#FTSE #Gold

As the daily massacre of crypto currency appears to be continuing, our chum who once enjoyed a substantial belief in Ripple has raised an eyebrow, asking for an update. Last time we glanced at Ripple, we finished with a throwaway comment giving criteria for reversal to 0.40. Currently, it’s around 0.32 which is pretty close to his original entry level…

Strangely, a few days ago, Ripple hit a logical bottom level and, while it hasn’t exactly bounced with conviction, there is slight hope the 0.28 level “may” prove to be a floor level. Since reversing to such a point, the price has certainly gyrated just above the floor but has neither recovered nor broken the floor. Maybe it’s a ‘fingers crossed’ moment as we’re seeing similar behaviour with Bitcoin and Ethereum. Of course, there’s always the risk the cryptocurrency market is awaiting a magical point, when it will decided everyone is convinced bottom is “in”, enacting a gotcha drop immediately thereafter. Certainly, with Bitcoin, sufficient argument remains threatening a final plunge to the 10,000 dollar level.

But we’re a little sceptical, ‘cos it’s all getting a little too obvious.

In the event Ripple does manage below 0.28 (or close a session below 0.308), further reversal to 0.208 looks possible with secondary, if broken, at 0.151 and hopefully an ultimate bottom, due to us being unable to calculate below such a point.

However, if our suspicion proves correct regarding the 0.28 level, Ripple need only exceed 0.37 to light the first spark of hope. This should apparently trigger movement to an initial 0.561 with secondary, if beaten, a more useful 0.735.

FTSE for FRIDAY (FTSE:UKX) Last night, I watched something strange happening. A moth was fluttering around, utterly directionless like the FTSE, when suddenly it dropped and flew directly to some yellow flowers growing in the garden. These flowers are generally awash with bees and wasps during the day, going about their business collecting nectar. The moth, illuminated by garden floodlights, behaved in exactly the same fashion as a bee, fluttering from bloom to bloom. For some reason, I’d always though moths existed solely on the shrieks of women, anxious not to gather one in her hair!

This, obviously, has everything to do with the FTSE as the unexpected can happen at any time…

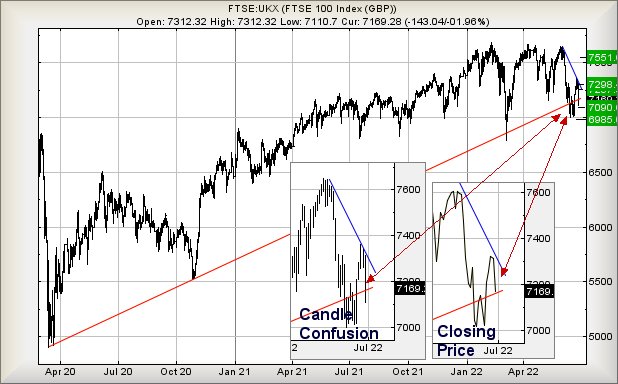

The chart inset below is quite fascinating, from our perspective. Despite the FTSE experiencing a truly awful Thursday, it emulated the moth by deciding to visit the uptrend which it had broken during the day. But curiously, almost as if it were intended, the FTSE did not close the session below the uptrend. As a result, our immediate inclination is not to anticipate July starting with a 1st of the month massacre. Instead, above 7193 points looks capable of triggering surprise recovery to an initial 7257 points with secondary, if exceeded, calculating at 7298 points. At risk of being ‘a tease’, there’s a curious phenomena shaping up which also suggests above 7298 risks provoking a further recovery cycle to 7551 points sometime in the future.

If everything intends go horribly wrong, below 7110 has the potential to inflict some real trouble, calculating with the risk of reversal to 7090 points with secondary, if broken at 6985 points.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:57:33PM | BRENT | 108.85 | 108 | 107.07 | 105.71 | 110.9 | 112.22 | 112.48 | 113.98 | 110.41 | Success |

| 9:59:43PM | GOLD | 1807.56 | 1802.24 | 1794.48 | 1784.29 | 1814 | 1826 | 1832 | 1842 | 1815 | ‘cess |

| 10:01:59PM | FTSE | 7194 | 7156 | 7125 | 7089 | 7206 | 7234 | 7261 | 7313 | 7165 | Success |

| 10:05:32PM | FRANCE | 5947.8 | 5904 | 5824 | 5810 | 5964 | 5961 | 5972 | 6013 | 5923 | |

| 10:08:03PM | GERMANY | 12805 | 12616 | 12556 | 12280 | 12710 | 12872 | 12958 | 13072 | 12756 | Success |

| 10:11:28PM | US500 | 3779.62 | 3735 | 3690 | 3670 | 3772 | 3818 | 3840 | 3875 | 3780 | ‘cess |

| 10:23:08PM | DOW | 30742 | 30412 | 30393 | 30194 | 30610 | 30990 | 31199 | 31460 | 30767 | ‘cess |

| 10:25:56PM | NASDAQ | 11486 | 11316 | 11071 | 11027 | 11422 | 11652 | 11763 | 11912 | 11504 | Success |

| 10:29:38PM | JAPAN | 26381 | 26134 | 26045 | 25957 | 26286 | 26507 | 26587 | 26737 | 26357 | Success |

