#FTSE_Futures #I_Hate_my_dog

Usually, we allocate 90 minutes to check weekly FTSE index movements, prior to collating everything and producing this headline section, hopefully with some numbers which shall prove useful. A dog called “Penny”, quite spitefully, sabotaged everything tonight, just because she didn’t like her ears being cleaned. It’s a Golden Retriever ailment, constant head shakes telling the owner the time has come for some hygiene. And dogs utterly hate the 10 minute job.

“Penny” was suitably ambushed at 9pm, her left ear being the guilty party, and the task quickly completed. As always, she celebrated completion by squirming on the wet, muddy, leaf strewn, lawn. But glancing outside later, she had utterly vanished. This risks being a bad thing, thanks to the darkness, the forest and mountain behind the house. If she ever failed to return when called, we’d never find her. She didn’t return, when called, repeatedly and worse, there was no barking. Eventually, it was time to clamber up the cliff, into the steep forest, and hope her eyes would be reflected with the hand-held floodlight. There was still no barking, something very unusual, as Golden Retrievers usually become very vocal when deer, rabbits, or hedgehogs outpace them.

Eventually, thankful for the bright moon and approaching the usual snow level at 500 feet (no snow currently), distant barks were heard. After starting to walk in the right direction with some relief, my phone rung. It was my wife, utterly furious and trying to catch the dog. The animal had circled round, come down to sea level, and was quite literally standing in the sea, barking at my wife and refusing to come out. When I eventually made it down the mountain, wife and 7 year old dog were home and angrily ignoring each other. There was no doubt we’d just been repaid for cleaning her ears.

They say “Never offer an excuse, when late” but what happened tonight just had to be mentioned, the sometimes dubious joys of staying in Argyll, by the sea and mountains!

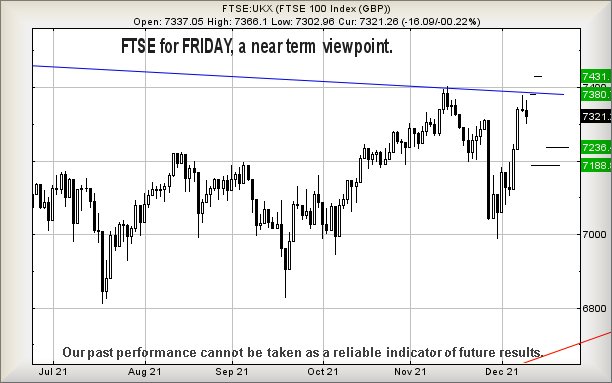

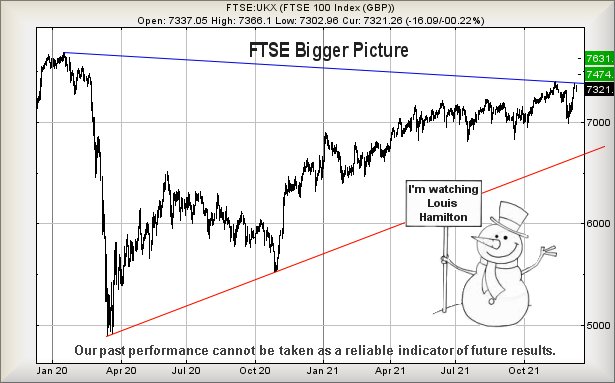

We’re late tonight with our report but this doesn’t detract from something quite important happening with the FTSE, along with wider markets. On Wednesday, quite a few markets made serious triggering movements which pointed to the potential of serious drops. For the FTSE, we’d marked 7189 as a danger point for clients and the UK index stumbled below the trigger, eventually deciding to bottom at 7166 points. But once the FTSE closed and we enjoyed the realms of after-hours futures, after 7pm there was a distinct mood change and it almost felt like the markets had noticed they’d opened the doors for some serious drop potentials. With miracle movements, the next two hours saw German futures gain 200 points, the Nasdaq 550 points, Wall St 500 points and the FTSE recovering 60 points. It was all very mysterious but sent a pretty firm message the markets, despite earlier triggering events, could not be expected to suffer on Thursday. This belief proved completely correct, aside from the Nasdaq which, alone, managed to unwind all the previous days movements. We’ve absolutely no idea what the Nasdaq is playing at, the behaviour akin to a Golden Retriever after getting its ears cleaned.

