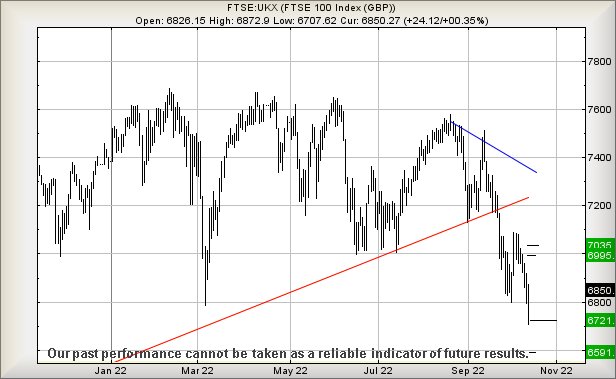

#FTSE #SP500

A warning light today on the car dashboard, consisting of a big orange spanner, caused immediate panic. It justified coming off the motorway in a panic as “a spanner” looked quite troubling. Parking safely, the manual was quickly searched, only to discover the car was telling me it was time for an oil change. Surely, in this day and age, Toyota could simply have the words “Oil Change Due” broadcast onto the LCD screen.

Now relaxing and looking for the on-ramp to rejoin the motorway, it transpires there wasn’t one. We needed now waste time, driving country roads, until eventually discovering a method of rejoining the motorway. Meanwhile, a bit of black tape now handily conceals the nagging spanner, the car was already booked in for a winter service next month.

Sometimes, we think share prices come pre-equipped with irritating warning lights. i3 Energy (we’re being careful to use lower case ‘i’, lest it look like number 13), listed on the UK AIM and also the Toronto exchange, has assets in the North Sea, along with further assets in Canada. Their website claims to commit to returning value to shareholders, an ambition which the decline from 120p to the current 22p appears to be failing. But on the bright side, they do pay a dividend, the value of which certainly provokes lively conversation in internet chatrooms…

Currently, their share price is visually alarming, price movements since July casting their version of a spanner at the 22.2p level, trying to convince the market of movement below such a point risking disaster. We’re not entirely sold on the concept, calculating weakness below 22.2 risks reversal to an initial 20.7 with secondary, if broken, at 18.7p and hopefully a bounce. A glance at the chart below suggests, in the grand scheme of things, this sort of movement isn’t particularly dangerous. For real panic to make itself known, the price currently needs settle below 14.7p.

There’s a converse scenario, one which doesn’t require a great deal of work for the share price to become quite interesting.

Above 29p presents the possibility of gains to an initial 38p with secondary, if bettered, at 42p.

Hopefully this shall prove worth keeping an eye on in the weeks ahead.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:44:51PM | BRENT | 89.6 | ‘cess | ||||||||

| 9:50:53PM | GOLD | 1652.02 | |||||||||

| 9:53:10PM | FTSE | 6979 | 6959 | 6912 | 6877 | 6991 | 7017 | 7029 | 7098 | 6948 | ‘cess |

| 9:55:09PM | STOX50 | 3500 | Success | ||||||||

| 9:57:55PM | GERMANY | 12893 | Success | ||||||||

| 10:11:00PM | US500 | 3748 | 3685 | 3654 | 3617 | 3735 | 3765 | 3791 | 3862 | 3721 | ‘cess |

| 10:13:48PM | DOW | 30678 | Success | ||||||||

| 10:16:08PM | NASDAQ | 11280 | Success | ||||||||

| 10:19:11PM | JAPAN | 27164 |

18/10/2022 FTSE Closed at 6936 points. Change of 0.23%. Total value traded through LSE was: £ 4,606,547,755 a change of 0%

17/10/2022 FTSE Closed at 6920 points. Change of 0.9%. Total value traded through LSE was: £ 4,606,393,574 a change of -22.77%

14/10/2022 FTSE Closed at 6858 points. Change of 0.12%. Total value traded through LSE was: £ 5,964,231,785 a change of 0.52%

13/10/2022 FTSE Closed at 6850 points. Change of 0.35%. Total value traded through LSE was: £ 5,933,139,923 a change of 16.34%

12/10/2022 FTSE Closed at 6826 points. Change of -0.86%. Total value traded through LSE was: £ 5,099,638,855 a change of -0.72%

11/10/2022 FTSE Closed at 6885 points. Change of -1.06%. Total value traded through LSE was: £ 5,136,859,995 a change of 18.36%

10/10/2022 FTSE Closed at 6959 points. Change of -0.46%. Total value traded through LSE was: £ 4,340,006,444 a change of -6.55%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BT.A British Telecom** **LSE:CCL Carnival** **LSE:FRES Fresnillo** **LSE:IAG British Airways** **LSE:ITRK Intertek** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:QFI Quadrise** **LSE:SRP Serco** **

********

Updated charts published on : Barclays, British Telecom, Carnival, Fresnillo, British Airways, Intertek, Natwest, Quadrise, Serco,

LSE:BARC Barclays. Close Mid-Price: 147.5 Percentage Change: + 1.44% Day High: 150.16 Day Low: 147.08

Even above 152 should prove interesting, apparently capable of 158 next wi ……..

</p

View Previous Barclays & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 126.7 Percentage Change: + 1.40% Day High: 127 Day Low: 125

Continued trades against BT with a mid-price ABOVE 127 should improve the ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 611 Percentage Change: + 8.10% Day High: 633.4 Day Low: 568.4

This is mildly interesting but comes with a warning. Above 634 still point ……..

</p

View Previous Carnival & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 705.6 Percentage Change: -0.34% Day High: 715.6 Day Low: 696.2

Continued weakness against FRES taking the price below 696.2 calculates a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 115.86 Percentage Change: + 0.71% Day High: 119.54 Day Low: 115.2

Further movement against British Airways ABOVE 119.54 should improve acc ……..

</p

View Previous British Airways & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 3780 Percentage Change: + 1.20% Day High: 3795 Day Low: 3750

All Intertek needs are mid-price trades ABOVE 3795 to improve acceleratio ……..

</p

View Previous Intertek & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 236.7 Percentage Change: + 1.46% Day High: 242.2 Day Low: 235.5

Continued trades against NWG with a mid-price ABOVE 242.2 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 480.1 Percentage Change: + 1.31% Day High: 492.1 Day Low: 476

In the event of Ocado Plc enjoying further trades beyond 492.1, the share ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:QFI Quadrise. Close Mid-Price: 2.75 Percentage Change: + 20.88% Day High: 2.8 Day Low: 2.31

Target met. All Quadrise needs are mid-price trades ABOVE 2.8 to improve ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SRP Serco Close Mid-Price: 160.2 Percentage Change: -0.06% Day High: 163.4 Day Low: 160

Target met. Continued trades against SRP with a mid-price ABOVE 163.4 sho ……..

</p

View Previous Serco & Big Picture ***