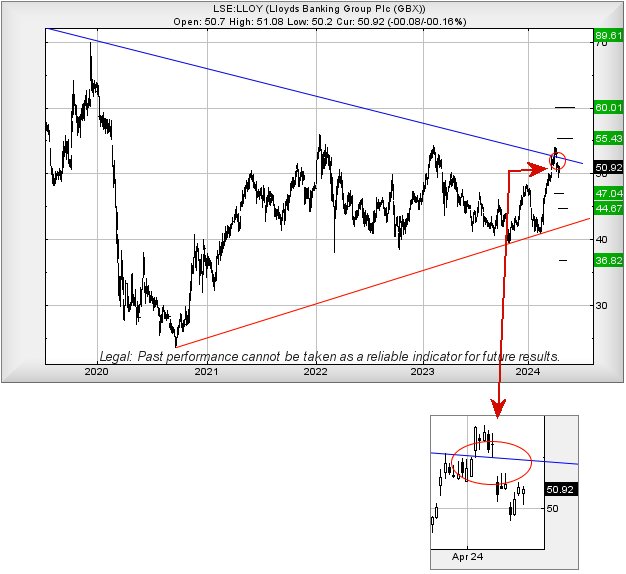

#Brent #Germany When we previously reviewed Lloyds, we commented on the importance of a 25 year old downtrend since 2009 and the way by which Lloyds share price was reacting to it. But on April 4th & 11th, something quite fascinating happened, confirming our belief the market regards this long term downtrend as really important. At risk of sounding like a dentist, it’s all to do with unsightly gaps!

Following a period of the share price gyrating against the Blue downtrend, on 4th April the price was manipulated above the trend line at the open of trade and in normal circumstances, this should have signalled a potential for some real price recovery, aside from the salient detail the share price was gapped upward. Despite its little nudge in the right direction, Lloyds failed to reach our initial target of 55.5p, the rise faded from the 54p level, causing immediate concern. On April 11th, as shown on the zoomed in bit of the chart below, this share price was gapped down below the trend. Conventional arguments for this type of price manipulation hints the share price should reverse to 49p and hopefully rebound. There’s a slight chance the movement on April 16th to 49.4p shall be deemed sufficiently close but visually, we have our doubts. With the level of effort going on to keep Lloyds share price under control, if “they” intend play by the rules, we’d normally be quite expectant of a solid 49p making an appearance.

Real danger comes if the price makes it below 49p as reversal to 47p calculates as possible with our secondary, if broken, at 44.7p and hopefully a rebound.

On a more positive note, it’s generally the case where the next time a share price heads upward should be the one which triggers some proper movement, a surge in price levels which is generally quite vivid. But for the present, we’re inclined toward caution and above 54.1p should next head to 55.4 with secondary, if beater, at 60p. What would really impress us now though is a serious movement, such as the share price being gapped above 54.1p at the open of trade as this would signal the game is changing and a long term 89p could become a sensible possibility.

Alas, for now, Lloyds remains trapped below this absurd Blue downtrend which dates back to the market crash of 2009.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 9:14:27PM | BRENT | 8663 | 8625 | 8427 | 8229 | 8730 | 8730 | 8790 | 8864 | 8640 |

| 9:17:13PM | GOLD | 2391.29 | 2387 | |||||||

| 9:20:42PM | FTSE | 7931.3 | 7889 | |||||||

| 9:43:49PM | STOX50 | 4905.3 | ||||||||

| 9:46:31PM | GERMANY | 17715.9 | 17647 | 17608 | 17553 | 17717 | 1774 | 17937 | 18116 | 17692 |

| 9:49:10PM | US500 | 4965 | ||||||||

| 9:51:50PM | DOW | 37974 | ||||||||

| 9:54:15PM | NASDAQ | 17033.3 | ||||||||

| 9:57:11PM | JAPAN | 37081 |

19/04/2024 FTSE Closed at 7895 points. Change of 0.23%. Total value traded through LSE was: £ 7,055,208,688 a change of 7.7%

18/04/2024 FTSE Closed at 7877 points. Change of 0.38%. Total value traded through LSE was: £ 6,551,072,926 a change of 27.48%

17/04/2024 FTSE Closed at 7847 points. Change of 0.35%. Total value traded through LSE was: £ 5,138,744,008 a change of -8.61%

16/04/2024 FTSE Closed at 7820 points. Change of -1.82%. Total value traded through LSE was: £ 5,622,635,189 a change of 16.7%

15/04/2024 FTSE Closed at 7965 points. Change of -0.38%. Total value traded through LSE was: £ 4,817,927,674 a change of -11.37%

12/04/2024 FTSE Closed at 7995 points. Change of 0.91%. Total value traded through LSE was: £ 5,435,726,241 a change of -8.93%

11/04/2024 FTSE Closed at 7923 points. Change of -0.48%. Total value traded through LSE was: £ 5,968,969,501 a change of -30.54%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:BLOE Block Energy PLC** **LSE:IAG British Airways** **

********

Updated charts published on : Aston Martin, Avacta, Block Energy PLC, British Airways,

LSE:AML Aston Martin. Close Mid-Price: 151.9 Percentage Change: + 0.60% Day High: 152.4 Day Low: 147.6

Weakness on Aston Martin below 147.6 will invariably lead to 145p with se ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 48.5 Percentage Change: + 1.04% Day High: 47.75 Day Low: 45.75

Target met. Continued weakness against AVCT taking the price below 45.75 ……..

</p

View Previous Avacta & Big Picture ***

LSE:BLOE Block Energy PLC. Close Mid-Price: 1.5 Percentage Change: + 7.14% Day High: 1.55 Day Low: 1.4

Continued trades against BLOE with a mid-price ABOVE 1.55 should improve ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 169.5 Percentage Change: -0.18% Day High: 170.1 Day Low: 162.15

If British Airways experiences continued weakness below 162.15, it will ……..

</p

View Previous British Airways & Big Picture ***