#FTSE #GOLD

Increasingly, we’re seeing market behaviour which is tending to prove a ‘safe’ indicator of future behaviour. Obviously, like any visual indicator, the “Gotcha” cannot be regarded as 100% reliable but currently, both the FTSE and Bitcoin appear to be prepping themselves to once again trap traders.

The Bitcoin chart below is fairly simple.

Back in December last year, #1 delineates a period where “everyone” finally concluded Bitcoin wasn’t going to fall far below $50,000. Suddenly, “Gotcha”.

In March this year, #2 shows a period where the market conspired to give a solid impression $40,000 was a solid floor. Once again, “Gotcha”.

Then came April/May, period #3 with an even longer period absolutely convincing everyone Bitcoin had finally bottomed at $30,000. Oops and another “Gotcha”.

Finally, it feels like Bitcoin is starting period #4, a visually assuring picture of Bitcoin finally stopping falling at $20,000 and just 29% of its high in 2021. Obviously, there’s no way Bitcoin is going to fall further… is there?

This market behaviour, a price essentially flatlining for a while, increasingly feels contrived and designed to create a situation where a large number of traders convince themselves a trade is “safe”. Often, during the relative flat period, there will be contradictory movements and in a falling market, these comprise short lived nudges upwards. When this sort of nonsense occurs, we generally insist on hard proof market direction has changed. In the case of Bitcoin, this is a demand the value exceed $28,000, the level of the most recent Red trend break.

Importantly, the converse also proves remarkably reliable. When a price starts to flatline in a rising market, it often feels this is designed to get folk to off-load positions as they convince themselves a price is going to higher. Virtually every trader has a tale to tell of selling (in profit), only to miss the real substantial rise.

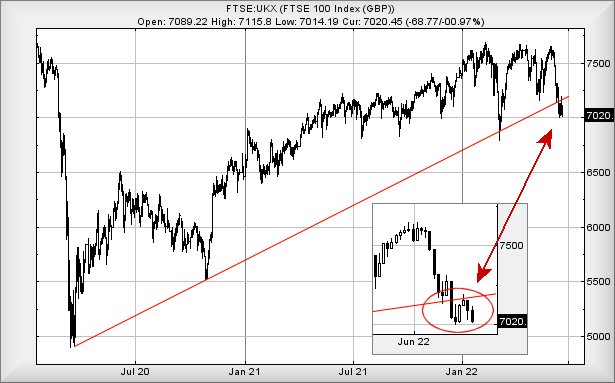

For The FTSE, the most recent 5 trading sessions appear contrived to convince the market the FTSE has a floor of 7000 points. The index broke through the uptrend since 2020, fell to 7000 and stopped falling. We should obviously all rush out and take Long positions with a Stop just below 7000 as the FTSE has obviously discovered a floor level. We’ve a little problem with this behaviour as it’s vanishingly rare for an item to break such an uptrend, then completely stop falling.

Instead, we suspect the market is preparing a “Gotcha” scenario, the FTSE needing above 7160 points to give us a reasonable first indication a further drop should not be anticipated. Curiously, when we examine other markets, Wall St remains in a “Gotcha” position whereas the Nasdaq has now given the first suggestion a severe reversal should not be anticipated. Hopefully the next few session should provide clarity while the world decides what it wants to do. Perhaps the Nasdaq is an early indicator the wildly mooted stock market recession is perhaps not currently scheduled.

As for the FTSE near term (trading around 7022 at time of writing), below 7014 looks problematic as reversal to an initial 6984 calculates as possible. Our secondary, should such a level break, works out at 6940 points, along with a probable bounce.

For an alternate scenario above 7075 looks mildly interesting, allowing an initial 7094 points with secondary, if exceeded, a rather more useful 7154 points, almost the level above which our Big Picture drop scenario becomes invalid.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:32:24PM | BRENT | 106.78 | 105.8 | 104.735 | 108.7 | 110 | 111.26 | 107.75 | |||

| 10:34:02PM | GOLD | 1822.9 | 1822 | 1813 | 1831 | 1846 | 1850 | 1834 | Success | ||

| 10:35:51PM | FTSE | 7015 | 6990 | 6959 | 7057 | 7122 | 7172 | 7055 | |||

| 10:37:57PM | FRANCE | 5911.3 | 5827 | 5821 | 5871 | 5912 | 5933 | 5892 | ‘cess | ||

| 10:40:29PM | GERMANY | 12928 | 12898 | 12850 | 12980 | 13014 | 13059 | 12910 | ‘cess | ||

| 10:42:03PM | US500 | 3782.42 | 3730 | 3711 | 3771 | 3801 | 3832 | 3758 | |||

| 10:44:13PM | DOW | 30590.9 | 30252 | 30065 | 30398 | 30714 | 30912 | 30536 | |||

| 10:46:14PM | NASDAQ | 11668.47 | 11450 | 11401 | 11590 | 11731 | 11828 | 11510 | |||

| 10:48:23PM | JAPAN | 26186 | 25972 | 25830 | 26129 | 26298 | 26337 | 26178 |

23/06/2022 FTSE Closed at 7020 points. Change of -0.97%. Total value traded through LSE was: £ 5,680,077,638 a change of -12.72%

22/06/2022 FTSE Closed at 7089 points. Change of -0.88%. Total value traded through LSE was: £ 6,507,643,698 a change of 40.38%

21/06/2022 FTSE Closed at 7152 points. Change of 0.44%. Total value traded through LSE was: £ 4,635,756,984 a change of -23.37%

20/06/2022 FTSE Closed at 7121 points. Change of 1.5%. Total value traded through LSE was: £ 6,049,529,686 a change of -50.99%

17/06/2022 FTSE Closed at 7016 points. Change of -0.4%. Total value traded through LSE was: £ 12,344,389,846 a change of 36.38%

16/06/2022 FTSE Closed at 7044 points. Change of -3.15%. Total value traded through LSE was: £ 9,051,276,874 a change of 32.71%

15/06/2022 FTSE Closed at 7273 points. Change of 1.2%. Total value traded through LSE was: £ 6,820,318,073 a change of -14.4%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:CBX Cellular Goods** **LSE:ITM ITM Power** **LSE:TRN The Trainline** **

********

Updated charts published on : Avacta, Cellular Goods, ITM Power, The Trainline,

LSE:AVCT Avacta Close Mid-Price: 97 Percentage Change: -11.01% Day High: 111 Day Low: 91

If Avacta experiences continued weakness below 91, it will invariably lea ……..

</p

View Previous Avacta & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 1.32 Percentage Change: -1.85% Day High: 1.35 Day Low: 1.31

Continued weakness against CBX taking the price below 1.31 calculates as ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 190.4 Percentage Change: -8.15% Day High: 207 Day Low: 189.65

Weakness on ITM Power below 189.65 will invariably lead to 182 with secon ……..

</p

View Previous ITM Power & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 284.6 Percentage Change: -10.14% Day High: 311.8 Day Low: 278.5

This is properly confusing, doubtless enjoying the effect of the current i ……..

</p

View Previous The Trainline & Big Picture ***