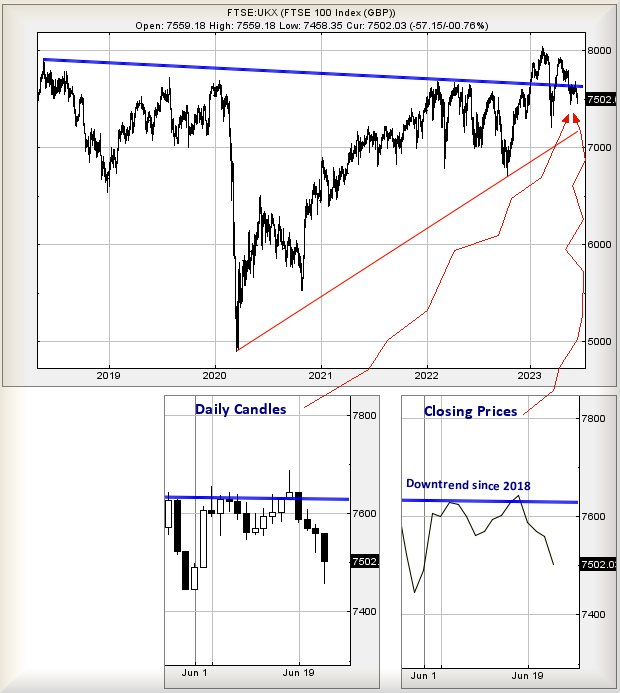

#FTSE #GOLD There’s a Blue line on the FTSE chart, one we believed important but now we’re wondering whether it is the object of a cosmic joke by the marketplace. After all our work last Friday, the index opened the session bang on the line at 7628 points, zoomed up to 7688 points (three points short of our target) and on Monday of this week, paraded lower like dancers at a Boris Johnston secret lockdown party. How we laughed…

It’s all very confusing, leaving an unpleasant notion the markets don’t actually have a clue what to do, a feeling slightly reinforced by the BoE’s latest attempts to damage the UK economy and make the recession they’d warned about last year become a reality, one actually caused by the Banks own policies. Quite why this should be the case is incomprehensible, other than a suspicion the UK is trying to prove it cannot manage for itself, ensuring any future vote on Europe opts to rejoin! We don’t claim to be economists but ongoing attempts to fight inflation by making everything more expensive surely defies logic.

Then again, maybe you can put out a fire by pouring petrol on it and we’ve always been taught incorrectly, the grown ups of the Bank of England Policy Committee knowing better.

As for Friday, it has been a rough week and perhaps the FTSE is due a break. In the event the FTSE manages above 7522 points, it should apparently trigger some recovery to an initial 7545 points with our secondary, if exceeded, at 7581 points. At this level, things do have the potential to become rather fascinating as above 7581 should enjoy the potential of spiking the index upward by nearly another 100 points to 7674 points. If this scenario triggers, the tightest stop loss level looks like 7467 points.

Our alternate scenario, if everything intends go wrong, suggests weakness below 7467 points risks triggering reversal down to an initial 7406 points with secondary, if broken, at 7356 points. To judge by market futures at this point early on Friday morning, it appears some hope is permitted for the FTSE near term.

Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:42:55PM | BRENT | 75.14 | 74.49 | 73.97 | 75.2 | 75.21 | 75.465 | 74.95 | ‘cess | ||

| 9:45:37PM | GOLD | 1912.55 | 1912 | 1907 | 1919 | 1922 | 1933 | 1915 | ‘cess | ||

| 9:48:02PM | FTSE | 7514.9 | 7453 | 7437 | 7496 | 7522 | 7531 | 7506 | ‘cess | ||

| 9:50:55PM | STOX50 | 4306.7 | 4256 | 4251 | 4282 | 4315 | 4326 | 4300 | ‘cess | ||

| 9:53:30PM | GERMANY | 15985 | 15880 | 15840 | 15956 | 16008 | 16099 | 15961 | Success | ||

| 9:57:18PM | US500 | 4383.8 | 4360 | 4342 | 4375 | 4387 | 4400 | 4369 | Success | ||

| 9:59:31PM | DOW | 33968.5 | 33847 | 33791 | 33907 | 33999 | 34057 | 33905 | ‘cess | ||

| 10:01:48PM | NASDAQ | 15058.3 | 14903 | 14834 | 15008 | 15062 | 15129 | 14985 | |||

| 10:04:49PM | JAPAN | 33504 | 33363 | 33301 | 33472 | 33560 | 33600 | 33450 | Success |

22/06/2023 FTSE Closed at 7502 points. Change of -0.75%. Total value traded through LSE was: £ 4,777,191,347 a change of 6.91%

21/06/2023 FTSE Closed at 7559 points. Change of -0.13%. Total value traded through LSE was: £ 4,468,515,731 a change of -18.02%

20/06/2023 FTSE Closed at 7569 points. Change of -0.25%. Total value traded through LSE was: £ 5,450,485,635 a change of 18.02%

19/06/2023 FTSE Closed at 7588 points. Change of -0.71%. Total value traded through LSE was: £ 4,618,439,635 a change of -67.02%

