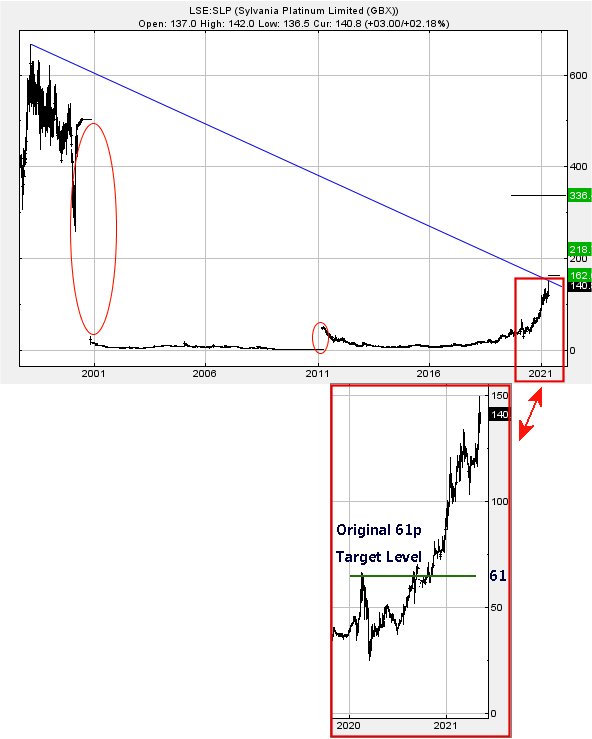

#Dax #Nasdaq Few things are more annoying than a song stuck in your head. Inevitably, this lot promoted “Sylvia’s Mother” by Dr Hook into the #1 position, making us wonder how long it takes employees of the company to start detesting the tune! In our review of Sylvania back in 2019 (link), we mentioned forces were at work which allowed a lunge in the direction of 61p. This was due to price movements from six years previously.

Obviously, with the share now trading around 140p, our goal was achieved. An awkward situation now exists as we’re forced to travel back to 1999. Thankfully an abiding dislike of the singer Prince ensured his dreadful tune with that number in the title didn’t emulate Dr Hook.

By this method, we can try and make sense of where current price movements find their inspiration. Once upon a time, the share was trading above 600p and this appears to provide the arithmetic powering current price strength, a quite extraordinary situation from our perspective. Making matters more difficult, a couple of gaps exist on the chart which circle major price adjustments where there was no trading. Something happened at the start of the 21st century, when one morning the market awoke and decided Sylvania was no longer worth 5 quid a share but instead, around 33p represented fair value.

In the period since the share price exceeded 96p, we’ve little choice but to seek inspiration from the days when it was trading at 650p. From our standpoint, this is now the only thing making sense, capable of explaining the rise to current levels.

Next above 151p should prove capable of bringing a visit to an initial 162p. If exceeded, our longer term secondary calculates at 218p. Above such a level, things are necessarily vague, thanks to the circled gaps and we shall prefer revisit to run the numbers again. We’ve chosen to show a long term 336p but the reality of such ambition almost needs guesswork.

Finally, the inset below shows a textbook case of our target levels. Earlier in 2020, the share price indeed hit – and exceeded – our target of 61p. The share price then tanked, plunging to 24p. But at the start of September 2020, the price once again attained our 61p and once the prior highs were finally beaten, a state of “higher highs” existed and the rest is history with the price languishing at 140p presently. The value of the share price would need to literally half before we’d suggest time to panic.

*** Writing a daily thanks to the kind folk who chose to visit adverts on this page reminds people shouldn’t be taken for granted. We’re pleased Google are obviously directing interesting content here.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:10:13PM | BRENT | 68.89 | Success | ||||||||

| 10:16:31PM | GOLD | 1815 | Success | ||||||||

| 10:18:46PM | FTSE | 6959.39 | |||||||||

| 10:20:26PM | FRANCE | 6245.5 | Shambles | ||||||||

| 10:22:46PM | GERMANY | 15079 | 15000 | 14969 | 14883 | 15129 | 15202 | 15226 | 15282 | 15112 | ‘cess |

| 10:25:51PM | US500 | 4056 | Success | ||||||||

| 10:29:32PM | DOW | 33579.8 | ‘cess | ||||||||

| 10:31:52PM | NASDAQ | 12978 | 12963 | 12899 | 12736 | 13195 | 13113 | 13204.5 | 13239 | 12992 | ‘cess |

| 10:36:12PM | JAPAN | 27963 |

12/05/2021 FTSE Closed at 7004 points. Change of 0.82%. Total value traded through LSE was: £ 5,968,278,155 a change of -15.12%

