#FTSE #Stoxx50 We’ve been ‘enjoying’ a battle with a practical joke grand-daughter. Somehow, she discovered the secret codes to systematically remove the beeps from each function of our microwave, claiming she hates electronic beeps. Another object of her humour was the kitchen Ninja cooker thing, a device which has an entire electronic choir embedded, along with our dishwasher. Finally today, the little monster was shipped home, gleefully saying “good luck finding the beeps” as she dispensed the usual hugs, doubtless thinking we’d plead with her to undo the witchcraft at the end of August holiday weekend.

Little did she know we also harboured a secret. To reset each device, it just needed unplugged for a few seconds, the beeps once again assuming their rightful place in the kitchen symphonic background. Quite how she’s going to cope, discovering the alarm tones in her phone have been replaced with AC/DC music samples, should be interesting. And as she’s now a teenager, this battle could continue for the next 5 years. Or if she follows her mother, the war of elaborate jokes will never end.

Rather neatly, this brings us to our immediate subject, hVivo Plc, not because they’re a joke, quite the opposite. But when a bunch of emails arrived asking us to update our outlook as we hadn’t looked at them since last year and our target had been achieved earlier this year. We thought it a joke, ‘cos we try and avoid “bunching” share topics and discussing Futura Medical one day, then covering another company in the same sector the next day risks being about as boring as listening to someone else talk about their illness.

However, hVivo Plc certainly achieved our initial target in February, so we can justify another look at their share price.

The situation now is fairly interesting, the share breaking through the downtrend since 2021 and actually closing above the trend. This probably explains the emails received!

Currently, above 18.25p calculates with the potential of a lift to 22.75 next. Our longer term secondary, if such a level is exceeded, works out at 28p. While quite a lot of enthusiasm is possible for the initial target, we’d prefer seeing the share price close a session above 21.6p before being comfortable about the potentials of our secondary – and beyond. For reasons which escape us, share prices seem to feel it’s important for a price to close above a level which defined a trend before displaying solid acceleration. In the case of hVivo, the trend defining 23.25p of February this year also had a closing price at 21.62p and this is the number to beat. And yes, we agree, it is very strange…

If everything intends go horribly wrong, below 13.5 risks being quite troubling, risking a visit to 6.4p and hopefully, an ultimate bottom. Visually, it seems unlikely.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:51:31PM | BRENT | 8566 | |||||||||

| 9:54:10PM | GOLD | 1943.88 | ‘cess | ||||||||

| 9:57:29PM | FTSE | 7657.1 | 7656 | 7646 | 7620 | 7665 | 7697 | 7713 | 7734 | 7665 | |

| 9:59:34PM | STOX50 | 4407 | 4399 | 4378 | 4340 | 4434 | 4441 | 4453 | 4471 | 4417 | Success |

| 10:01:52PM | GERMANY | 16241.2 | Success | ||||||||

| 10:04:14PM | US500 | 4574.5 | ‘cess | ||||||||

| 10:33:15PM | DOW | 35621.5 | |||||||||

| 10:35:09PM | NASDAQ | 15710.8 | Success | ||||||||

| 10:37:21PM | JAPAN | 33204 |

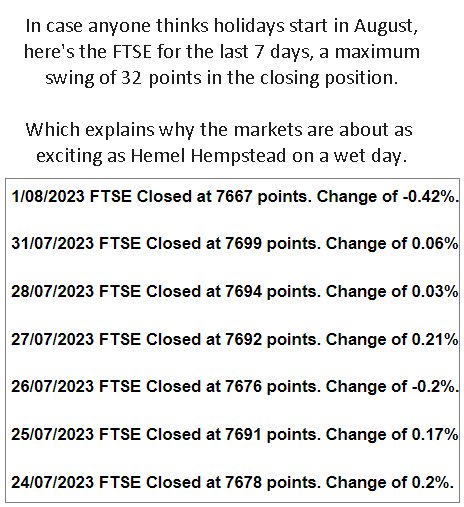

1/08/2023 FTSE Closed at 7667 points. Change of -0.42%. Total value traded through LSE was: £ 4,153,367,086 a change of -3.72%

31/07/2023 FTSE Closed at 7699 points. Change of 0.06%. Total value traded through LSE was: £ 4,313,676,670 a change of -54.58%

28/07/2023 FTSE Closed at 7694 points. Change of 0.03%. Total value traded through LSE was: £ 9,496,592,538 a change of 26.18%

27/07/2023 FTSE Closed at 7692 points. Change of 0.21%. Total value traded through LSE was: £ 7,526,466,026 a change of 81.26%

26/07/2023 FTSE Closed at 7676 points. Change of -0.2%. Total value traded through LSE was: £ 4,152,321,908 a change of -7.74%

25/07/2023 FTSE Closed at 7691 points. Change of 0.17%. Total value traded through LSE was: £ 4,500,914,113 a change of -15.2%

24/07/2023 FTSE Closed at 7678 points. Change of 0.2%. Total value traded through LSE was: £ 5,307,369,816 a change of 18.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CBX Cellular Goods** **LSE:CNA Centrica** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IPF International Personal Finance** **LSE:PMG Parkmead** **

********

Updated charts published on : Cellular Goods, Centrica, Fresnillo, Hikma, HSBC, International Personal Finance, Parkmead,

LSE:CBX Cellular Goods. Close Mid-Price: 0.8 Percentage Change: + 6.67% Day High: 0.88 Day Low: 0.75

Above 0.92p should signal recovery to 1.06 next with secondary, if beaten, ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 139.95 Percentage Change: + 1.38% Day High: 140.5 Day Low: 137.65

Continued trades against CNA with a mid-price ABOVE 140.5 should improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 591 Percentage Change: -4.40% Day High: 603.8 Day Low: 563.4

Target met. In the event Fresnillo experiences weakness below 563.4 it ca ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2105 Percentage Change: + 0.77% Day High: 2138 Day Low: 2086

All Hikma needs are mid-price trades ABOVE 2138 to improve acceleration t ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 654.9 Percentage Change: + 1.33% Day High: 665.6 Day Low: 649.9

Target met. All HSBC needs are mid-price trades ABOVE 665.6 to improve ac ……..

</p

View Previous HSBC & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 121.5 Percentage Change: + 4.74% Day High: 125 Day Low: 118

Target met. All International Personal Finance needs are mid-price trades ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 18 Percentage Change: + 7.46% Day High: 18.75 Day Low: 16.35

Something is potentially happening as above 18.75 now looks capable of 21 ……..

</p

View Previous Parkmead & Big Picture ***