#Brent #DAX

A single sentence on our Friday report summed everything up; “we’re curious about #Ferrari, suspecting they may not be outsiders this time“. It proved the case, the market really did know best, the red team conclusively winning in a fashion not seen since 2019. We’re not exactly great Ferrari fans but prefer seeing them able to properly compete, rather feature in the background. And, of course, we’d cheerfully accept a free new Ferrari. Amusingly, when it comes to buying expensive cars, the “new” Formula One management company, Liberty Media, are doing rather well. Interactive Investor produced a useful video, available at this link. We shall glance at Liberty Media share price in the coming week.

It’s all quite strange, a series of market movements indicating confidence in Ferrari ability. Just how this could be the case utterly defeats. If we were to fully embrace the old adage “The Market Always Knows!”, we’d now be banging a drum in praise of the pandemic being over and matters in Russia/Ukraine resolved in a manner the marketplace wholly approves of. Certainly, Monday should prove interesting with the Moscow Stock Exchange opening for the first time, since Mr Putin fired the metaphorical and literal starting gun for conflict.

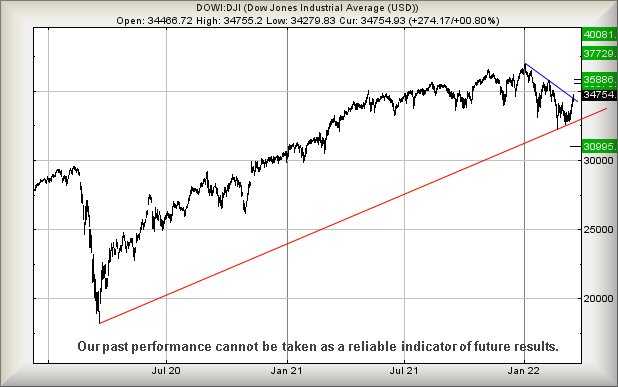

We’re choosing to start the week with the two traditional indicators for “How’s It Going?”, Wall St and the price of Gold. Conventional thinking leans toward Gold being expensive in times of trouble, Wall Street becoming decidedly weak should unrest prevail. At this time, the converse appears true for each derivative, Gold risking weakness, Wall St risking a leap over tall buildings with a single bound.

If we glance at Wall St from a near term and quite conservative perspective, it appears movement now above 34,760 points can easily justify price movement to an initial 35,576 points initially. If exceeded, our ‘longer term’ secondary (a feature which can mean later that week, the way the markets currently behave) works out at 35,886 points. While we’re cheerfully speculating on a potential 1,000+ point rise, the truly important detail comes, should the secondary be exceeded. A miracle such as this dumps the index value in a cycle, where ongoing traffic to 37,729 calculates as possible, a new all time high and once again trapping Wall St in a zone where an eventual 40,100 should be promoted as a level where some future volatility can be expected.

To justify hysterics, Wall St needs drop below 32,750 points, a movement capable of proving a near 2,000 point tumble.

Unlike the current strong Wall St view, Gold appears at risk of experiencing a slight melt down. To be honest, the risk is so obvious, we almost distrust it. The low price for Gold on Wed 16th rather neatly matched a series of price movements at the end of February. It looked like the market was indulging in a pictorial set-up, saying “Watch this, it’s about to make a rock solid ‘lower low’,” in a fashion capable of making traders open shorts, just before a Gotcha spike upward. Regular readers will know we’re painfully suspicious about the precious metal markets, an attitude which is often fully justified. For instance, at time of writing, Gold is trading around $1,925 and we shall not be aghast if it spikes up toward $1,960 prior to a surprise drop. Only above the 1,960 level is a rise liable to prove genuine as it allows a visit to 2,004.

Should we opt to work on the basis of playing safe, apparently it is now the case below 1,897 should trigger Gold price reversal to an initial 1,850 with secondary, if broken, down at a potential bottom of $1,754. Visually, there’s a heck of a strong argument favouring the concept of a bounce at 1,850, thanks to the downtrend since 2020. For some reason, when a price matches a point of trend break, invariably something happens to arrest a drop cycle – but rarely with sufficient strength to make a bounce a long term proposition.

