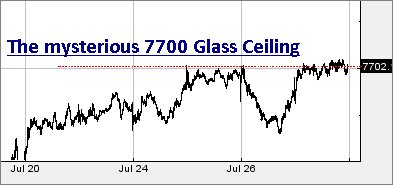

FTSE for FRIDAY (FTSE:UKX) It’s fairly obvious the FTSE intends head to 7840 points as the next major point of interest! The only problem appears to be a lack of will to actually go there. This week has provided a perfect ‘case in point’, the market essentially hitting the 7700 level, then just stopping as if a bunch of Just Stop Oil protestors were in the way.

Perhaps the FTSE has employed folk to wear Day-Glo jackets, parading around brokers to ensure FTSE 100 share prices stop recovering in a miraculous order, one capable of stalling the FTSE collectively at the 7700 point level. With share prices, we’re quite used to the formation of Glass Ceilings or Glass Floors, always with the expectation they shall break with strong movement following thereafter. But when an index which comprises 100 shares somehow conspires to stall so obviously, it’s only human to raise a question mark. Visually, this is as fishy as a snollygoster banker trying to explain the Farage farrago.

If we park our cynicism for a moment, the situation now exists where above 7710 points should apparently be capable of an attempt at a pretty tame 7735 points next. Our secondary, near term, works out at 7771 points. If triggered, the tightest stop loss looks tight at 7686 points, almost suspiciously reasonable.

Importantly, if taking us as gospel with an overall target level remaining at 7840 points on this cycle, we’d regard below 7610 as capable of utterly trashing our calculations.

Our alternate, negative, scenario allows for weakness below 7686 points to trigger reversal to a fairly benign 7665 points with secondary, if broken, at 7651 points.

Have a good weekend. Hopefully this Grand Prix is a bit better than last weekends.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:28:04PM | BRENT | 8339.9 | 8256 | 8223 | 8330 | 8403 | 8467 | 8333 | ‘cess | ||

| 9:31:19PM | GOLD | 1944.45 | 1942 | 1936 | 1953 | 1960 | 1964 | 1951 | Success | ||

| 9:33:10PM | FTSE | 7667 | 7654 | 7641 | 7671 | 7710 | 7718 | 7690 | Shambles | ||

| 9:36:02PM | STOX50 | 4418.6 | 4400 | 4376 | 4425 | 4463 | 4484 | 4436 | Success | ||

| 9:39:07PM | GERMANY | 16339 | 16300 | 16248 | 16342 | 16446 | 16488 | 16300 | Success | ||

| 9:42:00PM | US500 | 7667.8 | 7654 | 7630 | 7672 | 7677 | 7687 | 7667 | |||

| 9:45:19PM | DOW | 35317 | 35210 | 35125 | 35322 | 35418 | 35442 | 35345 | Success | ||

| 9:48:04PM | NASDAQ | 15486 | 15413 | 15370 | 15513 | 15640 | 15721 | 15574 | Success | ||

| 9:51:00PM | JAPAN | 32596 | 32427 | 32361 | 32603 | 32818 | 32898 | 32702 | Success |

27/07/2023 FTSE Closed at 7692 points. Change of 0.21%. Total value traded through LSE was: £ 7,526,466,026 a change of 81.26%

26/07/2023 FTSE Closed at 7676 points. Change of -0.2%. Total value traded through LSE was: £ 4,152,321,908 a change of -7.74%

25/07/2023 FTSE Closed at 7691 points. Change of 0.17%. Total value traded through LSE was: £ 4,500,914,113 a change of -15.2%

24/07/2023 FTSE Closed at 7678 points. Change of 0.2%. Total value traded through LSE was: £ 5,307,369,816 a change of 18.72%

21/07/2023 FTSE Closed at 7663 points. Change of 0.22%. Total value traded through LSE was: £ 4,470,558,321 a change of -16.97%

20/07/2023 FTSE Closed at 7646 points. Change of 0.76%. Total value traded through LSE was: £ 5,384,109,244 a change of -16.08%

19/07/2023 FTSE Closed at 7588 points. Change of 1.81%. Total value traded through LSE was: £ 6,416,071,113 a change of 56.65%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AVCT Avacta** **LSE:BLVN Bowleven** **LSE:CNA Centrica** **LSE:IHG Intercontinental Hotels Group** **LSE:OCDO Ocado Plc** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Aston Martin, Asos, Avacta, Bowleven, Centrica, Intercontinental Hotels Group, Ocado Plc, Rolls Royce, Sainsbury, Scottish Mortgage Investment Trust,

LSE:AML Aston Martin. Close Mid-Price: 372.2 Percentage Change: + 6.34% Day High: 378 Day Low: 346.6

All Aston Martin needs are mid-price trades ABOVE 378 to improve accelera ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 401.5 Percentage Change: -1.45% Day High: 432.3 Day Low: 393

Target met. In the event of Asos enjoying further trades beyond 432.3, th ……..

</p

View Previous Asos & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 92.5 Percentage Change: -4.15% Day High: 96.5 Day Low: 92.5

If Avacta experiences continued weakness below 92.5, it will invariably l ……..

</p

View Previous Avacta & Big Picture ***

LSE:BLVN Bowleven. Close Mid-Price: 3.1 Percentage Change: + 47.62% Day High: 3.35 Day Low: 1.9

Target met. In the event of Bowleven enjoying further trades beyond 3.35, ……..

</p

View Previous Bowleven & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 133.35 Percentage Change: + 7.54% Day High: 134.05 Day Low: 125.45

Target met. All Centrica needs are mid-price trades ABOVE 135 to improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 5716 Percentage Change: + 2.33% Day High: 5748 Day Low: 5602

Continued trades against IHG with a mid-price ABOVE 5748 should improve t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 952.6 Percentage Change: -0.81% Day High: 1017 Day Low: 853.4

In the event of Ocado Plc enjoying further trades beyond 1017, the share ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 189.6 Percentage Change: + 2.49% Day High: 190.85 Day Low: 185.55

All Rolls Royce needs are mid-price trades ABOVE 191 to improve accelerat ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 285.4 Percentage Change: -0.31% Day High: 290 Day Low: 284.7

Continued trades against SBRY with a mid-price ABOVE 290 should improve t ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 713 Percentage Change: + 1.89% Day High: 719.6 Day Low: 700.8

Further movement against Scottish Mortgage Investment Trust ABOVE 719.6 s ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***