#Gold #Nasdaq It’s that time of year, when strange things happen yet are excused, ‘cos it’s the Festive season. Tuesday night was one such occasion, a decision at 11pm to bottle and rack a dozen bottles of Chardonnay ending in the domestic equivalent of a car crash. The problem was simple, I dislike white wines (except for German) but found myself fermenting Chardonnay grape to produce something my wife “might” like. Aside from Drambuie at Christmas, she tends stick to orange juice.

Now we reach the most dodgy part of the wine production process. Each fermentation container will fill 6 bottles with wine and it’s always been irritating the amount of clear liquid left over, creating a 2cm deep pool just above all the dead yeast, wood chips, and so on. But armed with a 3d printer, I’d created what is essentially a little boat to float above the residual gunk ensuring nothing disturbed the brown paste yet allowing the liquid to be pumped away into a container. It transpired I could almost fill a 13th bottle from the fermentation container. Tasting it, using a shot glass, the stuff tasted well but the imperative was to stuff it into the fridge for an hour or so, just to bring out the full flavour while silently hoping the 12 new bottles on the wine rack would taste even better by Xmas time. Just after midnight, the 13th bottle was taken from the fridge and a generous wine glass poured.

The chilled Chardonnay was perfect!. Just two glasses of this wonderful wine sufficient to effectively knock me out with the result my work had to be finished just after 6am, something I wasn’t proud of. From now on, the wine racks shall be avoided until Friday rolls around and in any case, my next batch of grape juice is scheduled to be 25 litres of Rioja in a week or so. Hopefully, between the Chardonnay, Merlot, and Rioja, we shall be happily provided with sufficient booze for 2025 and hopefully, avoid the alcohol disaster of making 20° proof cider…

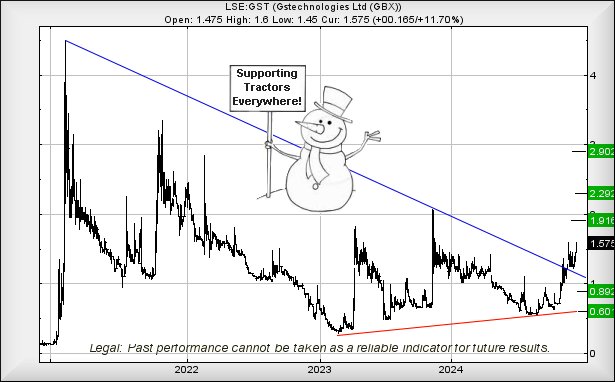

We reviewed Financial Technology company (FinTech) earlier this year, giving a trigger level which would hopefully indicate good things in the days ahead. It has finally achieved our trigger level, suggesting good things are ahead for this share price. The situation now suggests movement above just 1.6p should now trigger gains to an initial 1.91. Should this level be exceeded, our longer term secondary works out at a fairly confident looking 2,3p sometime in the viable future. This, while expected to provoke some hesitation, also places the share price in a zone where a long term 2.9p ambition calculates as apparently viable.

If things intend go wrong, below 1.2p looks troubling, triggering the potential for Big Picture reversal down to an eventual 0.6p.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:48:41PM | BRENT | 7354.9 | ‘cess | ||||||||

| 11:04:43PM | GOLD | 2719.2 | 2691 | 2682 | 2669 | 2706 | 2722 | 2725 | 2732 | 2713 | |

| 11:08:12PM | FTSE | 8308.7 | Shambles | ||||||||

| 11:17:07PM | STOX50 | 4962.9 | Success | ||||||||

| 11:19:39PM | GERMANY | 20403 | |||||||||

| 11:53:54PM | US500 | 6076 | |||||||||

| 11:41:31PM | DOW | 44067.5 | |||||||||

| 11:44:29PM | NASDAQ | 21721.8 | 21636 | 21589 | 21524 | 21735 | 21782 | 21839 | 22014 | 21710 | |

| 11:47:55PM | JAPAN | 40062 |

11/12/2024 FTSE Closed at 8301 points. Change of 0.25%. Total value traded through LSE was: £ 5,804,184,495 a change of 29.66%

10/12/2024 FTSE Closed at 8280 points. Change of -0.86%. Total value traded through LSE was: £ 4,476,630,300 a change of -11.71%

9/12/2024 FTSE Closed at 8352 points. Change of 0.53%. Total value traded through LSE was: £ 5,070,546,042 a change of 9.1%

6/12/2024 FTSE Closed at 8308 points. Change of -0.49%. Total value traded through LSE was: £ 4,647,469,843 a change of -11.07%

5/12/2024 FTSE Closed at 8349 points. Change of 0.17%. Total value traded through LSE was: £ 5,225,818,106 a change of -2.92%

4/12/2024 FTSE Closed at 8335 points. Change of -0.29%. Total value traded through LSE was: £ 5,383,163,281 a change of 3.03%

3/12/2024 FTSE Closed at 8359 points. Change of 0.57%. Total value traded through LSE was: £ 5,224,934,773 a change of 21.03%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:NG. National Glib** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : HSBC, British Airways, National Glib, Taylor Wimpey,

LSE:HSBA HSBC. Close Mid-Price: 755.9 Percentage Change: + 0.79% Day High: 758.9 Day Low: 750

All HSBC needs are mid-price trades ABOVE 758.9 to improve acceleration t ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 288 Percentage Change: + 2.13% Day High: 290.7 Day Low: 284

Target met. In the event of British Airways enjoying further trades beyo ……..

</p

View Previous British Airways & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 939.6 Percentage Change: -1.26% Day High: 953 Day Low: 939.8

Continued weakness against NG. taking the price below 939.8 calculates as ……..

</p

View Previous National Glib & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 126.5 Percentage Change: -0.63% Day High: 128.05 Day Low: 126.2

In the event Taylor Wimpey experiences weakness below 126.2 it calculates ……..

</p

View Previous Taylor Wimpey & Big Picture ***