16/06/2023 FTSE Closed at 7642 points. Change of 0.18%. Total value traded through LSE was: £ 14,002,242,699 a change of 107.37%

15/06/2023 FTSE Closed at 7628 points. Change of 0.34%. Total value traded through LSE was: £ 6,752,443,780 a change of 5.35%

14/06/2023 FTSE Closed at 7602 points. Change of 0.11%. Total value traded through LSE was: £ 6,409,785,309 a change of 14.25%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AV. Aviva** **LSE:BDEV Barrett Devs** **LSE:BME B & M** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:DGE Diageo** **LSE:FRES Fresnillo** **LSE:GRG Greggs** **LSE:IGAS Igas Energy** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:PMG Parkmead** **LSE:QED Quadrise** **LSE:SCLP Scancell** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aston Martin, Aviva, Barrett Devs, B & M, British Telecom, Caspian, Diageo, Fresnillo, Greggs, Igas Energy, ITV, Just Eat, Lloyds Grp., Natwest, Parkmead, Quadrise, Scancell, Spirax, Serco, Taylor Wimpey,

LSE:AML Aston Martin. Close Mid-Price: 332.8 Percentage Change: + 3.03% Day High: 338 Day Low: 315

Target met. In the event of Aston Martin enjoying further trades beyond 3 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AV. Aviva Close Mid-Price: 385.8 Percentage Change: -1.56% Day High: 391.7 Day Low: 386.1

Target met. If Aviva experiences continued weakness below 386.1, it will ……..

</p

View Previous Aviva & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 418.3 Percentage Change: -1.67% Day High: 428.1 Day Low: 411.2

Weakness on Barrett Devs below 411.2 will invariably lead to 361 with sec ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BME B & M. Close Mid-Price: 575.6 Percentage Change: + 1.34% Day High: 575.6 Day Low: 559.6

Continued trades against BME with a mid-price ABOVE 575.6 should improve ……..

</p

View Previous B & M & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 129.2 Percentage Change: -1.52% Day High: 130.8 Day Low: 128.1

If British Telecom experiences continued weakness below 128.1, it will in ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 4.4 Percentage Change: + 8.64% Day High: 4.4 Day Low: 3.95

Target met. In the event Caspian experiences weakness below 3.95 it calcu ……..

</p

View Previous Caspian & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3330.5 Percentage Change: + 0.76% Day High: 3341 Day Low: 3283

Target met. If Diageo experiences continued weakness below 3283, it will ……..

</p

View Previous Diageo & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 609.2 Percentage Change: -2.43% Day High: 622.6 Day Low: 605

Target met. In the event Fresnillo experiences weakness below 605 it calc ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 2510 Percentage Change: -1.95% Day High: 2552 Day Low: 2500

Target met. If Greggs experiences continued weakness below 2500, it will ……..

</p

View Previous Greggs & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 14.49 Percentage Change: -1.09% Day High: 14.4 Day Low: 14.2

Weakness on Igas Energy below 14.2 will invariably lead to 13 next with s ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:ITV ITV Close Mid-Price: 66.9 Percentage Change: -2.02% Day High: 68.26 Day Low: 66.8

In the event ITV experiences weakness below 66.8 it calculates with a dro ……..

</p

View Previous ITV & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1090 Percentage Change: + 2.16% Day High: 1093 Day Low: 1044

Weakness on Just Eat below 1044 will invariably lead to 1023 and hopefull ……..

</p

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 42.91 Percentage Change: -1.91% Day High: 43.47 Day Low: 42.95

Target met. Continued weakness against LLOY taking the price below 42.95 ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 231.5 Percentage Change: -1.74% Day High: 235.4 Day Low: 230.3

Target met. If Natwest experiences continued weakness below 230.3, it wil ……..

</p

View Previous Natwest & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 13 Percentage Change: + 0.00% Day High: 13 Day Low: 12.75

Continued weakness against PMG taking the price below 12.75 calculates as ……..

</p

View Previous Parkmead & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 1.84 Percentage Change: + 11.84% Day High: 1.85 Day Low: 1.7

Target met. Continued trades against QED with a mid-price ABOVE 1.85 shou ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 13.75 Percentage Change: -3.51% Day High: 14.25 Day Low: 13.75

If Scancell experiences continued weakness below 13.75, it will invariabl ……..

</p

View Previous Scancell & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 10235 Percentage Change: + 0.39% Day High: 10230 Day Low: 10090

If Spirax experiences continued weakness below 10090, it will invariably ……..

</p

View Previous Spirax & Big Picture ***

LSE:SRP Serco Close Mid-Price: 137.2 Percentage Change: -1.22% Day High: 139.6 Day Low: 136

Target met. In the event Serco experiences weakness below 136 it calculat ……..

</p

View Previous Serco & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 102.7 Percentage Change: -1.72% Day High: 104.85 Day Low: 101.2

In the event Taylor Wimpey experiences weakness below 101.2 it calculates ……..

</p

View Previous Taylor Wimpey & Big Picture ***