Firstly, Happy Christmas. Today is a short one on the markets, made worse by nothing of consequence usually happening until 12.20 or so, then all the planned movements happening in the final 10 minutes of play. It used to drive us crazy but after last nights events, it become clear a rather relaxed attitude is possible. Perhaps even essential.

The problem was a Murder!

My wife had bought a ridiculously complex Murder Mystery role playing game and insisted, just this once, I participate with our grand-daughters, after dinner. This is the point when an escape to the office was usually desired but “ho hum”, it was only a game. 2 and 1/2 hours later, the lead detective (the 14 year old) successfully presented her case against the killer and the game was over. Then, of course, it was time for Charades. And of course, this provoked a desert of self propelled Karaoke, those who could play an instrument required to provide the music for each tune.

Our impromptu party was a success, neither one of the children being glued to their smartphones as until the end, when they tried to find how “Money Money Money” could be played on guitar or mandolin. Suddenly, it was 2am and a choice awaited, go to the office and do some work or head to bed. This was not a difficult decision, knowing how painful Christmas Eve could be for the market place.

Thus, todays subject is fairly straightforward. It’s the UK Aim and the visuals very strongly imply, if the UK’s junior market manages to close a session above Green at just 800 points, we should anticipate recovery to an initial 845 with secondary, if bettered, at 907 points. Until such time the UK index actually closes above 907 points, we shall be cautious about pointing to happy days ahead with a future 1181 calculating as viable.

And thus, until closure above 907 points is achieved, it will probably be more satisfying spending time with your family or frients.

Best wishes.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 11:47:11PM | BRENT | 6191.4 | 6128 | 6096 | 6060 | 6180 | 6206 | 6221 | 6252 | 6170 |

| 11:16:38PM | GOLD | 4504.68 | 4430 | 4411 | 4377 | 4480 | 4510 | 4526 | 4558 | 4474 |

| 11:21:31PM | FTSE | 6191.4 | 9871 | 9861 | 9847 | 9887 | 9903 | 9925 | 9957 | 9870 |

| 11:28:25PM | STOX50 | 5746.3 | 5742 | 5738 | 5733 | 5751 | 5755 | 5765 | 5778 | 5740 |

| 11:31:26PM | GERMANY | 24318 | 24253 | 24225 | 24179 | 24329 | 24356 | 24368 | 24424 | 24326 |

| 11:55:30PM | US500 | 6905.7 | 6860 | 6841 | 6818 | 6882 | 6910 | 6934 | 7006 | 6862 |

| 11:59:18PM | DOW | 48420.8 | 48208 | 48120 | 47984 | 48355 | 48440 | 48762 | 49084 | 48268 |

23/12/2025 FTSE Closed at 9889 points. Change of 0.24%. Total value traded through LSE was: £ 4,498,839,426 a change of -17.8%

22/12/2025 FTSE Closed at 9865 points. Change of -0.32%. Total value traded through LSE was: £ 5,472,807,622 a change of -68.77%

19/12/2025 FTSE Closed at 9897 points. Change of 0.61%. Total value traded through LSE was: £ 17,521,574,490 a change of 151.82%

18/12/2025 FTSE Closed at 9837 points. Change of 0.64%. Total value traded through LSE was: £ 6,957,992,172 a change of -2.38%

17/12/2025 FTSE Closed at 9774 points. Change of 0.93%. Total value traded through LSE was: £ 7,127,448,786 a change of 18.41%

16/12/2025 FTSE Closed at 9684 points. Change of -0.69%. Total value traded through LSE was: £ 6,019,317,961 a change of 4.57%

15/12/2025 FTSE Closed at 9751 points. Change of 1.06%. Total value traded through LSE was: £ 5,756,132,548 a change of -4.78%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:CCL Carnival** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:HSBA HSBC** **LSE:LLOY Lloyds Grp.** **LSE:OPG OPG Power Ventures** **LSE:SAGA SAGA Plc** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Barclays, Carnival, MAN, Fresnillo, HSBC, Lloyds Grp., OPG Power Ventures, SAGA Plc, Scottish Mortgage Investment Trust, Standard Chartered,

LSE:BARC Barclays. Close Mid-Price: 471.6 Percentage Change: + 0.78% Day High: 473.1 Day Low: 465.85

In the event of Barclays enjoying further trades beyond 473.1, the share ……..