Despite Thursdays positive behaviour on the FTSE, we’re a little concerned as the index has failed show similar exuberance to other markets. From a near term perspective, the market requires exceed 7275 points to bring movement to an initial 7305 points. Our secondary, if exceeded, calculates at a less believable 7372 points but it’s worth noting, in passing, such an ambition collides with the Blue downtrend since the start of 2020. If triggered, the tightest stop looks like 7225 points and always remember, never trust a triggering movement in the opening seconds of the day. Unlike our wayward dog, this sort of thing often bites.

Our alternate scenario suggests weakness below 7225 risks bringing reversal to an initial 7207 points. If broken, hopefully the market shall choose to bounce at 7186 points.

Again, our thanks to the nice folk who discover adverts on this page worthy of a visit. It buys the morning coffee.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:49:56PM | BRENT | 74.54 | 73.9 | 73.485 | 75 | 75.48 | 75.935 | 74.16 | |||

| 10:52:03PM | GOLD | 1799.23 | 1780 | 1773 | 1792 | 1800 | 1805 | 1786 | Success | ||

| 10:55:33PM | FTSE | 7257.84 | 7225 | 7210 | 7265 | 7277 | 7292 | 7225 | ‘cess | ||

| 10:58:22PM | FRANCE | 6966.3 | 6958 | 6934.5 | 7002 | 7062 | 7103 | 6986 | |||

| 11:02:52PM | GERMANY | 15591 | 15527 | 15489 | 15626 | 15783 | 15834 | 15684 | ‘cess | ||

| 11:05:44PM | NASDAQ | 16866 | 15798 | 15631 | 15980 | 16090 | 16134 | 15870 | Success | ||

| 11:08:17PM | DOW | 35931 | 35768 | 35647 | 36004 | 36205 | 36248 | 36038 | Success | ||

| 11:10:28PM | US500 | 4671 | 4664 | 4650 | 4687 | 4695 | 4705 | 4665 | Success | ||

| 11:39:57PM | JAPAN | 28845 | 28710 | 28534 | 28896 | 29188 | 29261 | 28909 | Success |

16/12/2021 FTSE Closed at 7260 points. Change of 1.26%. Total value traded through LSE was: £ 1,205,733,107 a change of -77.58%

15/12/2021 FTSE Closed at 7170 points. Change of -0.67%. Total value traded through LSE was: £ 5,378,114,182 a change of 0.31%

14/12/2021 FTSE Closed at 7218 points. Change of -0.18%. Total value traded through LSE was: £ 5,361,283,608 a change of -6.74%

13/12/2021 FTSE Closed at 7231 points. Change of -0.82%. Total value traded through LSE was: £ 5,748,563,220 a change of 23.93%

10/12/2021 FTSE Closed at 7291 points. Change of -0.41%. Total value traded through LSE was: £ 4,638,576,552 a change of -14.79%

9/12/2021 FTSE Closed at 7321 points. Change of -0.22%. Total value traded through LSE was: £ 5,443,441,871 a change of -11.44%

8/12/2021 FTSE Closed at 7337 points. Change of -0.04%. Total value traded through LSE was: £ 6,146,296,986 a change of 1.35%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CBX Cellular Goods** **LSE:CNA Centrica** **LSE:EME Empyrean** **LSE:GKP Gulf Keystone** **LSE:IGAS Igas Energy** **LSE:NG. National Glib** **

********

Updated charts published on : Asos, Cellular Goods, Centrica, Empyrean, Gulf Keystone, Igas Energy, National Glib,

LSE:ASC Asos Close Mid-Price: 2119 Percentage Change: -4.81% Day High: 2195 Day Low: 1970.5

If Asos experiences continued weakness below 1970.5, it will invariably l ……..

</p

View Previous Asos & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 6.1 Percentage Change: -1.45% Day High: 6.15 Day Low: 6.05

Continued weakness against CBX taking the price below 6.05 calculates as ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 67.54 Percentage Change: + 1.32% Day High: 67.86 Day Low: 66.94

Continued trades against CNA with a mid-price ABOVE 67.86 should improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 7 Percentage Change: -2.78% Day High: 7.2 Day Low: 7

This is now looking a bit ropey as below 6 now expects weakness to an init ……..

</p

View Previous Empyrean & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 180 Percentage Change: + 3.21% Day High: 181 Day Low: 171

If Gulf Keystone experiences continued weakness below 171, it will invari ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 12.6 Percentage Change: -1.75% Day High: 12.6 Day Low: 12.6

If Igas Energy experiences continued weakness below 12.6, it will invaria ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1064.4 Percentage Change: + 0.51% Day High: 1066.2 Day Low: 1050

In the event of National Glib enjoying further trades beyond 1066.2, the ……..

</p

View Previous National Glib & Big Picture ***