#Gold #Dax As a long time fan of “probiotic” products, unfortunately for all the wrong reasons, it came as a surprise to discover we were being asked to review a company whi actually make and market these products. A personal favourite, Actimel, is something my wife strongly approves of, believing a consume it for health reasons. The truth is rather different, due to Strawberry Actimel tasting just like the end sips of a McDonalds strawberry milkshake, if you’ve ever been lucky enough to catch an outlet with a working milkshake machine! The silly little Actimel cartons tick a box which wasn’t an issue, when weight also wasn’t an issue.

There was one other single surprise with Optibiotix, due to their corporate website refusing to load on the Opera browser. It worked fine with Chrome and Edge, but simply refused to admit its own existence within an Opera environment. Due to the built in VPN with Opera, it’s a browser we actually like due to it seamlessly moving past UK censorship attempts, avoiding the dreaded “Content is NOT available in your region” from various US and Canadian and even Irish publications. Oddly, this is a problem which rarely appears from European news sources, aside from an occasional hissy fit from some of the Spanish media.

Optibiotix brand themselves as a Life Sciences company, operating at the cutting edge of ‘biotechnological’ research, currently working in areas which include obesity, cholesterol, heart health, and diabetes and producing a quite bewildering range of products which are doubtless popular among the healthy eating fraternity. Personally, it can be admitted there’s a real attraction in trying the meal replacement shakes, just to see if reality lives up to the hype.

As for their share price, something interesting appears to be happening as the value has successfully moved through the downtrend(s) since 2018. By this, we mean it has exceeded the closing price trend, along with the more commonly used high of the day trend. As a result, some hope is certainly possible.

The immediate situation suggests movement exceeding 34.5p has the potential to provoke a lift to an initial 42.7p with our longer term secondary, if bettered, calculating at a future 55p and the possibility of some hesitation, due to previous price behaviour. Visually, there is also the “risk” closure above 55p shall prove game changing for the longer term, dropping the share price into a region which shows an astounding 128p as exerting a Big Picture attraction. We’d not suggest holding our breath for this but it’s certainly unusual to present a scenario which neatly meets the share price’s historic high.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:57:35PM | BRENT | 8056.3 | |||||||||

| 11:01:46PM | GOLD | 2397.38 | 2397 | 2388 | 2373 | 2412 | 2433 | 2437 | 2454 | 2414 | Success |

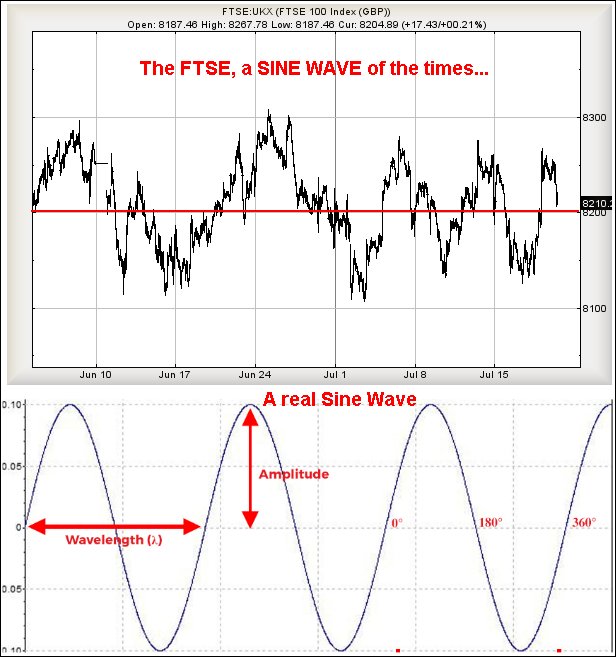

| 12:06:28AM | FTSE | 8138.8 | Shambles | ||||||||

| 12:09:08AM | STOX50 | 4840 | Success | ||||||||

| 12:13:06AM | GERMANY | 18369 | 18320 | 18286 | 18164 | 18406 | 18460 | 18489 | 18545 | 18355 | ‘cess |

| 12:14:51AM | US500 | 5443 | Success | ||||||||

| 12:28:02AM | DOW | 39959 | Success | ||||||||

| 12:31:47AM | NASDAQ | 19113 | Shambles |

24/07/2024 FTSE Closed at 8153 points. Change of -0.17%. Total value traded through LSE was: £ 5,128,130,189 a change of -2.6%

23/07/2024 FTSE Closed at 8167 points. Change of -0.38%. Total value traded through LSE was: £ 5,265,250,514 a change of 15.55%

22/07/2024 FTSE Closed at 8198 points. Change of 0.53%. Total value traded through LSE was: £ 4,556,598,316 a change of 4.43%

19/07/2024 FTSE Closed at 8155 points. Change of -0.6%. Total value traded through LSE was: £ 4,363,233,367 a change of 1.99%

18/07/2024 FTSE Closed at 8204 points. Change of 0.21%. Total value traded through LSE was: £ 4,278,080,573 a change of -5.62%

17/07/2024 FTSE Closed at 8187 points. Change of 0.28%. Total value traded through LSE was: £ 4,532,847,996 a change of 7.45%

16/07/2024 FTSE Closed at 8164 points. Change of -0.22%. Total value traded through LSE was: £ 4,218,485,938 a change of -1.45%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:BBY BALFOUR BEATTY** **LSE:CAR Carclo** **LSE:IGG IG Group** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **

********

Updated charts published on : AFC Energy, Aston Martin, BALFOUR BEATTY, Carclo, IG Group, Lloyds Grp., Marks and Spencer,

LSE:AFC AFC Energy Close Mid-Price: 15 Percentage Change: -3.85% Day High: 15.8 Day Low: 14.8

Weakness on AFC Energy below 14.8 will invariably lead to 14.4 with secon ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin. Close Mid-Price: 159.7 Percentage Change: + 6.47% Day High: 168.9 Day Low: 152.5

All Aston Martin needs are mid-price trades ABOVE 168.9 to improve accele ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BBY BALFOUR BEATTY Close Mid-Price: 416.2 Percentage Change: -0.95% Day High: 427.2 Day Low: 416.4

Continued trades against BBY with a mid-price ABOVE 427.2 should improve ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 29.4 Percentage Change: + 9.70% Day High: 30 Day Low: 26

Continued trades against CAR with a mid-price ABOVE 30 should improve the ……..

</p

View Previous Carclo & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 845 Percentage Change: -1.69% Day High: 870 Day Low: 851

Further movement against IG Group ABOVE 870 should improve acceleration t ……..

</p

View Previous IG Group & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 59.66 Percentage Change: + 0.24% Day High: 59.94 Day Low: 58.96

Further movement against Lloyds Grp. ABOVE 59.94 should improve accelerat ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 325.7 Percentage Change: + 0.03% Day High: 327.2 Day Low: 322.7

All Marks and Spencer needs are mid-price trades ABOVE 327.2 to improve a ……..

</p

View Previous Marks and Spencer & Big Picture ***