#Brent #DAX

We wish the stock market and Barclays could be fixed as simply as our tumble drier. On Saturday thing decided it was bored with life and stopped supplying heat to its contents. At this point, one of the true joys of the internet was discovered, a video which advised throwing a bit of the drier at a paving slab would fix the problem! The component (a thermal fuse) was thrown at a rock, then tested. Somehow, the problem was fixed.

It transpires the fuse has a bit of metal inside which expands and drops when things get too hot. The effort of tossing it at rock apparently encourages the metal to slip back into place. While a replacement thermal fuse was only around £20, the proposed delay of placing an order and awaiting delivery to the Scottish Highlands was deemed unacceptable. This piece of good luck with a fuse was the 2nd good thing to happen recently. On Friday, we visited the mainland to collect a Toyota Aygo, essentially a step up from a scooter and apparently cheaper to run. When we left in the morning, fuel locally was 147p a litre. When we returned, fuel was not 180p a litre. Thankfully, the little Aygo had a full tank anyway and despite using every opportunity to treat the thing like a go-cart on local roads, the fuel gauge remains showing almost full, despite covering almost 100 miles. The little car was bought, essentially for an older dog, who’d becoming grouchy about jumping into the larger Toyota 4WD but with current absurd petrol prices, it appears the smaller Toyota shall be the transport of choice until sanity reappears.

But if only we could just chuck Barclays share price at a solid object to make it perform with some reason!

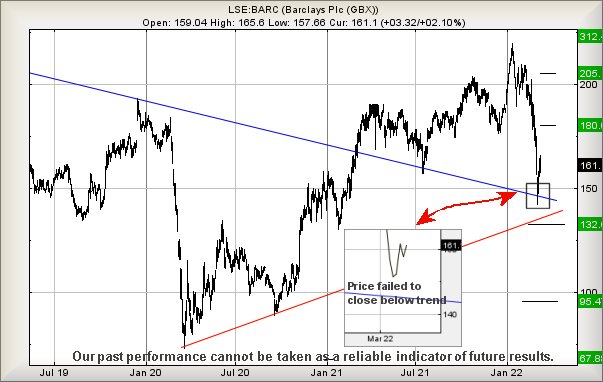

On Friday, we exhibited a picture of the FTSE dipping below a trend but, thankfully, failing to close below the painted line. Amusingly, Barclays exhibited almost identical behaviour recently (inset on chart) and there’s something fairly important about this sort of thing worth remembering. Essentially, this is a visual confirmation the markets regard a particular trend line as valid and important, creating a situation where close attention needs paid, if a share price actually closes a session below the particular trend line.

In the case of Barclays, the implication is of closure below currently 143.33 suggesting the share price intends a voyage down to 132p next with secondary, if broken, at a hopeful bottom of 95p. Hopefully such a level carries a similar threat to throwing the price at a rock…

Thankfully Barclays share price shouldn’t need try to hard to escape this doom as it appears movement next above 169p should supply some hope. Apparently, this should prove capable of triggering recovery to an initial 180p with secondary, if bettered, a happier 205p, visually pretending the Ukraine event didn’t happen.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:15:37PM | BRENT | 110.92 | 105 | 101 | 86.75 | 113 | 114 | 118 | 121 | 108 | |

| 9:18:29PM | GOLD | 1983.01 | ‘cess | ||||||||

| 9:21:32PM | FTSE | 7118.74 | Shambles | ||||||||

| 9:26:48PM | FRANCE | 6224.2 | Success | ||||||||

| 10:09:04PM | GERMANY | 13540.92 | 13402 | 13234 | 12943 | 13640 | 14107 | 14165 | 14460 | 13747 | Success |

| 10:13:02PM | US500 | 4235 | Success | ||||||||

| 10:15:02PM | DOW | 33089 | Success | ||||||||

| 10:17:06PM | NASDAQ | 13380 | |||||||||

| 10:29:39PM | JAPAN | 25199 | Success |

11/03/2022 FTSE Closed at 7155 points. Change of 0.79%. Total value traded through LSE was: £ 6,850,629,560 a change of -15.87%

10/03/2022 FTSE Closed at 7099 points. Change of -1.27%. Total value traded through LSE was: £ 8,142,573,429 a change of 0.69%

9/03/2022 FTSE Closed at 7190 points. Change of 3.25%. Total value traded through LSE was: £ 8,087,014,052 a change of -12.41%

8/03/2022 FTSE Closed at 6964 points. Change of 0.07%. Total value traded through LSE was: £ 9,232,494,481 a change of -9.7%

7/03/2022 FTSE Closed at 6959 points. Change of -0.4%. Total value traded through LSE was: £ 10,224,193,154 a change of 15.38%

4/03/2022 FTSE Closed at 6987 points. Change of -3.47%. Total value traded through LSE was: £ 8,861,498,669 a change of 14.29%

3/03/2022 FTSE Closed at 7238 points. Change of -2.57%. Total value traded through LSE was: £ 7,753,530,217 a change of -3.98%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:EME Empyrean** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:ODX Omega Diags** **LSE:POLY Polymetal** **

********

Updated charts published on : Astrazeneca, Empyrean, Genel, Glencore Xstra, Omega Diags, Polymetal,

LSE:AZN Astrazeneca. Close Mid-Price: 9275 Percentage Change: + 0.61% Day High: 9384 Day Low: 9221

All Astrazeneca needs are mid-price trades ABOVE 9384 to improve accelera ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:EME Empyrean. Close Mid-Price: 7.55 Percentage Change: + 7.09% Day High: 8.5 Day Low: 7

Target met. In the event of Empyrean enjoying further trades beyond 8.5, ……..

</p

View Previous Empyrean & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 158 Percentage Change: + 4.64% Day High: 159 Day Low: 154

All Genel needs are mid-price trades ABOVE 159 to improve acceleration to ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 511.3 Percentage Change: + 2.67% Day High: 514.1 Day Low: 500.5

Target met. Continued trades against GLEN with a mid-price ABOVE 514.1 sh ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 4.08 Percentage Change: -1.81% Day High: 4.2 Day Low: 3.08

Target met. In the event Omega Diags experiences weakness below 3.08 it c ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:POLY Polymetal. Close Mid-Price: 169.5 Percentage Change: + 12.07% Day High: 173.1 Day Low: 131

In the event Polymetal experiences weakness below 131 it still calculates ……..

</p

View Previous Polymetal & Big Picture ***