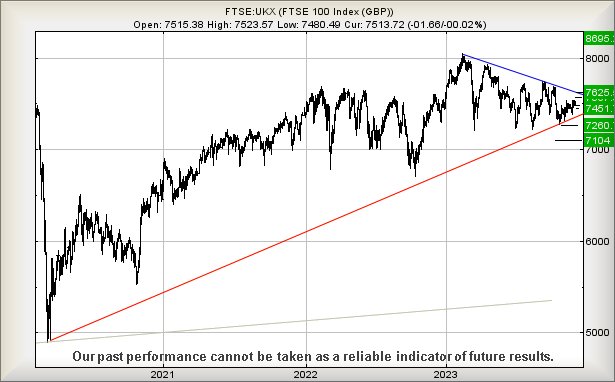

Vibrant, exciting, positive, are all words which cannot be used to describe the #FTSE. The markets behaviour for the start of December has been pretty awful but at least allows us to identify a couple of trigger levels, one for the near term and another important one for the longer term Big Picture.

There’s almost a pretty good argument favouring a future 8695 as exerting an attraction for the future. All the UK index needs do is exceed 7760 points to trigger some real fireworks. One thing which is quite fascinating about this trigger level is it was obviously generated by software but, when we look at the chart, market movements during May, July, and September managed to form a glass ceiling around the 7760 level. The puzzle for us comes from the fact our trigger level was generated due to market movements in 2020 and the work required by the FTSE to move away from the 4900 point bottom. What we can suggest now, the downtrend for 2023 appears pretty firmly formed and a nudge above 7760 shall certainly signify a breakout, breaking above the downtrend AND breaking above the illusory glass ceiling at 7760.

The reason we’re making so much noise about 7760 is the market actually doesn’t need try hard to achieve such an ambition. Allegedly, the first important box for movement to 7760 shall be ticked, if the FTSE manages to CLOSE a session above just 7532 points. At time of writing, it closed Thursday at 7513 points, so very little effort is required.

From a closer perspective, above 7542 points calculates with the potential of a lift to a fairly innocuous 7567 points with our secondary, if bettered, calculating at a confident looking 7625 points and a challenge against the Blue downtrend since February this year. If triggered, the market needs below 7512 to cancel, a fairly attractive stop loss position. But as always, if the movement happens in the opening second of the day, it will be perhaps best to ignore it and go pour a fresh coffee.

Unfortunately, market behaviour this week makes us suspect Friday shall experience some reversals, the index only needing below 7500 points to ring a small alarm bell, calculating with the chance of reversal to an initial 7482 along with a possible short lived bounce. Our secondary, if 7482 breaks, works out at 7451 points

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:36:24PM | BRENT | 7437 | 7359 | 7343 | 7477 | 7902 | 7953 | 7710 | |||

| 9:38:11PM | GOLD | 2028.34 | 2010 | 1980 | 2032 | 2040 | 2046 | 2024 | |||

| 9:46:03PM | FTSE | 7511 | 7477 | 7454 | 7424 | 7499 | 7523 | 7531 | 7549 | 7504 | |

| 9:48:33PM | STOX50 | 4473.8 | 4457 | 4445 | 4475 | 4486 | 4492 | 4466 | |||

| 9:51:54PM | GERMANY | 16629.3 | 16592 | 16535 | 16645 | 16670 | 16677 | 16614 | |||

| 9:54:39PM | US500 | 4578.8 | 4543 | 4530 | 4553 | 4586 | 4594 | 4567 | ‘cess | ||

| 9:56:48PM | DOW | 36098 | 35973 | 35897 | 36055 | 36167 | 36225 | 36099 | |||

| 9:59:18PM | NASDAQ | 15993 | 15774 | 15710 | 15839 | 16047 | 16128 | 15987 | Success | ||

| 10:04:42PM | JAPAN | 32404 | 32171 | 32076 | 32421 | 32954 | 33228 | 32694 | Success |

7/12/2023 FTSE Closed at 7513 points. Change of -0.03%. Total value traded through LSE was: £ 5,691,416,870 a change of -34.9%

6/12/2023 FTSE Closed at 7515 points. Change of 0.35%. Total value traded through LSE was: £ 8,742,933,283 a change of 113.36%

5/12/2023 FTSE Closed at 7489 points. Change of -0.31%. Total value traded through LSE was: £ 4,097,792,180 a change of -8.47%

4/12/2023 FTSE Closed at 7512 points. Change of -0.23%. Total value traded through LSE was: £ 4,476,825,041 a change of -0.54%

1/12/2023 FTSE Closed at 7529 points. Change of 1.02%. Total value traded through LSE was: £ 4,501,021,882 a change of -55.19%

30/11/2023 FTSE Closed at 7453 points. Change of 0.4%. Total value traded through LSE was: £ 10,044,675,963 a change of 155.31%

29/11/2023 FTSE Closed at 7423 points. Change of -0.43%. Total value traded through LSE was: £ 3,934,274,294 a change of -13.77%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CCL Carnival** **LSE:EZJ EasyJet** **LSE:IHG Intercontinental Hotels Group** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:OXIG Oxford Instruments** **LSE:SBRY Sainsbury** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Updated charts published on : Barrett Devs, BP PLC, British Telecom, Carnival, EasyJet, Intercontinental Hotels Group, Music Magpie, National Glib, Oxford Instruments, Sainsbury, Taylor Wimpey, Vodafone,

LSE:BDEV Barrett Devs. Close Mid-Price: 542 Percentage Change: + 1.92% Day High: 540.8 Day Low: 528.6

Continued trades against BDEV with a mid-price ABOVE 540.8 should improve ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 460.25 Percentage Change: -1.22% Day High: 466.05 Day Low: 459.7

Target met. Weakness on BP PLC below 459.7 will invariably lead to 450p w ……..

</p

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 134.4 Percentage Change: -1.65% Day High: 137.3 Day Low: 132.15

Target met. In the event of British Telecom enjoying further trades beyon ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1257 Percentage Change: + 1.70% Day High: 1270 Day Low: 1215

Target met. All Carnival needs are mid-price trades ABOVE 1270 to improve ……..

</p

View Previous Carnival & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 483.4 Percentage Change: + 0.10% Day High: 487.8 Day Low: 469.2

In the event of EasyJet enjoying further trades beyond 487.8, the share s ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 6590 Percentage Change: + 2.33% Day High: 6586 Day Low: 6384

Target met. All Intercontinental Hotels Group needs are mid-price trades ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:MMAG Music Magpie Close Mid-Price: 11.5 Percentage Change: -8.00% Day High: 12.5 Day Low: 11.75

Target met. In the event Music Magpie experiences weakness below 11.75 it ……..

</p

View Previous Music Magpie & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1066 Percentage Change: + 1.38% Day High: 1072.5 Day Low: 1052

Target met. Further movement against National Glib ABOVE 1072.5 should im ……..

</p

View Previous National Glib & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2100 Percentage Change: -2.10% Day High: 2240 Day Low: 2085

In the event of Oxford Instruments enjoying further trades beyond 2240, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 290.1 Percentage Change: + 0.03% Day High: 291.8 Day Low: 288.3

All Sainsbury needs are mid-price trades ABOVE 291.8 to improve accelerat ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 137.1 Percentage Change: + 1.82% Day High: 137.25 Day Low: 134.1

Further movement against Taylor Wimpey ABOVE 137.25 should improve accele ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 69.8 Percentage Change: -3.31% Day High: 71.73 Day Low: 69.71

In the event Vodafone experiences weakness below 69.71 it calculates with ……..

</p

View Previous Vodafone & Big Picture ***