#FTSE #GOLD Good news appeared to come from everywhere on Thursday. From a personal perspective, an unwelcome diagnosis of Type 2 Diabetes early this year has proven difficult to live with, the medication provoking unpleasant side effects. A routine blood test threw up something which demanded further checks, resulting in an absence of diabetes! Which is a good thing, along with a suspicion the real “cure” came from losing some weight.

The FTSE similarly looks poised to deliver some good cheer following a rather spectacular session on Thursday, the best day of the year for the index. The mining sector certainly received a sprinkling of fairy dust with the oilers receiving a smaller boost. The banking sector, unsurprisingly, lagged behind the party, doubtless due to the ECB taking interest rates to all time highs. We note UK chip designer ARM chose to launch their IPO in the USA on the Nasdaq, sending quite nasty signals about their confidence in the UK and the FTSE. Regardless, the FTSE certainly cheered from the sidelines as a day up by just over 2% at one point was a welcome relief.

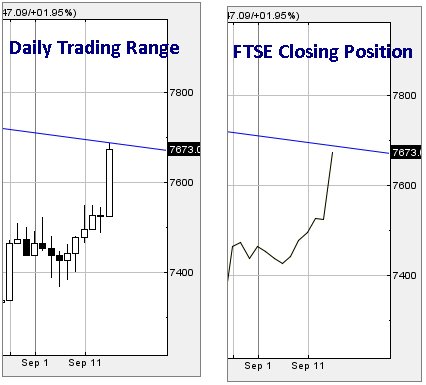

However, there is a chance some unpleasantness awaits for the FTSE, despite the visual impression currently being given. As always, the problem comes from a trend line, the Blue downtrend on the chart for 2023. The FTSE closed Thursday at 7673 points, effectively slightly below the downtrend which is currently sitting at 7682 points. This isn’t an encouraging signal but the FTSE needs below 7606 points to incite any serious concern, risking triggering reversals to an initial 7578 points with secondary, if broken, at 7541 and hopefully a rebound. Should this scenario trigger, the tightest stop loss level looks like 7650 points.

Our alternate, more positive, scenario is fairly palatable. Above 7687 points calculates with the potential of a lift up to an initial impressive 7804 points. Our secondary, should this level be exceeded, works out at 7868 points. Definitely a fingers crossed day appears to be ahead but market futures currently indicate some optimism.

Have a good weekend and enjoy the grand prix.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:10:49PM | BRENT | 9353.8 | 9158 | 9091 | 9236 | 9360 | 9598 | 9111 | Success | ||

| 9:15:34PM | GOLD | 1909.52 | 1901 | 1897 | 1913 | 1915 | 1919 | 1907 | |||

| 9:18:50PM | FTSE | 7707.2 | 7531 | 7455 | 7621 | 7714 | 7752 | 7575 | Success | ||

| 9:23:26PM | STOX50 | 4299 | 4257 | 4245 | 4288 | 4302 | 4315 | 4278 | Success | ||

| 9:26:27PM | GERMANY | 15871.6 | 15727 | 15668 | 15827 | 15878 | 15908 | 15799 | Success | ||

| 9:30:52PM | US500 | 4509 | 4470 | 4466 | 4490 | 4511 | 4518 | 4491 | Success | ||

| 9:41:30PM | DOW | 34961.5 | 34655 | 34599 | 34839 | 34965 | 35011 | 34891 | Success | ||

| 9:45:09PM | NASDAQ | 15491.5 | 15332 | 15305 | 15431 | 15515 | 15538 | 15429 | ‘cess | ||

| 9:50:17PM | JAPAN | 33397 | 32939 | 32809 | 33105 | 33415 | 33452 | 33304 | Success |

14/09/2023 FTSE Closed at 7673 points. Change of 1.97%. Total value traded through LSE was: £ 6,026,828,350 a change of 14.3%

13/09/2023 FTSE Closed at 7525 points. Change of -0.03%. Total value traded through LSE was: £ 5,272,761,043 a change of 13.44%

12/09/2023 FTSE Closed at 7527 points. Change of 0.41%. Total value traded through LSE was: £ 4,648,224,872 a change of 0.61%

11/09/2023 FTSE Closed at 7496 points. Change of 0.24%. Total value traded through LSE was: £ 4,619,826,018 a change of -15.09%

8/09/2023 FTSE Closed at 7478 points. Change of 0.5%. Total value traded through LSE was: £ 5,440,944,541 a change of 24.28%

7/09/2023 FTSE Closed at 7441 points. Change of 0.2%. Total value traded through LSE was: £ 4,377,889,513 a change of 26.38%

6/09/2023 FTSE Closed at 7426 points. Change of -0.15%. Total value traded through LSE was: £ 3,464,082,337 a change of -12.27%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:BP. BP PLC** **LSE:CNA Centrica** **LSE:EME Empyrean** **LSE:IHG Intercontinental Hotels Group** **LSE:NG. National Glib** **LSE:PHP Primary Health** **LSE:RR. Rolls Royce** **LSE:SPX Spirax** **LSE:TRN The Trainline** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Anglo American, BP PLC, Centrica, Empyrean, Intercontinental Hotels Group, National Glib, Primary Health, Rolls Royce, Spirax, The Trainline, Zoo Digital,

LSE:AAL Anglo American. Close Mid-Price: 2262.5 Percentage Change: + 7.74% Day High: 2272.5 Day Low: 2123.5

Further movement against Anglo American ABOVE 2272.5 should improve accel ……..

</p

View Previous Anglo American & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 524.1 Percentage Change: + 3.13% Day High: 526.1 Day Low: 510

Continued trades against BP. with a mid-price ABOVE 526.1 should improve ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 168.7 Percentage Change: + 1.50% Day High: 168.7 Day Low: 165.8

Continued trades against CNA with a mid-price ABOVE 168.7 should improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 0.82 Percentage Change: -2.94% Day High: 0.8 Day Low: 0.78

If Empyrean experiences continued weakness below 0.78, it will invariably ……..

</p

View Previous Empyrean & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 6242 Percentage Change: + 0.42% Day High: 6244 Day Low: 6126

Further movement against Intercontinental Hotels Group ABOVE 6244 should ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1026.5 Percentage Change: + 2.45% Day High: 1029.5 Day Low: 1003.5

In the event of National Glib enjoying further trades beyond 1029.5, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 99 Percentage Change: + 2.75% Day High: 98.85 Day Low: 95.8

All Primary Health needs are mid-price trades ABOVE 98.85 to improve acce ……..

</p

View Previous Primary Health & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 225.8 Percentage Change: + 0.22% Day High: 226.6 Day Low: 222.9

In the event of Rolls Royce enjoying further trades beyond 226.6, the sha ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 9836 Percentage Change: + 1.30% Day High: 9876 Day Low: 9614

Target met. In the event Spirax experiences weakness below 9614 it calcul ……..

</p

View Previous Spirax & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 276 Percentage Change: + 11.56% Day High: 286.4 Day Low: 263.2

Target met. Further movement against The Trainline ABOVE 286.4 should imp ……..

</p

View Previous The Trainline & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 57.5 Percentage Change: -4.96% Day High: 60.5 Day Low: 57.5

Weakness on Zoo Digital below 57.5 will invariably lead to 40p and hopefu ……..

</p

View Previous Zoo Digital & Big Picture ***