#FTSE #WallSt Just as we’d started to feel the markets were growing immune to politics, the current US President managed to spend Thursday destabilising them with his comments on Ukraine. Until now, we’d felt the Ukraine thing was ‘just’ an excuse to ensure Russia earned higher income from gas sales during winter. Now, we’re less confident and the futures markets appear to share our fears.

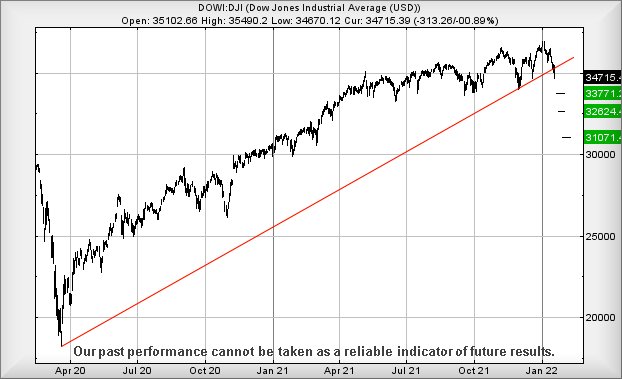

At time of writing, Wall St futures are trading around 34,686, having achieved an after hours low of 34,525. What bothers us with this behaviour is fairly simple. The Dow Jones had experienced a pretty solid uptrend since the pandemic low in 2020. That uptrend has now broken pretty conclusively, creating a situation where traffic continuing below 34,525 risks marching down to 33,771 next with secondary, if broken, at 32,624 eventually, hopefully with a proper bounce. Wall St requires exceed 35,285 points (Red on the chart) to make a nonsense of these reversal potentials.

As for the FTSE for Friday, a peculiar calculation demands the UK index exceed 7,634 points to extract itself from a zone where some reversal is probable. This week has proven quite strange, the FTSE ‘wanting’ to go up but clearly being restrained by external events. Friday should prove interesting, especially as the FTSE has (so far) been relatively immune to the stock market drama’s being enacted in Europe and the USA. However, with FTSE Futures presently trading around 7,515 points, a massive 65 points below the level (7,580) at which the market closed Thursday, common sense alone suggests the UK market faces a bit of a hammering on Friday.

We shall not be aghast, if the FTSE is gapped down in the opening second, perhaps to around 7,526 points. Things risk becoming quite fragrant with any movement below such as we can calculate an initial tame sounding ambition at 7,503 points. Below 7,503 risks knocking on the gates of trouble as we can calculate a secondary and hopeful bounce level at 7,421 points.

We shall not embrace our inner optimist unless the UK somehow scrambles above 7,588 points. In theory, this should trigger gains to 7,609 with secondary, if exceeded at 7,628 points. We suspect we wasted our time, running these recovery calculations. Some solace can be taken from the detail no immediate calculations are presenting the threat of reversals below Blue (7,370) on the chart. From a FTSE perspective, returning below this longer term downtrend would be “a bad thing”

.

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:13:48PM | BRENT | 86.61 | 86.18 | 85.475 | 87.77 | 88.85 | 89.43 | 86.9 | ‘cess | ||

| 9:15:48PM | GOLD | 1838.18 | 1835 | 1833 | 1844 | 1844 | 1848 | 1835 | Shambles | ||

| 9:19:43PM | FTSE | 7530 | 7520 | 7504 | 7572 | 7590 | 7617 | 7548 | Success | ||

| 9:22:20PM | FRANCE | 7162.4 | 7121 | 7067 | 7204 | 7207 | 7236 | 7147 | |||

| 9:24:20PM | GERMANY | 15754 | 15726 | 15643 | 15831 | 15922 | 15985 | 15808 | Shambles | ||

| 9:28:28PM | US500 | 4473.12 | 4472 | 4462 | 4575 | 4505 | 4534 | 4474 | Success | ||

| 9:30:46PM | NASDAQ | 14771.47 | 14771 | 14726 | 14911 | Absolutely | no | idea! | Will | ‘cess | |

| 9:33:36PM | DOW | 34633 | 34626 | 34423 | 34944 | issue Live | Report | at 9.30 | AM | Success | |

| 9:35:44PM | JAPAN | 27500 | 27468 | 27437 | 27778 | 27778 | 27844 | 27560 | Shambles |

