#Gold #WallSt With all this Brexit hullabaloo, we’ve a sneaking suspicion the markets anticipate the major supermarkets to do rather well in the event of any supplies crisis. After all, in times of shortage or disruptions, retailers price goods against “worst possible” scenario. Almost accidentally, they will generally do rather well out of a major issue as the need for “Special Offers” or price comparison vanishes.

Already, Sainsbury are poised at the starting gate for some reasonable share price movement.

Essentially, there looks like a trigger level of 225p which, if exceeded, allows price growth to an initial 238p. Better still, if exceeded, this allows ongoing travel toward a secondary calculation of 284p. Beyond 284p, we shall need re-examine the tea leaves (if we can afford them) as some quite extraordinary longer term movement becomes possible.

Of course, there’s a fly on the soufflé.

Regular readers will be aware of out historical hysteria over Gap Up / Gap Down movements on shares. On many occasions, they proved incredibly reliable indicators for serious trouble ahead and in the case of Sainsbury, it produced a couple of textbook warning gaps. We’ve circled them on the chart.

Unless Sainsbury actually makes an effort to close above 225p anytime soon, it’s trading in a region where below 192p risks reversal down to an initial 167p. Worse, if broken, our longer term secondary (and hopefully bottom) calculates down at 138p. We can go lower as ultimate bottom, the point we cannot calculate below, is at 100p. At present, nothing threatens such a calamity

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:51:24PM |

BRENT |

61.65 |

‘cess | ||||||||

|

9:53:13PM |

GOLD |

1503.86 |

1501 |

1497.5 |

1485 |

1508 |

1508 |

1509.5 |

1512.74 |

1502 |

Success |

|

9:55:25PM |

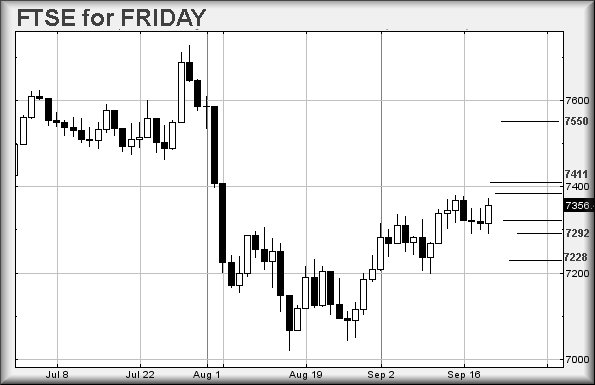

FTSE |

7306.38 |

‘cess | ||||||||

|

10:00:14PM |

FRANCE |

5595.2 |

Success | ||||||||

|

10:02:19PM |

GERMANY |

12264 |

‘cess | ||||||||

|

10:04:50PM |

US500 |

2984.97 |

‘cess | ||||||||

|

10:33:35PM |

DOW |

26984 |

26734 |

26618 |

26481 |

26915 |

27028 |

27078.5 |

27205 |

26884 | |

|

10:37:02PM |

NASDAQ |

7805 |

Success | ||||||||

|

10:42:53PM |

JAPAN |

22030 |