#Brent #Dax

The UK retail banks are still driving us crackers. It’s as if their share prices are being driven a BMW driver in the middle lane of a motorway approaching a turn lane. Everyone knows the BMW is going to do something, the only problem is what? Will it suddenly veer left without indicating or accelerate right, again without indicating. Perhaps it will indicate left, then accelerate right!

We constantly run scenario which monitor near term movements in the hope of getting a clue. Essentially, should a share price move a bit further in a specific direction than expected, this is often a reliable clue of a coming change, telling us which direction we’re best focussing on. A “funny” example of this nonsense came three weeks ago, where Lloyds had a pretty certain criteria pointing at coming reversal to 41.4p. But when the criteria triggered, the lowest the share price fell was to 41.52p. While the miss by 0.12p may appear inconsequential, perhaps this is a small clue which suggests hidden strength with Lloyds, the share price proving mildly protected from triggering greater reversals.

It’s a theory, one which often proves itself correct.

On this basis, if by 12/100ths of a penny Lloyds is opting to conceal hidden strength, we can calculate perhaps above just 43.72p shall not provide sufficient excuse to invest in a single party popper. At time of writing, the share is trading around 42.27p, so it hasn’t got far to go.

Above 43.72p calculates with the potential of a gain in the direction of 44.7 next with secondary, if exceeded, a slightly more interesting 46.4p. While these gains are visually fairly tame, importantly they exceed the immediate downtrend, challenge existing glass ceiling levels, and quite surprisingly, place the share price in a zone where “surprise” acceleration to a future 58p abruptly makes a degree of sense for the future.

Of course, there’s an alternate scenario we need consider.

What if Lloyds share price is driven by our mythical BMW pilot, opting to indicate right while veering to the left for the exit lane! Or in plain English, behaves just like a real share price in the UK stock market. We’re going to play relatively safe here, suggesting below 41.4p will not prove traumatic, breaking the Red uptrend since the pandemic low of 2020. Movement such as this risks triggering reversal to an initial 40.2p with secondary, when broken, at 38.2p and hopefully a proper bounce, if only due to sufficient number of folk assuming the price must rebound when it matches the “Russia Drop” of earlier this year. From a bigger picture perspective, we fear this would not be the case as a solid argument exists demanding it bounce from 32.5p eventually, should this scenario come to fruition.

Lloyds Bank, considerably less exciting than the British Grand Prix was! And there wasn’t a single BMW involved in the race…

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:34:08PM | BRENT | 111.05 | 107.7 | 107.1 | 105.9 | 109.8 | 112.1 | 112.53 | 114.14 | 110.6 | |

| 9:39:37PM | GOLD | 1811.18 | Success | ||||||||

| 9:41:44PM | FTSE | 7235 | Shambles | ||||||||

| 9:43:54PM | FRANCE | 5994.8 | Shambles | ||||||||

| 9:45:48PM | GERMANY | 12921 | 12733 | 12657 | 12563 | 12846 | 12939 | 13000 | 13128 | 12850 | |

| 9:52:33PM | US500 | 3825.72 | |||||||||

| 9:55:45PM | DOW | 31093 | |||||||||

| 9:57:24PM | NASDAQ | 11584 | |||||||||

| 9:59:44PM | JAPAN | 26325 | Success |

1/07/2022 FTSE Closed at 7186 points. Change of 0.24%. Total value traded through LSE was: £ 4,840,883,193 a change of -20.03%

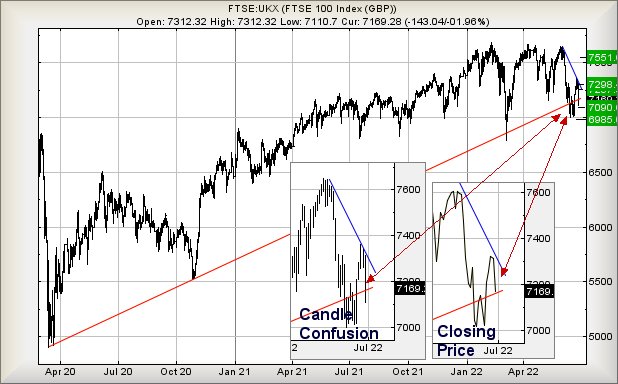

30/06/2022 FTSE Closed at 7169 points. Change of -1.96%. Total value traded through LSE was: £ 6,053,180,020 a change of 8.35%

29/06/2022 FTSE Closed at 7312 points. Change of -0.15%. Total value traded through LSE was: £ 5,586,821,429 a change of -8.41%

28/06/2022 FTSE Closed at 7323 points. Change of 0.9%. Total value traded through LSE was: £ 6,100,040,096 a change of -3.89%

27/06/2022 FTSE Closed at 7258 points. Change of 0.69%. Total value traded through LSE was: £ 6,347,029,355 a change of 0.8%

24/06/2022 FTSE Closed at 7208 points. Change of 2.68%. Total value traded through LSE was: £ 6,296,850,381 a change of 10.86%

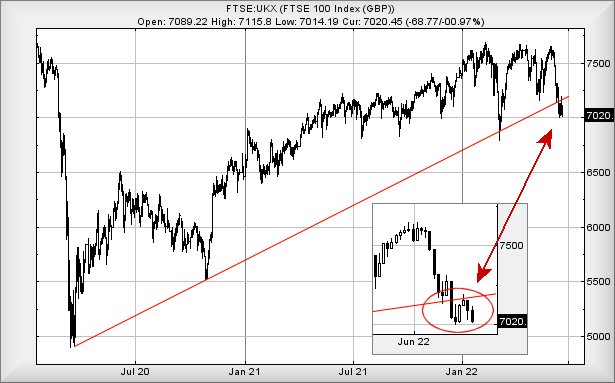

23/06/2022 FTSE Closed at 7020 points. Change of -0.97%. Total value traded through LSE was: £ 5,680,077,638 a change of -12.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:DARK Darktrace Plc** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:IPF International Personal Finance** **LSE:TLW Tullow** **

********

Updated charts published on : AFC Energy, Darktrace Plc, Genel, Glencore Xstra, International Personal Finance, Tullow,

LSE:AFC AFC Energy Close Mid-Price: 19.89 Percentage Change: -3.45% Day High: 21.96 Day Low: 19.43

Weakness on AFC Energy below 19.43 will invariably lead to 19 with second ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 292.6 Percentage Change: -0.68% Day High: 300 Day Low: 284

Weakness on Darktrace Plc below 284 will invariably lead to 275 with seco ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:GENL Genel Close Mid-Price: 133.8 Percentage Change: -4.70% Day High: 140.4 Day Low: 132.8

This is getting a little dodgy as weakness now below 130 risks triggering ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 426.35 Percentage Change: -4.21% Day High: 445.3 Day Low: 409.75

Continued weakness against GLEN taking the price below 409.75 calculates ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 76.9 Percentage Change: + 0.52% Day High: 76.9 Day Low: 71.8

Target met. In the event International Personal Finance experiences weakn ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 43.52 Percentage Change: -7.13% Day High: 46.42 Day Low: 42.8

If Tullow experiences continued weakness below 42.8, it will invariably l ……..

</p

View Previous Tullow & Big Picture ***