#Gold #Germany The term “Fear of Missing Out” can often drive traders into utterly idiotic situations. Goodness knows how many folks made ill advised investments in Electric Vehicle Companies, Blockchain initiatives, Artificial Intelligence hype, and of course the ongoing fantasy which is crypto currency. But the funny thing about the markets currently is probably a fear of getting involved, due to various world issues being capable of forcing a market retreat.

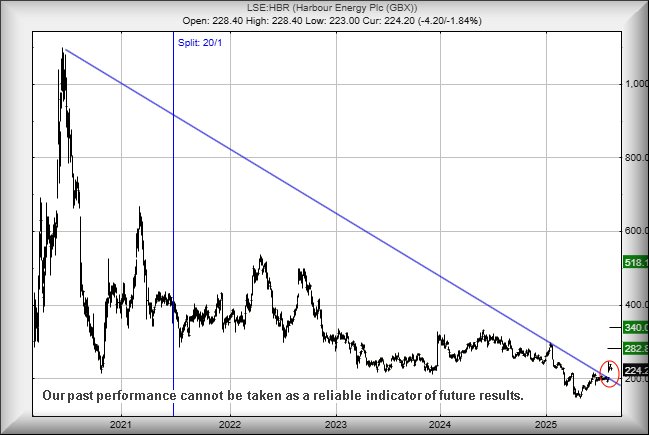

The largest independent UK Oil Company, when we reviewed them back in 2023, managed to reverse and smack both our drop targets. But something interesting has now happened and we’ve circled it on the chart below. We’ve previously commented on Harbour Energy’s share price ability to perform in ignorance of the oil market. But the market opted to “gap” (circled) Harbour Energy up above the five year downtrend since 2020, suggesting a cycle of gains should be anticipated. The market decided a 28p rise was justified, along with dumping the share price into a new region above the trend. It was a pretty clear signal the market is planning some changes for the share price.

Currently, above 246p should trigger gains to an initial 282p with our longer term secondary, if beaten, at a future 340p. It’s quite a big deal, potentially launching the share price into a scenario where a future 518p shall be viewed as extending a magnetic attraction.

For Harbour share price to lose its way, the price needs sink below 201p.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:16:36PM | BRENT | 6602.6 | ‘cess | ||||||||

| 10:20:03PM | GOLD | 3332.2 | 3332 | 3322 | 3310 | 3340 | 3358 | 3369 | 3382 | 3341 | |

| 10:22:41PM | FTSE | 9173.1 | |||||||||

| 10:25:59PM | STOX50 | 5439 | Success | ||||||||

| 10:29:03PM | GERMANY | 24346 | 24298 | 24223 | 24118 | 24367 | 24365 | 24392 | 24442 | 24300 | ‘cess |

| 10:31:50PM | US500 | 6446.3 | |||||||||

| 10:51:02PM | DOW | 44903.5 | ‘cess | ||||||||

| 10:55:27PM | NASDAQ | 23701.5 |

18/08/2025 FTSE Closed at 9157 points. Change of 0.21%. Total value traded through LSE was: £ 4,796,925,972 a change of -21.07%

15/08/2025 FTSE Closed at 9138 points. Change of -0.42%. Total value traded through LSE was: £ 6,077,567,012 a change of 24.32%

14/08/2025 FTSE Closed at 9177 points. Change of 0.13%. Total value traded through LSE was: £ 4,888,645,281 a change of -12.34%

13/08/2025 FTSE Closed at 9165 points. Change of 0.2%. Total value traded through LSE was: £ 5,576,963,719 a change of 12.35%

12/08/2025 FTSE Closed at 9147 points. Change of 0.2%. Total value traded through LSE was: £ 4,963,866,673 a change of 14.87%

11/08/2025 FTSE Closed at 9129 points. Change of 0.37%. Total value traded through LSE was: £ 4,321,122,132 a change of -15.66%

8/08/2025 FTSE Closed at 9095 points. Change of -0.05%. Total value traded through LSE was: £ 5,123,576,118 a change of -18.06%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CPI Capita** **LSE:SFOR S4 Capital** **LSE:SRP Serco** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Capita, S4 Capital, Serco, Taylor Wimpey,

LSE:CPI Capita Close Mid-Price: 230 Percentage Change: -0.22% Day High: 232 Day Low: 228

If Capita experiences continued weakness below 228, it will invariably le ……..

</p

View Previous Capita & Big Picture ***

LSE:SFOR S4 Capital Close Mid-Price: 20.7 Percentage Change: -3.27% Day High: 21.85 Day Low: 20.55

Continued weakness against SFOR taking the price below 20.55 calculates a ……..

</p

View Previous S4 Capital & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 229.4 Percentage Change: + 1.96% Day High: 229.4 Day Low: 224

All Serco needs are mid-price trades ABOVE 229.4 to improve acceleration ……..

</p

View Previous Serco & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 99.02 Percentage Change: -0.92% Day High: 100.8 Day Low: 98.56

In the event Taylor Wimpey experiences weakness below 98.56 it calculates ……..

</p

View Previous Taylor Wimpey & Big Picture ***