#Brent #Dax Optimism, a strange word to use, when discussing the UK Retail Bank sector. Rather than use the term “suspend disbelief’, we rather prefer the slightly more arcane term ‘cognitive estrangement’ when asking for acceptance of the looming scenario for Lloyds.

It should probably be pointed out, when a writer employs terminology no-one is quite familiar with, it’s usually because they don’t actually believe the argument about to be presented. Most of the UK doubtless watched, with ‘cognitive estrangement’ the appalling performance of our countries prospective leaders during the 2 hour Question Time on Friday. It took a while for the penny to drop, it was Light Entertainment, just lacking Ant ‘n’ Dec presenting due to their prior engagements anywhere else.

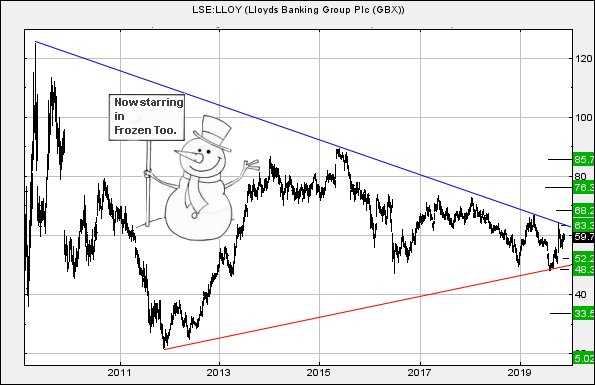

Lloyds Bank has two distinct calculations telling us the price is about to wander up to 63.3p. If exceeded, our secondary calculates at a longer term (or later that day!) 68p. The trigger for such a wonderful movement is supposes to be trades anytime now above 60.7p. It’s very possible the 63.3p ambition shall prove viable, especially due to the presence of the downtrend since 2009.

As for our 68p calculation, this enters the land of politicians, lies, and broken promises. As the chart shows, achieving 68p shall break the downtrend of the last 10 years. Such a movement also achieves a “higher high” than the previous time the share price touched the trend, theoretically allowing a longer term 85p to enter the picture.

We have our doubts, certainly until December 13th at the very earliest.

If Lloyds intends trouble, now below 55p allows for an initial believable 52p. If broken, secondary is at 48p and should prove capable of a rebound, given the presence of the prior low.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:58:35PM |

BRENT |

62.81 |

57.9 |

52.765 |

45.38 |

63 |

63.8 |

65.96 |

69.11 |

59.15 |

‘cess |

|

10:01:10PM |

GOLD |

1462.49 | |||||||||

|

10:03:43PM |

FTSE |

7344.83 |

Success | ||||||||

|

10:08:07PM |

FRANCE |

5896 |

Success | ||||||||

|

2:33:53PM |

GERMANY |

13200 |

13034 |

12951 |

12808 |

13182 |

13247 |

13355 |

13795 |

12788 |

Success |

|

2:35:40PM |

US500 |

8276.12 |

Shambles | ||||||||

|

2:45:37PM |

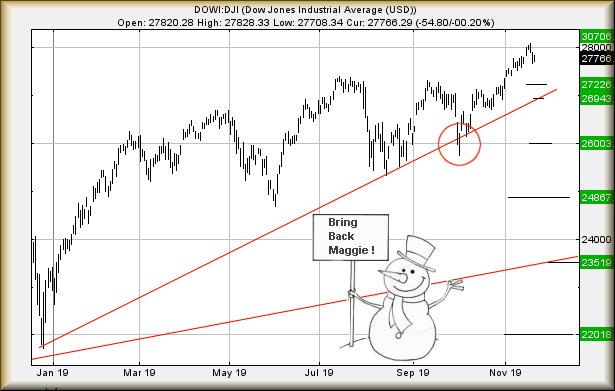

DOW |

27886 | |||||||||

|

3:00:51PM |

NASDAQ |

8276 |

Shambles | ||||||||

|

3:02:28PM |

JAPAN |

23167 |