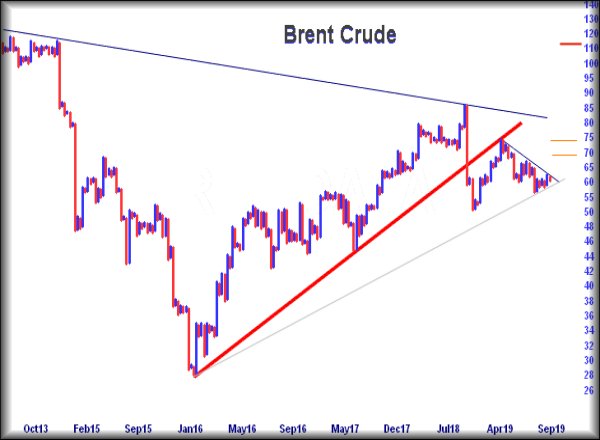

#Gold #Nasdaq While we were panicked about the price of Brent, due to some hysterical price moves during the early hours of Monday, we should perhaps have focused on Gold & Bitcoin. Despite Brent Futures indulging in frantic spasms, neither Bitcoin nor Gold were doing anything particularly interesting. This, alone, should have warned the Saudi crisis was probably another case of media hype overtaking reality.

As Monday developed, a clearer idea of the impact on oil production emerged and still, neither of the alternate havens did anything useful. Gradually, we started suspect whatever had happened in the Gulf not actually causing real panic in the marketplace. Both Gold and Bitcoin actually started reversals, making us question the future for Bitcoin. The phoney currency has been looking useful just a month ago yet has failed trigger upward movements.

The immediate situation with Bitcoin appears straightforward. The price need only slip below 9850 to enter a reversal cycle to an initial 9218 dollars. Despite some sort of bounce being probable at such a level, if broken, our secondary calculates at 7220 dollars. Visually, this matches the lows of May this year and will be expected to provoke a real rebound.

Presently trading around 10,140, Bitcoin needs above 10510 to give hope an upward surge is coming. In theory, this should trigger movement up to an initial 10756 with secondary, if bettered, a longer term 11,662 dollars.

For now, if we fall back to our “if it ain’t goin’ up” philosophy, we suspect it intends reversal.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:45:44PM |

BRENT |

67.22 | |||||||||

|

9:47:32PM |

GOLD |

1498.81 |

1495 |

1491 |

1484 |

1507 |

1507 |

1511.5 |

1517 |

1496 |

Success |

|

9:49:00PM |

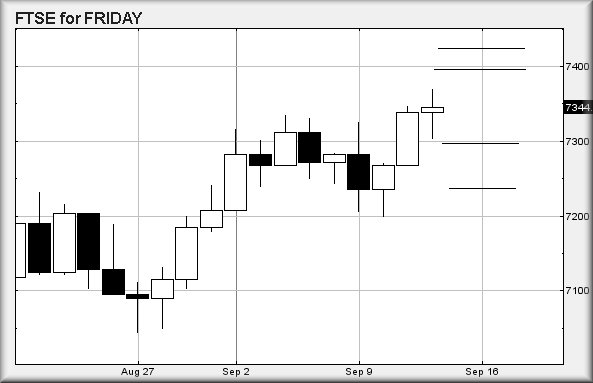

FTSE |

7334.15 |

7316 | ||||||||

|

9:50:31PM |

FRANCE |

5607.3 |

5609 |

Success | |||||||

|

9:53:31PM |

GERMANY |

12409.26 |

12362 |

‘cess | |||||||

|

9:55:36PM |

US500 |

3000.92 |

2991 |

Success | |||||||

|

9:57:55PM |

DOW |

27101.9 |

27053 |

Success | |||||||

|

10:00:29PM |

NASDAQ |

7861.75 |

7803 |

7789.5 |

7727 |

7870 |

7870 |

7882 |

7918 |

7830 |

Success |

|

10:02:42PM |

JAPAN |

21934 |

|

21681 |

21542 |

21980 |

21980 |

22029.5 |

22108 |

21879 |

‘cess |