For now, Gold feels like some slight reversal is possible, perhaps coming with comedy but unable to match the TV show, the Marvellous Mrs Maisel which has returned to telly, our guilty secret and better than ever.

Many thanks to the nice folk who discover a fascinating advert on this page. Every click contributes to our morning coffee!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 7:09:46PM | BRENT | 106.43 | 103.5 | 102.15 | 100.29 | 106.59 | 105.45 | 110.48 | 115.51 | 104 | ‘cess |

| 7:36:59PM | GOLD | 1921.5 | Shambles | ||||||||

| 8:03:57PM | FTSE | 7444.47 | |||||||||

| 8:12:28PM | FRANCE | 6647 | ‘cess | ||||||||

| 8:14:27PM | GERMANY | 14465 | 14105 | 14031 | 13875 | 14270 | 14499 | 14582 | 14741 | 14311 | ‘cess |

| 8:16:43PM | US500 | 4461.12 | ‘cess | ||||||||

| 8:19:38PM | DOW | 34723 | |||||||||

| 8:23:39PM | NASDAQ | 14415 | |||||||||

| 8:26:58PM | JAPAN | 27331 | Success |

18/03/2022 FTSE Closed at 7404 points. Change of 0.26%. Total value traded through LSE was: £ 13,580,954,595 a change of 97.5%

17/03/2022 FTSE Closed at 7385 points. Change of 1.29%. Total value traded through LSE was: £ 6,876,379,438 a change of -21.82%

16/03/2022 FTSE Closed at 7291 points. Change of 1.69%. Total value traded through LSE was: £ 8,795,974,053 a change of 28.56%

15/03/2022 FTSE Closed at 7170 points. Change of -0.32%. Total value traded through LSE was: £ 6,841,972,853 a change of 11.2%

14/03/2022 FTSE Closed at 7193 points. Change of 0.53%. Total value traded through LSE was: £ 6,152,854,583 a change of -10.19%

11/03/2022 FTSE Closed at 7155 points. Change of 0.79%. Total value traded through LSE was: £ 6,850,629,560 a change of -15.87%

10/03/2022 FTSE Closed at 7099 points. Change of -1.27%. Total value traded through LSE was: £ 8,142,573,429 a change of 0.69%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AZN Astrazeneca** **LSE:EMG MAN** **LSE:EXPN Experian** **LSE:PHP Primary Health** **LSE:SPX Spirax** **

********

Updated charts published on : Aston Martin, Astrazeneca, MAN, Experian, Primary Health, Spirax,

LSE:AML Aston Martin Close Mid-Price: 914.2 Percentage Change: -0.48% Day High: 957.8 Day Low: 876.4

Following a pretty lacklustre performance in Dubai, we’re now curious as t ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AZN Astrazeneca Close Mid-Price: 9536 Percentage Change: -0.26% Day High: 9650 Day Low: 9511

Target met. All Astrazeneca needs are mid-price trades ABOVE 9650 to impr ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 226.2 Percentage Change: + 1.30% Day High: 228.6 Day Low: 218.4

Further movement against MAN ABOVE 228.6 should improve acceleration towa ……..

</p

View Previous MAN & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3073 Percentage Change: + 1.19% Day High: 3064 Day Low: 2993

In the event of Experian enjoying further trades beyond 3064, the share s ……..

</p

View Previous Experian & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 147.7 Percentage Change: + 0.48% Day High: 147.6 Day Low: 144.1

All Primary Health needs are mid-price trades ABOVE 147.6 to improve acce ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 13070 Percentage Change: + 1.55% Day High: 13105 Day Low: 12755

In the event of Spirax enjoying further trades beyond 13105, the share sh ……..

</p

View Previous Spirax & Big Picture ***