</p

View Previous Barclays & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 2343 Percentage Change: -0.64% Day High: 2426 Day Low: 2338

Target met. All Carnival needs are mid-price trades ABOVE 2426 to improve ……..

</p

View Previous Carnival & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 226.2 Percentage Change: + 0.71% Day High: 227.2 Day Low: 222.2

All MAN needs are mid-price trades ABOVE 227.2 to improve acceleration to ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 3246 Percentage Change: -0.43% Day High: 3288 Day Low: 3208

In the event of Fresnillo enjoying further trades beyond 3288, the share ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1175.2 Percentage Change: + 0.69% Day High: 1178.4 Day Low: 1162.4

Target met. Further movement against HSBC ABOVE 1178.4 should improve acc ……..

</p

View Previous HSBC & Big Picture ***

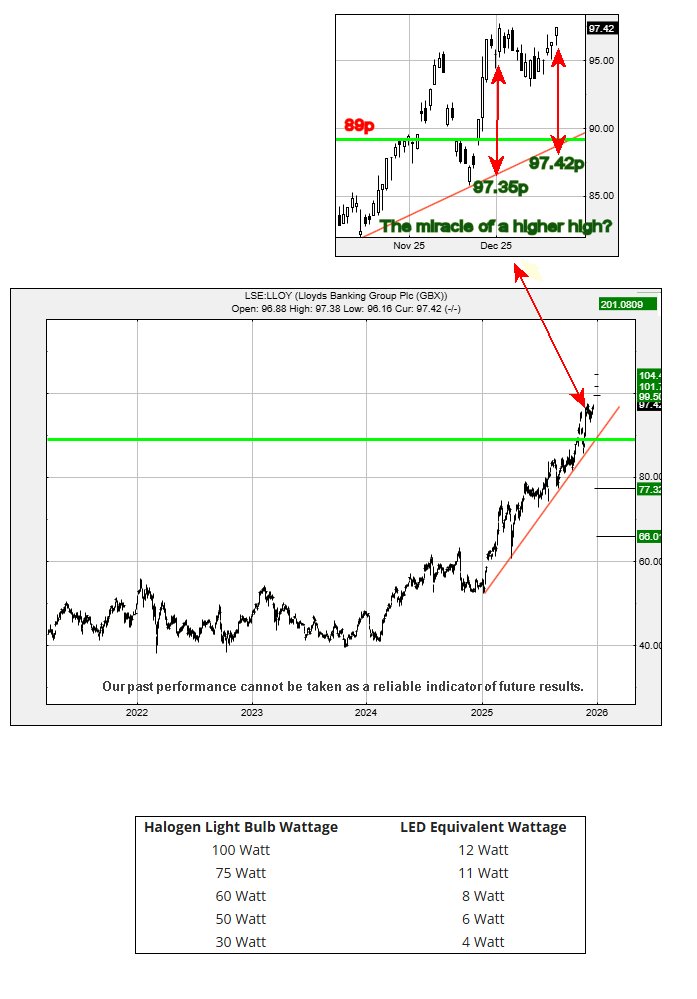

LSE:LLOY Lloyds Grp.. Close Mid-Price: 97.52 Percentage Change: + 0.45% Day High: 97.92 Day Low: 96.36

Continued trades against LLOY with a mid-price ABOVE 97.92 should improve ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 5.4 Percentage Change: -0.74% Day High: 5.9 Day Low: 5.3

Further movement against OPG Power Ventures ABOVE 5.9 should improve acce ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:SAGA SAGA Plc. Close Mid-Price: 397 Percentage Change: + 2.72% Day High: 396 Day Low: 384.5

Target met. All SAGA Plc needs are mid-price trades ABOVE 396 to improve ……..

</p

View Previous SAGA Plc & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1187 Percentage Change: + 0.59% Day High: 1189.5 Day Low: 1178.5

Continued trades against SMT with a mid-price ABOVE 1189.5 should improve ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1806.5 Percentage Change: + 0.67% Day High: 1811.5 Day Low: 1790

In the event of Standard Chartered enjoying further trades beyond 1811.5, ……..

</p

View Previous Standard Chartered & Big Picture ***