#Gold #WallSt Tuesday was a day with an epiphany, celebrated with a “Click & Collect” order from our guilty secret, a Wagamama outlet just off the motorway on the way to the ferry and a return to miserable weather in Argyll. On the basis there’s nothing more boring than other peoples illness’, suffering from chemo inflicted sore legs for a decade has been difficult, levels of pain kept to a dull roar with some exotic medications.

Trying a quack idea involved a visit to a place called Bathgate and something called a “Float Centre”. This new fangled concept involves lying inside what looks like a dragons egg, filled with water, for an hour or so. The water is heavily loaded with special salts, and once the lid of the egg is closed, it’s a true sensory deprivation experience with no sound, light, or even any sensation of weight due to the salt content making it impossible to sink.

When light returned inside the pod, it was a matter of enjoying a power shower, drying hair, and assuring the places attentive staff that I felt fine, hadn’t fallen asleep, didn’t experience any hallucinations, and was starving. It was only when walking to the car park did realisation dawn of the ever present, 10 year pain, being missing. Returning to reception and mentioning this to the staff produced plenty of cheer, apparently I was reporting a common result.

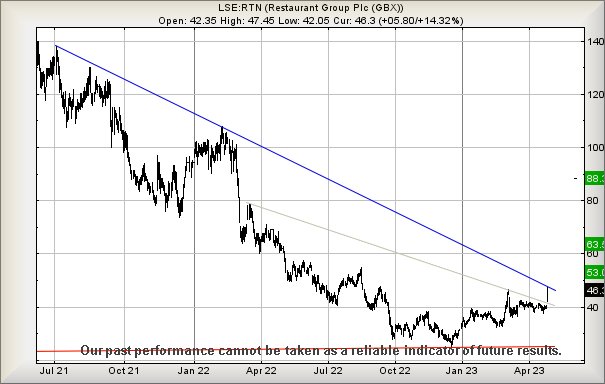

We ordered our pickup from Wagamama, collecting it 30 minutes later, discovering the walk into their outlet was accomplished still with a lack of leg pains, a state of affairs which continues, now six hours later. But our takeaway food reminded us the owners of Wagamama – Restaurant Group Plc – were probably due a review of their share price, the quality of their meals remaining a constant rather than a reflection of the mood of kitchen staff.

Something significant appears to be happening with Restaurant Groups share price, making it appear the downtrend since 2021 somehow has adopted self importance. Now, above 48p looks very capable of triggering share price movement toward an initial 53p next. Should this initial ambition be exceeded, our longer term secondary works out at 63p. The important detail behind such movements is once this share price actually closes a session above Blue, we shall feel duty bound to promote a future 88p as a viable distant hope.

We quite strongly suspect this shall prove worth keeping an eye on in the days ahead. The share price needs below 31p to produce any early hint of pain ahead.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:01:26PM | BRENT | 75.23 | ‘cess | ||||||||

| 10:03:39PM | GOLD | 2016.98 | 2009 | 2007 | 2003 | 2016 | 2019 | 2024 | 2036 | 2009 | ‘cess |

| 10:06:08PM | FTSE | 7793.05 | |||||||||

| 10:08:07PM | STOX50 | 4312.2 | Success | ||||||||

| 10:10:27PM | GERMANY | 15763.94 | ditto | ||||||||

| 10:12:25PM | US500 | 4117 | ditto | ||||||||

| 10:15:59PM | DOW | 33668 | 33430 | 33330 | 33019 | 33690 | 34010 | 34212 | 34475 | 33850 | ditto |

| 10:18:09PM | NASDAQ | 13100 | ditto | ||||||||

| 10:20:52PM | JAPAN | 28771 | ditto |

2/05/2023 FTSE Closed at 7773 points. Change of -1.23%. Total value traded through LSE was: £ 8,014,658,915 a change of 6.5%

1/05/2023 FTSE Closed at 7870 points. Change of 0%. Total value traded through LSE was: £ 7,525,342,837 a change of 5.53%

28/04/2023 FTSE Closed at 7870 points. Change of 0.5%. Total value traded through LSE was: £ 7,130,992,980 a change of 35.22%

27/04/2023 FTSE Closed at 7831 points. Change of -0.27%. Total value traded through LSE was: £ 5,273,731,128 a change of -19.3%

26/04/2023 FTSE Closed at 7852 points. Change of -0.49%. Total value traded through LSE was: £ 6,534,580,339 a change of 22.98%

25/04/2023 FTSE Closed at 7891 points. Change of -0.27%. Total value traded through LSE was: £ 5,313,341,670 a change of -9.21%

24/04/2023 FTSE Closed at 7912 points. Change of -0.03%. Total value traded through LSE was: £ 5,852,631,583 a change of -1.53%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BDEV Barrett Devs** **LSE:FGP Firstgroup** **LSE:GRG Greggs** **LSE:HSBA HSBC** **LSE:ITV ITV** **LSE:OXIG Oxford Instruments** **LSE:RKH Rockhopper** **LSE:TW. Taylor Wimpey** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Barrett Devs, Firstgroup, Greggs, HSBC, ITV, Oxford Instruments, Rockhopper, Taylor Wimpey, Zoo Digital,

LSE:BDEV Barrett Devs. Close Mid-Price: 505.2 Percentage Change: + 1.04% Day High: 515 Day Low: 502.2

Further movement against Barrett Devs ABOVE 515 should improve accelerati ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:FGP Firstgroup. Close Mid-Price: 117 Percentage Change: + 4.09% Day High: 117.2 Day Low: 112.4

All Firstgroup needs are mid-price trades ABOVE 117.2 to improve accelera ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 2846 Percentage Change: + 0.99% Day High: 2870 Day Low: 2804

Continued trades against GRG with a mid-price ABOVE 2870 should improve t ……..

</p

View Previous Greggs & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 593.9 Percentage Change: + 3.50% Day High: 610.6 Day Low: 592.4

In the event of HSBC enjoying further trades beyond 610.6, the share shou ……..

</p

View Previous HSBC & Big Picture ***

LSE:ITV ITV Close Mid-Price: 77.66 Percentage Change: -3.86% Day High: 80.84 Day Low: 77.18

Continued weakness against ITV taking the price below 77.18 calculates as ……..

</p

View Previous ITV & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2760 Percentage Change: + 0.00% Day High: 2810 Day Low: 2735

In the event of Oxford Instruments enjoying further trades beyond 2810, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 13.5 Percentage Change: + 8.43% Day High: 13.7 Day Low: 12.45

Target met. All Rockhopper needs are mid-price trades ABOVE 13.7 to impro ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 128.25 Percentage Change: + 0.04% Day High: 132 Day Low: 128.7

Continued trades against TW. with a mid-price ABOVE 132 should improve th ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 156.5 Percentage Change: -2.19% Day High: 170.25 Day Low: 156.5

If Zoo Digital experiences continued weakness below 156.5, it will invari ……..

</p

View Previous Zoo Digital & Big Picture ***