#FTSE #WallSt Holiday Mondays often sneak up on us and two, in quick succession, feels very strange. Doubtless, each are going to create havoc with the markets, thanks to neither being international events. The USA and Europe will cheerfully keep trading, ignoring the empty seat at the table of international markets and by 7th May, the FTSE will be playing catch-up in a major fashion.

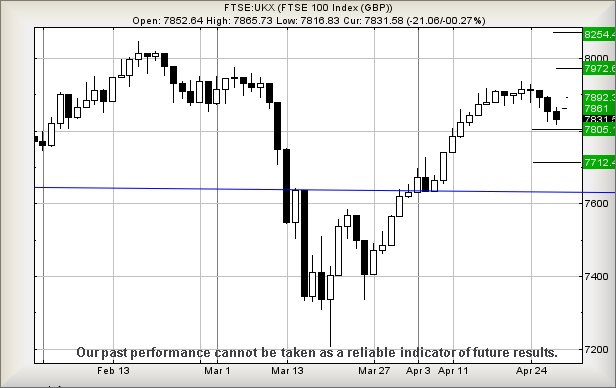

This week has proven especially limp, the FTSE experiencing death by a million papercuts as it fails to make any form of real headway, despite, from almost every perspective, the market residing in a price zone where we’re now painting 8254 as a Big Picture ambition for some point this year, the index requiring below 7600 to make a nonsense of the target level.

Currently, the FTSE needs weaken below 7816 points to suggest another painful doze of the recent lethargy poisoning the index, providing an initial lame drop target of 7805 with secondary, if broken, down at 7712 points. Perhaps it was the case Thursdays low of 7816 was actually an indication of strength as the index enjoyed a little bounce!

The market closed the session on Thursday at 7830 but unfortunately, our arithmetic demanded the index move above 7844 to tick the first box in any argument which would make a bounce “genuine!”.

If things intend take a happy pill, very possible due to it being a Grand Prix weekend, above 7844 calculates with the potential of a lift toward another tame target of 7861 points near term. If bettered, our secondary works out at 7892 points. However, do remember Friday 28th is the end of the month, a day on which logic is usually carefully placed aside, where everyone can trip over it.

As mentioned earlier, we still suspect some market gains are in the offing, hopefully to become visible next week.

Have a good weekend. For us, the situation is less certain as grand-daughters are visiting again.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:05:03PM | BRENT | 78.27 | 77.1 | 76.7 | 78.6 | 78.5 | 78.9 | 78.1 | |||

| 10:07:10PM | GOLD | 1988.05 | 1973 | 1961 | 1990 | 1993 | 1998 | 1986 | ‘cess | ||

| 10:09:07PM | FTSE | 7873 | 7850 | 7841 | 7871 | 7893 | 7905 | 7858 | |||

| 10:11:12PM | STOX50 | 4384.5 | 4342 | 4321 | 4366 | 4393 | 4400 | 4374 | Success | ||

| 10:13:20PM | GERMANY | 15881 | 15702 | 15686 | 15788 | 15920 | 15995 | 15844 | ‘cess | ||

| 10:15:47PM | US500 | 4140.6 | 4110 | 4106 | 4126 | 4148 | 4165 | 4120 | Success | ||

| 10:19:27PM | DOW | 33805.9 | 33416 | 33339 | 33638 | 33862 | 33764 | 33747 | ‘cess | ||

| 10:21:42PM | NASDAQ | 13189.22 | 13134 | 13084 | 13177 | 13252 | 13306 | 13140 | Success | ||

| 10:36:31PM | JAPAN | 28722 | 28452 | 28392 | 28638 | 28748 | 28831 | 28650 | Success |

27/04/2023 FTSE Closed at 7831 points. Change of -0.27%. Total value traded through LSE was: £ 5,273,731,128 a change of -19.3%

26/04/2023 FTSE Closed at 7852 points. Change of -0.49%. Total value traded through LSE was: £ 6,534,580,339 a change of 22.98%

25/04/2023 FTSE Closed at 7891 points. Change of -0.27%. Total value traded through LSE was: £ 5,313,341,670 a change of -9.21%

24/04/2023 FTSE Closed at 7912 points. Change of -0.03%. Total value traded through LSE was: £ 5,852,631,583 a change of -1.53%

21/04/2023 FTSE Closed at 7914 points. Change of 0.15%. Total value traded through LSE was: £ 5,943,468,959 a change of 7%

20/04/2023 FTSE Closed at 7902 points. Change of 0.05%. Total value traded through LSE was: £ 5,554,730,029 a change of 35.28%

19/04/2023 FTSE Closed at 7898 points. Change of -0.14%. Total value traded through LSE was: £ 4,106,183,420 a change of -11.15%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BARC Barclays** **LSE:CCL Carnival** **LSE:GKP Gulf Keystone** **LSE:GRG Greggs** **LSE:JET Just Eat** **LSE:SBRY Sainsbury** **LSE:SPX Spirax** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Barclays, Carnival, Gulf Keystone, Greggs, Just Eat, Sainsbury, Spirax, Tesco,

LSE:AML Aston Martin. Close Mid-Price: 241.4 Percentage Change: + 5.88% Day High: 245 Day Low: 220

Continued trades against AML with a mid-price ABOVE 245 should improve the ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 162.04 Percentage Change: + 5.32% Day High: 162.26 Day Low: 155.4

In the event of Barclays enjoying further trades beyond 163, the share sho ……..

</p

View Previous Barclays & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 634.8 Percentage Change: -0.25% Day High: 642.4 Day Low: 626.4

Continued weakness against CCL taking the price below 626 calculates as le ……..

</p

View Previous Carnival & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 135.9 Percentage Change: -7.93% Day High: 145.7 Day Low: 132.2

Now below 132 looks capable of drilling down to 126 with secondary, if bro ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 2800 Percentage Change: -1.20% Day High: 2840 Day Low: 2778

Further movement against Greggs ABOVE 2840 should improve acceleration tow ……..

</p

View Previous Greggs & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1384 Percentage Change: + 2.59% Day High: 1385 Day Low: 1310

Continued weakness against JET taking the price below 1310 still calculate ……..

</p

View Previous Just Eat & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 274.1 Percentage Change: -3.45% Day High: 285.5 Day Low: 271.6

Now above 286p should make an attempt at 298p next with secondary, if bett ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 11000 Percentage Change: + 0.96% Day High: 11070 Day Low: 10780

Almost an ouch, this now needs below 10780 to bring a visit to 10553 with ……..

</p

View Previous Spirax & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 278.7 Percentage Change: -0.32% Day High: 281.7 Day Low: 278.4

Target Met or near enuff. While some hesitation is anticipated around the ……..

</p

View Previous Tesco & Big Picture ***