the Russia situation to resolve itself, and the FTSE itself to start behaving with some integrity.

To justify panic, Natwest now needs trade below 191p, movement such as this calculating with a reversal potential to an initial 155p with secondary, if broken, at an eventual bottom (hopefully) down at 125p.

Finally, a long awaited cartilage operation means a plan to return to skiing can be made, unfortunately after a recovery delay of around 6 months. It will certainly be interesting, returning to the slopes without the ever present threat of a guilty left knee collapsing, provoking amusing one legged emergency stops in the most inconvenient places while in utter agony. This is doubly annoying, thanks to snow being forecast locally for the coming week. Today though, it was 18c here in Argyll.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 6:11:39PM | BRENT | 117.07 | 112.3 | 110.67 | 107.36 | 116.2 | 118.1 | 118.9 | 121.1 | 116 | Shambles |

| 6:14:19PM | GOLD | 1958.45 | |||||||||

| 6:17:13PM | FTSE | 7510 | |||||||||

| 6:19:50PM | FRANCE | 6593 | ‘cess | ||||||||

| 9:35:12PM | GERMANY | 14389 | 14243 | 14183 | 14100 | 14350 | 14432 | 14468 | 14561 | 14304 | Shambles |

| 9:37:27PM | US500 | 4542.64 | ‘cess | ||||||||

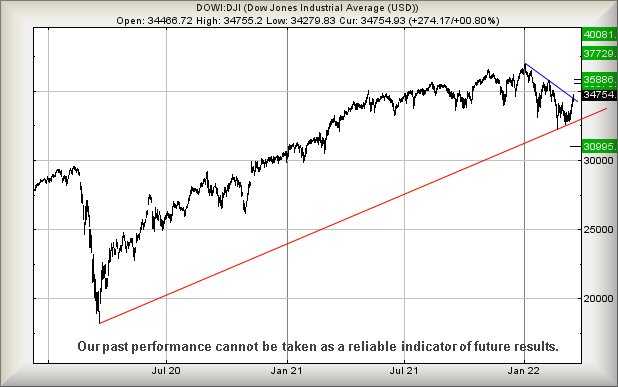

| 9:39:22PM | DOW | 34858 | Success | ||||||||

| 9:41:20PM | NASDAQ | 14752.2 | ‘cess | ||||||||

| 9:42:56PM | JAPAN | 28232 |

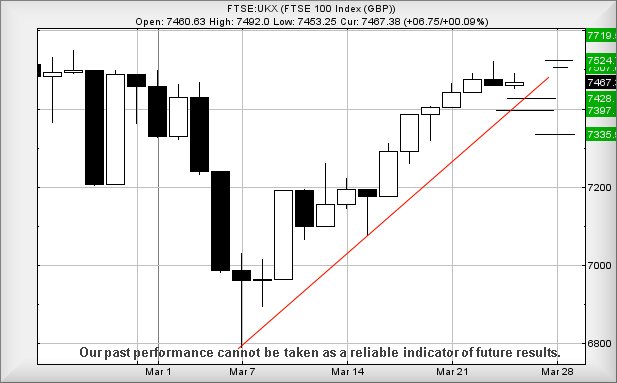

25/03/2022 FTSE Closed at 7483 points. Change of 0.21%. Total value traded through LSE was: £ 6,219,662,517 a change of -9.68%

24/03/2022 FTSE Closed at 7467 points. Change of 0.09%. Total value traded through LSE was: £ 6,886,600,225 a change of 4.56%

23/03/2022 FTSE Closed at 7460 points. Change of -0.21%. Total value traded through LSE was: £ 6,586,106,936 a change of -2.72%

22/03/2022 FTSE Closed at 7476 points. Change of 0.46%. Total value traded through LSE was: £ 6,769,927,193 a change of 15.91%

21/03/2022 FTSE Closed at 7442 points. Change of 0.51%. Total value traded through LSE was: £ 5,840,589,175 a change of -56.99%

18/03/2022 FTSE Closed at 7404 points. Change of 0.26%. Total value traded through LSE was: £ 13,580,954,595 a change of 97.5%

17/03/2022 FTSE Closed at 7385 points. Change of 1.29%. Total value traded through LSE was: £ 6,876,379,438 a change of -21.82%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AZN Astrazeneca** **LSE:BDEV Barrett Devs** **LSE:CNA Centrica** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:PHP Primary Health** **LSE:POLY Polymetal** **LSE:RR. Rolls Royce** **LSE:SRP Serco** **

********

Updated charts published on : AFC Energy, Astrazeneca, Barrett Devs, Centrica, ECO (Atlantic) O & G, Empyrean, Genel, Gulf Keystone, Primary Health, Polymetal, Rolls Royce, Serco,

LSE:AFC AFC Energy Close Mid-Price: 39.75 Percentage Change: -0.62% Day High: 41.4 Day Low: 39.3

Further movement against AFC Energy ABOVE 41.4 should improve acceleratio ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 9843 Percentage Change: + 0.07% Day High: 9934 Day Low: 9797

Target met. All Astrazeneca needs are mid-price trades ABOVE 9934 to impr ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 509.6 Percentage Change: -3.04% Day High: 524.8 Day Low: 504.6

Continued weakness against BDEV taking the price below 504.6 calculates a ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 84.5 Percentage Change: + 2.90% Day High: 84.78 Day Low: 82.04

In the event of Centrica enjoying further trades beyond 84.78, the share ……..

</p

View Previous Centrica & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 40 Percentage Change: + 1.27% Day High: 42.5 Day Low: 39.25

Target met. All ECO (Atlantic) O & G needs are mid-price trades ABOVE 42. ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EME Empyrean. Close Mid-Price: 11 Percentage Change: + 4.02% Day High: 12.05 Day Low: 10.8

Target met. In the event of Empyrean enjoying further trades beyond 12.05 ……..

</p

View Previous Empyrean & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 181.2 Percentage Change: + 1.23% Day High: 184.2 Day Low: 172.4

Target met. Further movement against Genel ABOVE 184.2 should improve acc ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 245.5 Percentage Change: + 1.87% Day High: 246.5 Day Low: 232.5

Continued trades against GKP with a mid-price ABOVE 246.5 should improve ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 149 Percentage Change: + 1.98% Day High: 149.2 Day Low: 146.3

In the event of Primary Health enjoying further trades beyond 149.2, the ……..

</p

View Previous Primary Health & Big Picture ***

LSE:POLY Polymetal. Close Mid-Price: 176 Percentage Change: + 6.02% Day High: 187.7 Day Low: 165

All Polymetal needs are mid-price trades ABOVE 187.7 to improve accelerat ……..

</p

View Previous Polymetal & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 110.14 Percentage Change: + 19.33% Day High: 111 Day Low: 91.06

Target met. Continued trades against RR. with a mid-price ABOVE 111 shoul ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 142 Percentage Change: + 1.57% Day High: 142.5 Day Low: 136.8

Further movement against Serco ABOVE 142.5 should improve acceleration to ……..

</p

View Previous Serco & Big Picture ***