#Gold #SP500 It appears Yellow Cake shares are about as near to uranium enjoying a dedicated index as possible. To quote from the company website: “Yellow Cake is a uranium focused company offering direct exposure to the spot uranium price without exploration, development, mining or processing risk

“. It appears the company owns and stores uranium oxide in various locations in both Canada and France.

Barely a month goes by without someone enquiring about uranium, invariably discussing North American based companies, as increasingly it seems many investors are becoming confident “Nuclear” shall become the greenest route to the future. Personally, an expectation the new Rolls Royce micro reactors shall provide a welcome boost to the company share price, is the reason we perhaps watch the share too closely, suspecting at some point it shall boost upward, regardless of whatever is going on with the aviation industry.

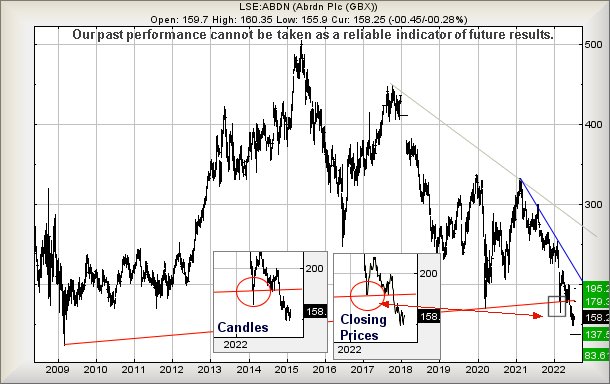

Yellow Cake Plc has certainly enjoyed quite strong and steady movement since the inevitable pandemic low back in 2020. Through thick and thin, the share price has paid enormous respect to the Red uptrend on the chart below.

The implication of this slavish devotion suggests a slight threat of any future weakness below 313p triggering reversal to an initial 287p with secondary, if broken, at 259p and hopefully a bounce. In many ways, the share price dare not close a session below 259p as, longer term, we currently cannot calculate any sort of reliable bottom.

On a more positive note, above the immediate Blue downtrend, presently just 261p, works out with some useful potentials as it risks triggering recovery to an initial 373p with secondary, if exceeded, at a longer term 409p and some very possible hesitation. With closure above 409p, we shall be required to revisit our tea leaves, thanks to some quite interesting long term potentials.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:09:32PM | BRENT | 100.41 | |||||||||

| 10:11:06PM | GOLD | 1720.23 | 1714 | 1710 | 1701 | 1721 | 1736 | 1740 | 1748 | 1722 | Shambles |

| 10:13:35PM | FTSE | 7308 | |||||||||

| 10:16:45PM | STOX50 | 3602.2 | |||||||||

| 10:19:13PM | GERMANY | 13191 | Success | ||||||||

| 10:21:12PM | US500 | 3955.47 | 3942 | 3930 | 3911 | 3976 | 3987 | 3994 | 4011 | 3952 | Success |

| 10:23:20PM | DOW | 31840 | |||||||||

| 10:25:25PM | NASDAQ | 12286 | Shambles | ||||||||

| 10:27:24PM | JAPAN | 27730 |

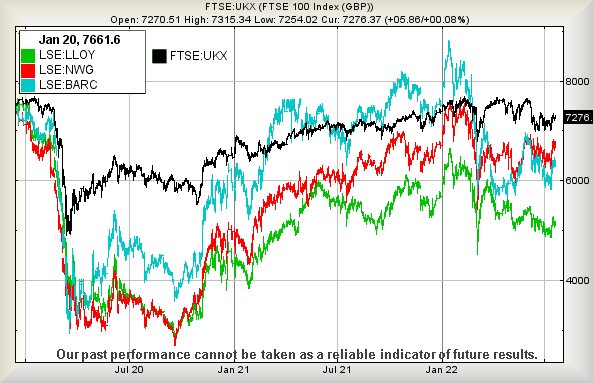

25/07/2022 FTSE Closed at 7306 points. Change of 0.41%. Total value traded through LSE was: £ 6,062,435,734 a change of 37.23%

22/07/2022 FTSE Closed at 7276 points. Change of 0.08%. Total value traded through LSE was: £ 4,417,687,866 a change of -18.83%

21/07/2022 FTSE Closed at 7270 points. Change of 0.08%. Total value traded through LSE was: £ 5,442,605,910 a change of -14.07%

20/07/2022 FTSE Closed at 7264 points. Change of -0.44%. Total value traded through LSE was: £ 6,333,828,189 a change of 35.6%

19/07/2022 FTSE Closed at 7296 points. Change of 1.01%. Total value traded through LSE was: £ 4,670,793,885 a change of -13.24%

18/07/2022 FTSE Closed at 7223 points. Change of 0.89%. Total value traded through LSE was: £ 5,383,848,988 a change of -4.09%

15/07/2022 FTSE Closed at 7159 points. Change of 1.7%. Total value traded through LSE was: £ 5,613,237,251 a change of -3.92%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:DARK Darktrace Plc** **LSE:HUR Hurrican Energy** **LSE:IGG IG Group** **LSE:MKS Marks and Spencer** **LSE:SNN Sanne Plc** **LSE:SRP Serco** **LSE:TW. Taylor Wimpey** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : BALFOUR BEATTY, Darktrace Plc, Hurrican Energy, IG Group, Marks and Spencer, Sanne Plc, Serco, Taylor Wimpey, Zoo Digital,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 272 Percentage Change: + 1.80% Day High: 274.6 Day Low: 267.4

In the event of BALFOUR BEATTY enjoying further trades beyond 274.6, the ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 365.9 Percentage Change: -3.20% Day High: 382.7 Day Low: 365.3

Continued trades against DARK with a mid-price ABOVE 382.7 should improve ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:HUR Hurrican Energy. Close Mid-Price: 8.45 Percentage Change: + 16.55% Day High: 9 Day Low: 7.47

Target met. Further movement against Hurrican Energy ABOVE 9 should impro ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 795.5 Percentage Change: + 2.65% Day High: 797.5 Day Low: 771

Continued trades against IGG with a mid-price ABOVE 797.5 should improve ……..

</p

View Previous IG Group & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 145.4 Percentage Change: + 0.41% Day High: 148 Day Low: 144

Further movement against Marks and Spencer ABOVE 148 should improve accel ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:SNN Sanne Plc. Close Mid-Price: 920 Percentage Change: + 0.66% Day High: 924 Day Low: 917

Continued trades against SNN with a mid-price ABOVE 924 should improve th ……..

</p

View Previous Sanne Plc & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 186.8 Percentage Change: + 2.41% Day High: 188.7 Day Low: 180.4

Continued trades against SRP with a mid-price ABOVE 188.7 should improve ……..

</p

View Previous Serco & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 127 Percentage Change: + 0.63% Day High: 128 Day Low: 124.15

Target met. All Taylor Wimpey needs are mid-price trades ABOVE 128 to imp ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 124.5 Percentage Change: + 1.22% Day High: 124.5 Day Low: 123

Continued trades against ZOO with a mid-price ABOVE 124.5 should improve ……..

</p

View Previous Zoo Digital & Big Picture ***