11/05/2021 FTSE Closed at 6947 points. Change of -2.47%. Total value traded through LSE was: £ 7,031,531,361 a change of 14.21%

10/05/2021 FTSE Closed at 7123 points. Change of -0.08%. Total value traded through LSE was: £ 6,156,776,739 a change of 2.81%

7/05/2021 FTSE Closed at 7129 points. Change of 0.75%. Total value traded through LSE was: £ 5,988,474,650 a change of -25.26%

6/05/2021 FTSE Closed at 7076 points. Change of 0.53%. Total value traded through LSE was: £ 8,012,209,382 a change of 24%

5/05/2021 FTSE Closed at 7039 points. Change of 1.68%. Total value traded through LSE was: £ 6,461,512,143 a change of 1.02%

4/05/2021 FTSE Closed at 6923 points. Change of -100%. Total value traded through LSE was: £ 6,395,995,707 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BLVN Bowleven** **LSE:BPC Bahamas Pet** **LSE:CAR Carclo** **LSE:DGE Diageo** **LSE:GLEN Glencore Xstra** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:MRW Morrisons** **LSE:SBRY Sainsbury** **

********

Updated charts published on : Aviva, Bowleven, Bahamas Pet, Carclo, Diageo, Glencore Xstra, International Personal Finance, IQE, Morrisons, Sainsbury,

LSE:AV. Aviva. Close Mid-Price: 403.5 Percentage Change: + 0.75% Day High: 405.1 Day Low: 397.3

Apparently this only needs above 417p to next start a path toward 473p. If ……..

</p

View Previous Aviva & Big Picture ***

LSE:BLVN Bowleven. Close Mid-Price: 4.75 Percentage Change: + 0.00% Day High: 4.75 Day Low: 4.25

Even below 4.1 now looks troubling, still painting 2.5 as a “bottom” targe ……..

</p

View Previous Bowleven & Big Picture ***

LSE:BPC Bahamas Pet. Close Mid-Price: 0.34 Percentage Change: + 5.47% Day High: 0.32 Day Low: 0.3

If Bahamas Pet experiences continued weakness below 0.30, it will invaria ……..

</p

View Previous Bahamas Pet & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 68.8 Percentage Change: + 12.79% Day High: 70 Day Low: 58.8

Target met. In the event of Carclo enjoying further trades beyond 70, the ……..

</p

View Previous Carclo & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3298.5 Percentage Change: + 3.40% Day High: 3326 Day Low: 3251

Target met. Further movement against Diageo ABOVE 3326 should improve acc ……..

</p

View Previous Diageo & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 333.1 Percentage Change: + 1.59% Day High: 339.25 Day Low: 329.6

Target met. Continued trades against GLEN with a mid-price ABOVE 339.25 s ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 134.4 Percentage Change: + 2.75% Day High: 136 Day Low: 129.6

In the event of International Personal Finance enjoying further trades be ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:IQE IQE Close Mid-Price: 52.6 Percentage Change: -2.23% Day High: 55.6 Day Low: 52.6

Should IQE experiences weakness below 52.6, it calculates with a drop pote ……..

</p

View Previous IQE & Big Picture ***

LSE:MRW Morrisons. Close Mid-Price: 184.3 Percentage Change: + 1.07% Day High: 186.45 Day Low: 183

In the event of Morrisons enjoying further trades beyond 186.45, the shar ……..

</p

View Previous Morrisons & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 259.3 Percentage Change: + 2.13% Day High: 259.9 Day Low: 253.4

Target met. Continued trades against SBRY with a mid-price ABOVE 259.9 sh ……..

</p

View Previous Sainsbury & Big Picture ***