20/01/2022 FTSE Closed at 7585 points. Change of -0.05%. Total value traded through LSE was: £ 6,521,628,941 a change of -25.14%

19/01/2022 FTSE Closed at 7589 points. Change of 0.34%. Total value traded through LSE was: £ 8,711,225,225 a change of 13.49%

18/01/2022 FTSE Closed at 7563 points. Change of -0.63%. Total value traded through LSE was: £ 7,675,745,106 a change of 32.82%

17/01/2022 FTSE Closed at 7611 points. Change of 0.91%. Total value traded through LSE was: £ 5,779,249,970 a change of -10.18%

14/01/2022 FTSE Closed at 7542 points. Change of -0.28%. Total value traded through LSE was: £ 6,434,562,809 a change of 1.01%

13/01/2022 FTSE Closed at 7563 points. Change of 0.16%. Total value traded through LSE was: £ 6,370,299,567 a change of -13.58%

12/01/2022 FTSE Closed at 7551 points. Change of 0.83%. Total value traded through LSE was: £ 7,371,380,208 a change of 17.9%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:EZJ EasyJet** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:HL. Hargreaves Lansdown** **LSE:ITM ITM Power** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:PPC President Energy** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aviva, EasyJet, Genel, Glencore Xstra, Hargreaves Lansdown, ITM Power, National Glib, Omega Diags, Oxford Instruments, Primary Health, President Energy, Zoo Digital,

LSE:AV. Aviva Close Mid-Price: 440.2 Percentage Change: -0.18% Day High: 445.1 Day Low: 437.1

Further trades ABOVE 445.1 should still improve acceleration toward an ini ……..

</p

View Previous Aviva & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 645.8 Percentage Change: + 3.29% Day High: 649.6 Day Low: 618.6

Further movement against EasyJet ABOVE 650 should improve acceleration tow ……..

</p

View Previous EasyJet & Big Picture ***

LSE:GENL Genel Close Mid-Price: 153.8 Percentage Change: -0.13% Day High: 157.2 Day Low: 152.2

Above 158 still suggests travel coming to an initial 160p. If bettered, o ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 412.5 Percentage Change: -1.57% Day High: 423.2 Day Low: 408.9

Further movement against Glencore Xstra ABOVE 4242 should improve accelera ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 1334.5 Percentage Change: -0.93% Day High: 1357 Day Low: 1325

This is still not looking great as travel below 1302 now points toward 119 ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 332.4 Percentage Change: + 6.33% Day High: 334.6 Day Low: 308

Target Met or near enough. The interesting thing about the bounce is the p ……..

</p

View Previous ITM Power & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1092.2 Percentage Change: + 0.29% Day High: 1098.2 Day Low: 1086.2

In the event of National Glib enjoying further trades beyond 1099, the sha ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 13.25 Percentage Change: -4.50% Day High: 14.12 Day Low: 12.25

Continued weakness against ODX taking the price below 12.25 calculates as ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2225 Percentage Change: + 0.23% Day High: 2250 Day Low: 2205

Weakness on Oxford Instruments below 2205 will invariably lead to 2074 wit ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 144.8 Percentage Change: -0.75% Day High: 146.4 Day Low: 144.6

Target Met. This is not terribly encouraging as below 144 now paints a pic ……..

</p

View Previous Primary Health & Big Picture ***

LSE:PPC President Energy. Close Mid-Price: 1.77 Percentage Change: + 1.43% Day High: 1.77 Day Low: 1.73

Weakness on President Energy below 1.72 will invariably lead to 1.45 with ……..

</p

View Previous President Energy & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 136.5 Percentage Change: + 4.60% Day High: 137.5 Day Low: 130.5

All Zoo Digital needs are mid-price trades ABOVE 138 to confirm^ accelerat ……..

</p

View Previous Zoo Digital & Big Picture ***