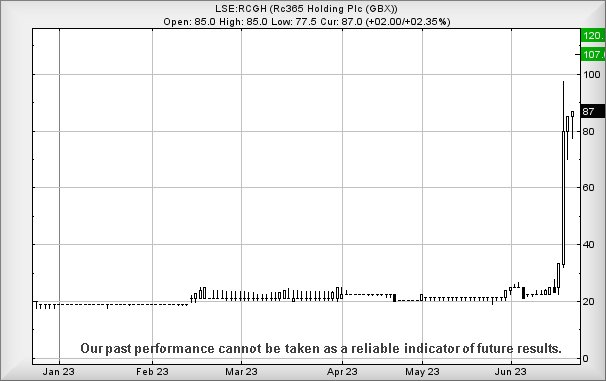

#Gold #US500 Chipset company, Nvidia, have a lot to answer for. By dabbling with Artificial Intelligence, their share price soared with quite a few others in the same field following suit. Someone even noticed the top 20 “movers” in the S&P500 all mentioned AI in their earnings reports. Obviously, there’s a frantic search on this side of the pond for an equally skilled candidate and with their recent Press Release, RC 365 appear to be a leading candidate for growth.

To cut a long story short, their subsidiary has signed a non-legally binding agreement (our underline) to collaborate to bringing RC 365 Ai solutions into a financial services arena, aimed at providing digital wealth management solutions. While there’s an inherent suspicion the collection of buzzwords is designed to conceal no-one knows exactly what the end game should be, the markets in the UK appear fairly impressed as the share price has quadrupled in recent days, blowing up faster than a beached dead porpoise under our absurd Argyll sun. (yes, our Golden Retriever did roll on it)

Unfortunately, from our perspective, there’s a little issue, due to a lack of meaningful historical data to play with in attempting to express a future. With the best will in the world, neither the human brain or an Ai can hope to weave a future from a share price which previously spent a year pottering around the 20p level. However, we’re willing to make a stab at things, due to the pace of acceleration since June 15th as hopefully the optimism isn’t only being generated by enthusiasts active in internet chat rooms.

The immediate situation suggests share price growth now exceeding 97p could make an attempt at 107p next with secondary, if exceeded, at 120p. In the event the share price bursts above 120p, we’re at a loss, other than to nod sagely and write “it’s probably going higher!”. It’s one of these occasions where the market is going to define the value, rather than a more conventional reflection on historical share price movements.

Equally, if things intend go Boris Johnston shaped, the price needs below 52p to provoke serious issues.

This is doubtless worth keeping an eye on, especially if it ever exceeds 120p as it will be out-accelerating logic.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:18:24PM | BRENT | 77.11 | ‘cess | ||||||||

| 9:20:33PM | GOLD | 1932.86 | 1918 | 1915 | 1905 | 1931 | 1939 | 1942 | 1950 | 1929 | ‘cess |

| 9:22:32PM | FTSE | 7538 | ‘cess | ||||||||

| 9:28:36PM | STOX50 | 4323.44 | |||||||||

| 9:32:18PM | GERMANY | 15990.1 | ‘cess | ||||||||

| 9:35:27PM | US500 | 4365.3 | 4360 | 4263 | 4217 | 4380 | 4393 | 4399 | 4412 | 4367 | ‘cess |

| 9:40:44PM | DOW | 33961 | ‘cess | ||||||||

| 9:49:17PM | NASDAQ | 14865 | |||||||||

| 10:20:49PM | JAPAN | 33569 | Success |

21/06/2023 FTSE Closed at 7559 points. Change of -0.13%. Total value traded through LSE was: £ 4,468,515,731 a change of -18.02%

20/06/2023 FTSE Closed at 7569 points. Change of -0.25%. Total value traded through LSE was: £ 5,450,485,635 a change of 18.02%

19/06/2023 FTSE Closed at 7588 points. Change of -0.71%. Total value traded through LSE was: £ 4,618,439,635 a change of -67.02%

16/06/2023 FTSE Closed at 7642 points. Change of 0.18%. Total value traded through LSE was: £ 14,002,242,699 a change of 107.37%

15/06/2023 FTSE Closed at 7628 points. Change of 0.34%. Total value traded through LSE was: £ 6,752,443,780 a change of 5.35%

14/06/2023 FTSE Closed at 7602 points. Change of 0.11%. Total value traded through LSE was: £ 6,409,785,309 a change of 14.25%

