#Gold #Nasdaq As one of the UK’s largest and oldest investment trusts, it was something of a surprise to discover they’re domiciled In Dundee, a city famous for cartoon characters like ‘Desperate Dan’, George Galloway, the DC Thomson empire, and little else. Similar to every country in the world, Scotland has a social split between the West Coast and East Coast. Dundee is an East Coast town, deserving of little attention and long been cursed as somewhere you must pass through on the way to somewhere more interesting. But a glance at the history of Alliance Trust reveals an aggressively outgoing company, its very DNA always focussed on investment across the Atlantic and now, globally.

Okay, we’re west coast based and expected to be biased about the wrong side of Scotland.

It appears Alliance Trust enjoy a share price which is shuffling toward the starting position for some positive movement. Presently trading around 995p, we regard 1,008p as a potential trigger level which should prove capable of providing a lift to an initial 1,070p. Visually, this matches the previous all time high of last year but, should the price close a session above 1,070, we’d hope a further cycle shall commence to our secondary target of 1,164p. The company has certainly experienced a firm climb in value, since the lows of the financial crash in 2009 and now, in the long term, suggests an eventual 1,215p shall provide some sort of future ceiling and probable hesitation.

As always, we’d be careful with that number as, should the market start to “gap” the share price up at the open, it will become entirely possible the market itself has different ideas beyond 1,215p.

The converse scenario demands weakness below 875p to trigger potential reversal to an initial 800p with secondary, if broken, at 656p and hopefully a bounce. Visually, there’s nothing suggesting this scenario shall become an issue.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:11:20PM | BRENT | 96.19 | |||||||||

| 10:15:14PM | GOLD | 1789.05 | 1681 | 1648 | 1507 | 1740 | 1790 | 1797 | 1808 | 1755 | |

| 10:18:05PM | FTSE | 7494.57 | Success | ||||||||

| 10:19:39PM | STOX50 | 3764 | ‘cess | ||||||||

| 10:22:26PM | GERMANY | 13700 | ‘cess | ||||||||

| 10:26:00PM | US500 | 4153 | ‘cess | ||||||||

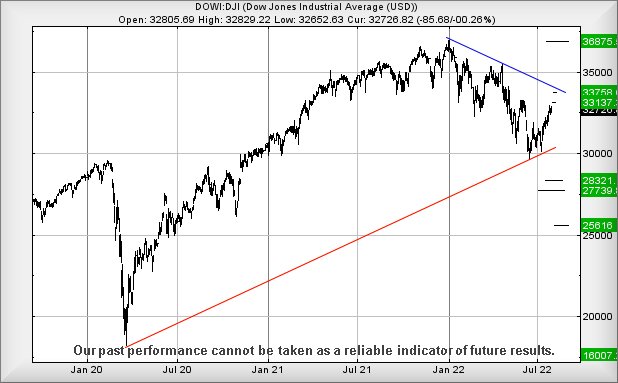

| 10:35:42PM | DOW | 32930 | Success | ||||||||

| 10:39:14PM | NASDAQ | 13211 | 13170 | 13115 | 13021 | 13220 | 13320 | 13445 | 13500 | 13153 | Success |

| 10:41:53PM | JAPAN | 28174 | ‘cess |

8/08/2022 FTSE Closed at 7482 points. Change of 0.58%. Total value traded through LSE was: £ 4,663,235,289 a change of 8.84%

5/08/2022 FTSE Closed at 7439 points. Change of -0.12%. Total value traded through LSE was: £ 4,284,416,444 a change of -24.22%

4/08/2022 FTSE Closed at 7448 points. Change of 0.04%. Total value traded through LSE was: £ 5,653,918,717 a change of 0.91%

3/08/2022 FTSE Closed at 7445 points. Change of 0.49%. Total value traded through LSE was: £ 5,602,756,478 a change of -3.28%

2/08/2022 FTSE Closed at 7409 points. Change of -0.05%. Total value traded through LSE was: £ 5,792,539,911 a change of 52.35%

1/08/2022 FTSE Closed at 7413 points. Change of -0.13%. Total value traded through LSE was: £ 3,802,113,332 a change of -37.81%

29/07/2022 FTSE Closed at 7423 points. Change of 1.06%. Total value traded through LSE was: £ 6,113,428,375 a change of 2.61%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:IAG British Airways** **LSE:IGAS Igas Energy** **LSE:IGG IG Group** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:PHP Primary Health** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Barclays, British Airways, Igas Energy, IG Group, National Glib, Natwest, Primary Health, Rolls Royce,

LSE:BARC Barclays. Close Mid-Price: 166 Percentage Change: + 1.22% Day High: 166.92 Day Low: 164.74

This is starting to make, I think, a bigger picture movement. Above 167 no ……..

</p

View Previous Barclays & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 120.64 Percentage Change: + 0.75% Day High: 121.52 Day Low: 118.92

All British Airways needs are mid-price trades ABOVE 122 to improve accel ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 55.8 Percentage Change: + 9.20% Day High: 55.8 Day Low: 52

Continued trades against IGAS with a mid-price ABOVE 56 should improve the ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 822 Percentage Change: + 0.55% Day High: 831 Day Low: 818.5

In the event of IG Group enjoying further trades beyond 831, the share sho ……..

</p

View Previous IG Group & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1135 Percentage Change: + 1.16% Day High: 1142.5 Day Low: 1122

It feels increasingly likely moves now above 1156 shall bring recovery to ……..

</p

View Previous National Glib & Big Picture ***

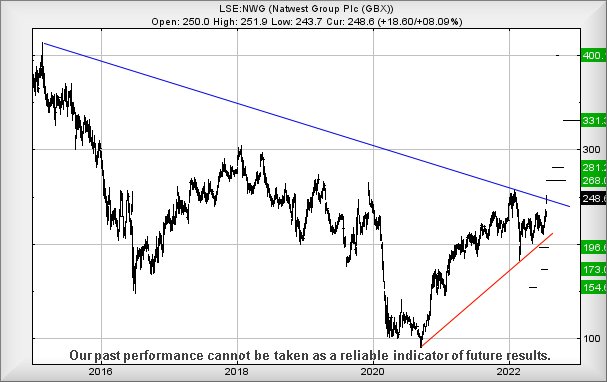

LSE:NWG Natwest. Close Mid-Price: 254.1 Percentage Change: + 0.36% Day High: 256.3 Day Low: 252.3

Target Met or near enough. Interesting to report, movement next above 258 ……..

</p

View Previous Natwest & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 145.4 Percentage Change: + 1.68% Day High: 146.2 Day Low: 143.1

This is confusing. It now needs movement above 152 to signal the potential ……..

</p

View Previous Primary Health & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 86.7 Percentage Change: + 4.46% Day High: 87.05 Day Low: 82.96

Trades now above 90 should prove interesting, making a visit to an initial ……..

</p

View Previous Rolls Royce & Big Picture ***