30/06/2022 FTSE Closed at 7169 points. Change of -1.96%. Total value traded through LSE was: £ 6,053,180,020 a change of 8.35%

29/06/2022 FTSE Closed at 7312 points. Change of -0.15%. Total value traded through LSE was: £ 5,586,821,429 a change of -8.41%

28/06/2022 FTSE Closed at 7323 points. Change of 0.9%. Total value traded through LSE was: £ 6,100,040,096 a change of -3.89%

27/06/2022 FTSE Closed at 7258 points. Change of 0.69%. Total value traded through LSE was: £ 6,347,029,355 a change of 0.8%

24/06/2022 FTSE Closed at 7208 points. Change of 2.68%. Total value traded through LSE was: £ 6,296,850,381 a change of 10.86%

23/06/2022 FTSE Closed at 7020 points. Change of -0.97%. Total value traded through LSE was: £ 5,680,077,638 a change of -12.72%

22/06/2022 FTSE Closed at 7089 points. Change of -0.88%. Total value traded through LSE was: £ 6,507,643,698 a change of 40.38%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:CCL Carnival** **LSE:EZJ EasyJet** **LSE:IAG British Airways** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:LLOY Lloyds Grp.** **LSE:ODX Omega Diags** **LSE:OPG OPG Power Ventures** **LSE:RMG Royal Mail** **LSE:SBRY Sainsbury** **LSE:TLW Tullow** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : AFC Energy, Aston Martin, Carnival, EasyJet, British Airways, ITM Power, Intertek, ITV, Lloyds Grp., Omega Diags, OPG Power Ventures, Royal Mail, Sainsbury, Tullow, Taylor Wimpey,

LSE:AFC AFC Energy Close Mid-Price: 20.6 Percentage Change: -5.94% Day High: 22.7 Day Low: 19.95

If AFC Energy experiences continued weakness below 19.95, it will invaria ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 442 Percentage Change: -7.96% Day High: 476.2 Day Low: 385

Target met. Continued weakness against AML taking the price below 385 cal ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 619.6 Percentage Change: -5.14% Day High: 651.8 Day Low: 597.8

In the event Carnival experiences weakness below 597.8 it calculates with ……..

</p

View Previous Carnival & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 366.6 Percentage Change: -5.17% Day High: 380 Day Low: 352.6

Target met. Weakness on EasyJet below 352.6 will invariably lead to 334 w ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 107.62 Percentage Change: -3.64% Day High: 111 Day Low: 104.44

Target met. If British Airways experiences continued weakness below 104. ……..

</p

View Previous British Airways & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 172.8 Percentage Change: -0.46% Day High: 178.25 Day Low: 165.45

Continued weakness against ITM taking the price below 165.45 calculates a ……..

</p

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4206 Percentage Change: -3.31% Day High: 4276 Day Low: 4139

If Intertek experiences continued weakness below 4139, it will invariably ……..

</p

View Previous Intertek & Big Picture ***

LSE:ITV ITV Close Mid-Price: 65.26 Percentage Change: -2.28% Day High: 65.62 Day Low: 63.36

Target met. In the event ITV experiences weakness below 63.36 it calculat ……..

</p

View Previous ITV & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 42.31 Percentage Change: -1.63% Day High: 42.69 Day Low: 41.52

Weakness on Lloyds Grp. below 41.52 will invariably lead to 40.7 with sec ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 3.1 Percentage Change: -7.46% Day High: 3.35 Day Low: 3.1

In the event Omega Diags experiences weakness below 3.1 it calculates wit ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 6.05 Percentage Change: -2.42% Day High: 6.33 Day Low: 5.9

If OPG Power Ventures experiences continued weakness below 5.9, it will i ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:RMG Royal Mail. Close Mid-Price: 269.7 Percentage Change: + 0.52% Day High: 272.3 Day Low: 257.6

Weakness on Royal Mail below 257.6 will invariably lead to 248 with secon ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 204 Percentage Change: -3.32% Day High: 209.1 Day Low: 200.9

Continued weakness against SBRY taking the price below 200.9 calculates a ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 46.86 Percentage Change: -3.38% Day High: 48.08 Day Low: 46.28

In the event Tullow experiences weakness below 46.28 it calculates with a ……..

</p

View Previous Tullow & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 116.65 Percentage Change: -1.52% Day High: 117 Day Low: 113.65

Weakness on Taylor Wimpey below 113.65 will invariably lead to 112 with s ……..

</p

View Previous Taylor Wimpey & Big Picture ***