13/06/2023 FTSE Closed at 7594 points. Change of 1.66%. Total value traded through LSE was: £ 5,610,301,636 a change of 24.77%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AV. Aviva** **LSE:BME B & M** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:FGP Firstgroup** **LSE:FRES Fresnillo** **LSE:GRG Greggs** **LSE:IQE IQE** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:PHP Primary Health** **LSE:PMG Parkmead** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:TERN Tern Plc** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aston Martin, Aviva, B & M, British Telecom, Caspian, Firstgroup, Fresnillo, Greggs, IQE, ITV, Just Eat, Lloyds Grp., Natwest, Primary Health, Parkmead, Spirax, Serco, Taylor Wimpey,

LSE:AML Aston Martin. Close Mid-Price: 323 Percentage Change: + 4.19% Day High: 325 Day Low: 306.2

Target met. Continued trades against AML with a mid-price ABOVE 325 shoul ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AV. Aviva Close Mid-Price: 391.9 Percentage Change: -0.51% Day High: 395 Day Low: 389.8

Weakness on Aviva below 389.8 will invariably lead to 387 with secondary, ……..

</p

View Previous Aviva & Big Picture ***

LSE:BME B & M. Close Mid-Price: 568 Percentage Change: + 0.28% Day High: 571.4 Day Low: 560.8

All B & M needs are mid-price trades ABOVE 571.4 to improve acceleration ……..

</p

View Previous B & M & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 131.2 Percentage Change: -2.85% Day High: 133.9 Day Low: 130.85

In the event British Telecom experiences weakness below 130.85 it calcula ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 4.05 Percentage Change: -7.95% Day High: 4.4 Day Low: 4.05

Weakness on Caspian below 4.05 will invariably lead to 3.9p with secondar ……..

</p

View Previous Caspian & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 141 Percentage Change: + 0.21% Day High: 145.3 Day Low: 139.8

Continued trades against FGP with a mid-price ABOVE 145.3 should improve ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 624.4 Percentage Change: -3.22% Day High: 644 Day Low: 623

Target met. Continued weakness against FRES taking the price below 623p c ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 2560 Percentage Change: -1.31% Day High: 2594 Day Low: 2560

Target met. In the event Greggs experiences weakness below 2560 it calcul ……..

</p

View Previous Greggs & Big Picture ***

LSE:IQE IQE Close Mid-Price: 19.08 Percentage Change: -3.64% Day High: 19.92 Day Low: 18.92

Target met. Weakness on IQE below 18.92 will invariably lead to 17p with ……..

</p

View Previous IQE & Big Picture ***

LSE:ITV ITV Close Mid-Price: 68.28 Percentage Change: -1.53% Day High: 69.38 Day Low: 67.96

Continued weakness against ITV taking the price below 67.96 calculates as ……..

</p

View Previous ITV & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1067 Percentage Change: -0.84% Day High: 1088 Day Low: 1058

If Just Eat experiences continued weakness below 1058, it will invariably ……..

</p

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 43.74 Percentage Change: -2.39% Day High: 44.48 Day Low: 43.44

Weakness on Lloyds Grp. below 43.44 will invariably lead to 43.1 with sec ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 235.6 Percentage Change: -3.95% Day High: 243.2 Day Low: 235.1

Target met. In the event of NWG share price managing to break below 235 ( ……..

</p

View Previous Natwest & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 96.8 Percentage Change: -0.87% Day High: 98.1 Day Low: 94.85

In the event Primary Health experiences weakness below 94.85 it calculate ……..

</p

View Previous Primary Health & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 13 Percentage Change: -7.14% Day High: 14 Day Low: 13

If Parkmead experiences continued weakness below 13, it will invariably l ……..

</p

View Previous Parkmead & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 10195 Percentage Change: -1.02% Day High: 10285 Day Low: 10145

In the event Spirax experiences weakness below 10145 it calculates with a ……..

</p

View Previous Spirax & Big Picture ***

LSE:SRP Serco Close Mid-Price: 138.9 Percentage Change: -1.14% Day High: 141.5 Day Low: 139.2

Continued weakness against SRP taking the price below 139.2 calculates as ……..

</p

View Previous Serco & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 4.25 Percentage Change: -5.56% Day High: 4.5 Day Low: 4.25

In the event Tern Plc experiences weakness below 3.25 it calculates with ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 104.5 Percentage Change: -3.51% Day High: 106.9 Day Low: 104.3

Weakness on Taylor Wimpey below 104.3 will invariably lead to 97 with sec ……..

</p

View Previous Taylor Wimpey & Big Picture ***