#FTSE #Stoxx50 It’s funny how it can transpire a company we’ve known for years is actually just a little bit bigger than thought. The logo of “Clansman”, adorning numerous boxes of stationary back in the day when businesses used paper (they still do!), concealed just how massive local company MacFarlane had become. Thankfully, there’s little sign their share price has been tarnished with the proximity of their Glasgow packaging centre in Uddingstone to a notorious house of Nicola Sturgeon, featured strongly for several days with a police search which rivalled most murder scenes.

In many ways, the disgrace was deserved as the “alphabet women”, the conspirators labelled from Ms A through to Ms H, are unmasked and to no-ones amazement, it transpires they were all members of Nicola Sturgeons inner cabal, with some dodgy financial dealings remaining unanswered. However, it’s still the case none can be named, despite growing calls for legal action for perjury. But to get down to brass tacks, what international company would like to have such a person as a neighbour? While perhaps a small degree of bias may be sneaking through, witness ‘Ms H’ was even warned at Mr Salmonds trial she was skirting on the edge of a legal black hole due to the frequency of her rotating storylines.

One thing which is slightly amusing with the Macfarlane Group analysis comes from it being requested, not by a reader in the UK but instead, someone in Spain! It was almost ignored until the realisation dawned we actually know the company, hence our interest.

The share price has been in the doldrums this year but certainly is developing an argument for some price growth. Currently trading around 110p, it need only exceed 115p currently to kick off a cycle to an initial 120p with secondary, if exceeded, at 131p and some probable hesitation. The funny thing, closure above 131p should prove interesting as a future all time high of 152p becomes possible.

Our alternate scenario suggests trouble below 101p as giving an early indication of coming reversal to an initial 92p with our longer term secondary, if broken, calculating down at 73p and hopefully a proper bounce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:27:25PM | BRENT | 9390.2 | Success | ||||||||

| 10:31:05PM | GOLD | 1930.87 | ‘cess | ||||||||

| 10:33:41PM | FTSE | 7658.3 | 7641 | 7634 | 7597 | 7667 | 7682 | 7688 | 7704 | 7645 | |

| 10:39:00PM | STOX50 | 4247.7 | 4225 | 4214 | 4193 | 4251 | 4255 | 4265 | 4278 | 4239 | ‘cess |

| 10:41:32PM | GERMANY | 15690.3 | ‘cess | ||||||||

| 10:43:54PM | US500 | 4445.4 | Success | ||||||||

| 10:47:20PM | DOW | 34513 | ‘cess | ||||||||

| 10:49:36PM | NASDAQ | 15196.8 | ‘cess | ||||||||

| 10:52:16PM | JAPAN | 33247 |

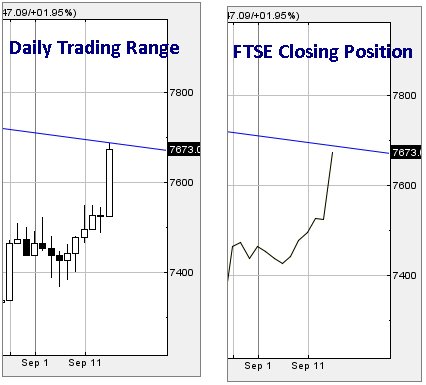

19/09/2023 FTSE Closed at 7660 points. Change of 0.1%. Total value traded through LSE was: £ 4,847,212,890 a change of 23.66%

18/09/2023 FTSE Closed at 7652 points. Change of -0.77%. Total value traded through LSE was: £ 3,919,854,652 a change of -71.71%

15/09/2023 FTSE Closed at 7711 points. Change of 0.5%. Total value traded through LSE was: £ 13,856,220,608 a change of 129.91%

14/09/2023 FTSE Closed at 7673 points. Change of 1.97%. Total value traded through LSE was: £ 6,026,828,350 a change of 14.3%

13/09/2023 FTSE Closed at 7525 points. Change of -0.03%. Total value traded through LSE was: £ 5,272,761,043 a change of 13.44%

12/09/2023 FTSE Closed at 7527 points. Change of 0.41%. Total value traded through LSE was: £ 4,648,224,872 a change of 0.61%

11/09/2023 FTSE Closed at 7496 points. Change of 0.24%. Total value traded through LSE was: £ 4,619,826,018 a change of -15.09%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CNA Centrica** **LSE:OXIG Oxford Instruments** **LSE:SCLP Scancell** **LSE:SPT Spirent Comms** **LSE:TSCO Tesco** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Centrica, Oxford Instruments, Scancell, Spirent Comms, Tesco, Zoo Digital,

LSE:CNA Centrica. Close Mid-Price: 172.5 Percentage Change: + 1.47% Day High: 173.15 Day Low: 170.3

In the event of Centrica enjoying further trades beyond 174, the share sho ……..

</p

View Previous Centrica & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2145 Percentage Change: -1.83% Day High: 2175 Day Low: 2110

Now below 2110 indicates reversal coming to an initial 2096 with secondary ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 16 Percentage Change: + 21.90% Day High: 16.75 Day Low: 15.5

All change, finally! Now above 16.75 suggests ongoing recovery to an initi ……..

</p

View Previous Scancell & Big Picture ***

LSE:SPT Spirent Comms. Close Mid-Price: 140.8 Percentage Change: + 0.86% Day High: 141.5 Day Low: 137.2

Target Met. Now below 137 suggests a coming visit to 134 with secondary, i ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 273.1 Percentage Change: + 0.59% Day High: 273.4 Day Low: 271.1

All Tesco needs are mid-price trades ABOVE 274 to improve acceleration tow ……..

</p

View Previous Tesco & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 55 Percentage Change: -4.35% Day High: 57.5 Day Low: 54.5

Weakness on Zoo Digital below 54 will invariably lead to 43p and hopefully ……..

</p

View Previous Zoo Digital & Big Picture ***