#Gold #Nasdaq When we previously reviewed Babcock back in 2021, we provided some quite horrific criteria for a scenario which arithmetically would culminate in a bottom around 55p. Perhaps due to the period of geopolitical instability, their share price managed to wander in quite a different direction, the years since showing significant recovery from the 2 quid point at which we reviewed them. By “normal” criteria, the share price now trading around 7 quid is now showing some significant potentials for the future.

We use the term “normal” cautiously, the company being in the defence sector and therefore vulnerable to the disgusting effects of peace breaking out in the world, due to a US president who seems to disagree with the concept of wars. It’s certainly going to be interesting watching how the US defence industry responds to President Trumps initiatives to reduce warfare. Perhaps he shall prove more successful than a prior US leader who met his end in Texas, yet the administration still hasn’t released the entire archive of information relating to Kennedy’s death in a time long before most of us were born! But a popular conspiracy theory gives credit to the defence industry being implicated, due to his potential interference in their business.

With President Trump going after the Defence, Green, Oil, import, and Political Trough industries, there’s likely to be a queue forming behind Grassy Knolls wanting to have a short conversation with him. It can only be hoped his protection team have figured this out!

Currently, above just 720p risks triggering a share price launch in the direction of 830p next with our secondary, if bettered, a longer term 1042p. As the chart below shows, such ambitions make a lot of visual sense, surprising but also quite encouraging for the longer term. From a charty perspective, Babcock certainly produce an optimistic picture, their price being gapped above the long term downtrend since 2014, achieving an official “higher high” above the pre-pandemic spike at the start of 2020. and generally, a share which can be usually safely assumed to be in safe recovery territory. Due to the fragility of peace and stability, it’s probably accurate to assume the defence industry shall always win but some caution is suggested. After all, the share price need only close below 572p to turn our hopes for the future into a pile of minced numbers.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:39:36PM | BRENT | 6911 | |||||||||

| 11:42:26PM | GOLD | 2882.99 | 2880 | 2876 | 2858 | 2892 | 2916 | 2923 | 2953 | 2896 | |

| 11:47:40PM | FTSE | 8570.4 | Success | ||||||||

| 11:50:29PM | STOX50 | 5358.2 | Success | ||||||||

| 11:35:07PM | GERMANY | 22505.4 | Success | ||||||||

| 11:37:54PM | US500 | 5592 | |||||||||

| 11:41:25PM | DOW | 41855.5 | Success | ||||||||

| 11:44:05PM | NASDAQ | 19263 | 19202 | 18768 | 17608 | 19607 | 19678 | 19805 | 20006 | 19345 | Success |

| 11:47:11PM | JAPAN | 36207 | ‘cess |

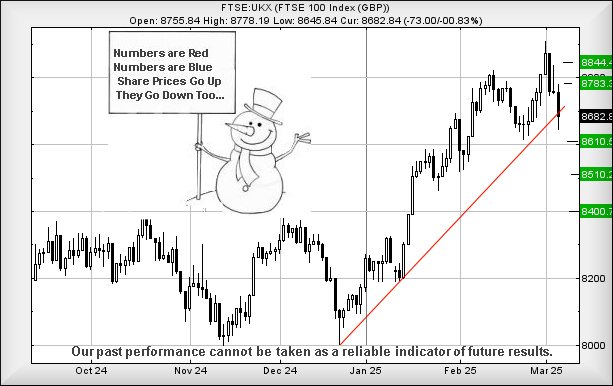

10/03/2025 FTSE Closed at 8600 points. Change of -0.91%. Total value traded through LSE was: £ 7,652,125,992 a change of 21.38%

7/03/2025 FTSE Closed at 8679 points. Change of -0.03%. Total value traded through LSE was: £ 6,304,463,649 a change of -17.82%

6/03/2025 FTSE Closed at 8682 points. Change of -0.83%. Total value traded through LSE was: £ 7,671,130,291 a change of 6.49%

5/03/2025 FTSE Closed at 8755 points. Change of -0.05%. Total value traded through LSE was: £ 7,203,655,204 a change of -19.84%

4/03/2025 FTSE Closed at 8759 points. Change of -1.26%. Total value traded through LSE was: £ 8,986,196,002 a change of 22.76%

3/03/2025 FTSE Closed at 8871 points. Change of 0.7%. Total value traded through LSE was: £ 7,320,378,637 a change of -49.26%

28/02/2025 FTSE Closed at 8809 points. Change of 0.61%. Total value traded through LSE was: £ 14,426,533,627 a change of 91.89%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:IHG Intercontinental Hotels Group** **LSE:OXIG Oxford Instruments** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Asos, Intercontinental Hotels Group, Oxford Instruments, Tern Plc, Tullow, Zoo Digital,

LSE:ASC Asos Close Mid-Price: 276 Percentage Change: -4.37% Day High: 293.6 Day Low: 275.2

In the event Asos experiences weakness below 275.2 it calculates with a d ……..

</p

View Previous Asos & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 9100 Percentage Change: -0.13% Day High: 9190 Day Low: 9056

Weakness on Intercontinental Hotels Group below 9056 will invariably lead ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 1838 Percentage Change: -3.67% Day High: 1998 Day Low: 1838

Target met. Continued weakness against OXIG taking the price below 1838 c ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:TERN Tern Plc. Close Mid-Price: 1.2 Percentage Change: + 4.35% Day High: 1.2 Day Low: 1.11

Continued weakness against TERN taking the price below 1.11 calculates as ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 13.48 Percentage Change: -1.96% Day High: 13.76 Day Low: 13.2

Weakness on Tullow below 13.2 will invariably lead to 13p with secondary ……..

</p

View Previous Tullow & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 10.88 Percentage Change: -17.92% Day High: 13.25 Day Low: 10.12

Target met. In the event Zoo Digital experiences weakness below 10.12 it ……..

</p

View Previous Zoo Digital & Big Picture ***