#Gold #Nasdaq The headline, the BBC has closed down their Scottish news service, ensuring all news is controlled by London is scary. Thankfully, both Sky and RT appear to be following a different agenda, ensuring reportage of “the lockdown” has more than Derbyshire polices slanted perspective! A gloom laden weekend prompted the thought, not “how low ill the markets go. Instead, will there be markets once this is all over?”

Equally, stories of governments, the world over, printing money to alleviate hardship through these difficult times tends prompt the question; “how will nations cope with such record levels of increased National Debt?” Of course, perhaps a simple solution shall be for governments to simply cancel the added debt they owe themselves if this crisis ever ends. Then again, wasn’t this the behaviour which provoked hyper-inflation in Germany in the years prior to WW2? Maybe if all governments cancel their debt at the same time, the world shall dodge such a risk.

It’s proving amusing watching economists tying themselves in knots, trying to predict what will happen once lockdown completes. Given the current situation is completely new, it feels like we are just going to have to wait and see. It’s pretty certain many small businesses will never be able to re-open without eventual debt forgiveness as few are insured for current events, fewer still will have financial reserves to cope with prolonged lockdown.

To escape from overthinking immediate events, we’ve taken a look at Wall St and shall comment against it, daily, for the coming week. The Big Picture number on the DOW is at 18,000 points. Essentially, movement below such a level allows for panic, thanks to reversal to 14,000 being pretty likely. Unfortunately, recent moves on the index already risk troubling this level.

Now below 21,450 allows weakness toward an initial 20,392 points. If broken, secondary calculates at 19,643 points. At this level, we need to take a deep breath and steady our hands as we compute the third level, should 19,643 break. It’s down at 17,190 points, obviously breaking the 18,000 trigger and risking really severe reversals.

HOWEVER, there is something worthy of consideration and it’s shown on the chart inset. The DOW broke the uptrend since 2009 and somehow, despite world (and NY) events, has recovered above this important trend. Due to this, allegedly it’s now the case of movement above 22,330 allowing a journey to 23,207 to commence. If exceeded, secondary calculates at 24,415 points.

We’re pretty far from convinced unless some bloke, working in his garden shed in Sheffield, has a big surprise cure to announce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 8:56:29PM | BRENT | 27.78 | Success | ||||||||

| 8:57:57PM | GOLD | 1632.89 | 1610 | 1597.5 | 1582 | 1630 | 1644 | 1661 | 1715 | 1609 | |

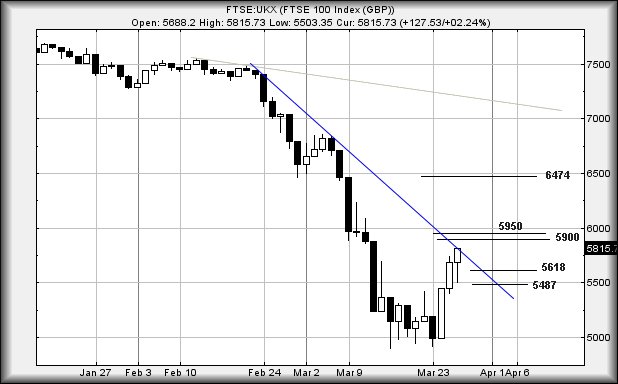

| 9:00:09PM | FTSE | 5443.97 | |||||||||

| 9:13:50PM | FRANCE | 4324 | ‘cess | ||||||||

| 9:42:34PM | GERMANY | 9550.01 | |||||||||

| 9:43:55PM | US500 | 2532.77 | |||||||||

| 9:46:36PM | DOW | 21551 | |||||||||

| 9:48:45PM | NASDAQ | 7575 | 7565 | 7504 | 7369 | 7688 | 7820 | 7874.5 | 7977 | 7700 | |

| 9:50:55PM | JAPAN | 18740 | ‘cess |