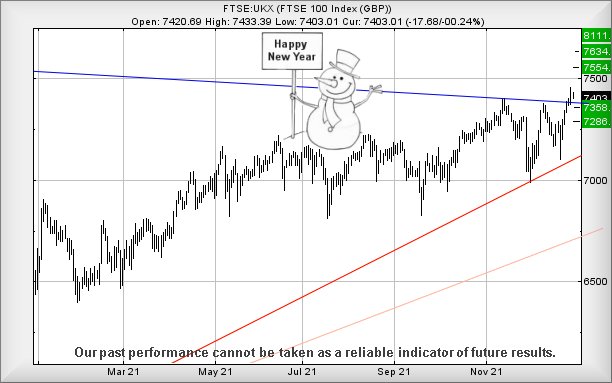

Thursday, the last full day on the markets before New Year dawns, managed to pass virtually un-noticed. We shouldn’t really have been surprised thanks to volumes being lower than public expectations of politicians. The media appear to be enjoying a feeding frenzy, telling anyone who’ll listen Covid-19 cases are at record numbers, but thankfully the stock market appears to be taking a sceptical stance.

Obviously, we hope the situation continues but the harsh reality is of a market requiring above 7459 to trigger some useful recovery, now pointing at the potential of movement to an initial 7554 points with secondary, if bettered, recalculating at 7634 points.

If everything intends go wrong, below 7380 looks slightly troublesome, allowing weakness to an initial 7358 points with secondary, if broken, now working out at 7286 points. Such movement obviously risks undoing the recent upward trend break, effectively parking the index until such time the state of the nations health becomes clear.

This time of year is always fascinating, many pundits giving tips for shares and markets to watch next year. Scanning the US financial press currently reveals a bias toward coming growth in the financial sector and, somewhat humorously, the UK financial sector is mentioned as “one to watch” as it’s been underperforming for years. Who knows, maybe 2022 shall prove to be the year this prediction actually comes to fruition?

For now, our best wishes for the coming year. We’re not inclined to throwing “tips” at readers but do suspect, quite strongly, the travel industry and its associated components in aviation shall be one capable of disproportionate movements, should a belief in Covid-19 retreating gain credence. Shares such as Rolls Royce, IAG, even Easyjet, should accelerate pretty fast if things ever start to return to whatever passes as normal.

Hopefully Google celebrate the final Friday of 2021 by producing some really fascinating adverts for this page. We enjoy the coffee each visit buys.

Have a great New Year and long may ‘yer lum reek.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:27:38PM | BRENT | 79.02 | 78.14 | 77.575 | 76.74 | 79.69 | 80.1 | 80.3 | 80.93 | 78.85 | |

| 9:33:07PM | GOLD | 1817.31 | 1796 | 1789 | 1778 | 1804 | 1818 | 1821 | 1825 | 1810 | Success |

| 9:35:07PM | FTSE | 7395 | 7381 | 7363 | 7331 | 7418 | 7438 | 7452 | 7471 | 7402 | ‘cess |

| 9:38:00PM | FRANCE | 7167 | 7151 | 7146 | 7132 | 7178 | 7190 | 7199 | 7212 | 7172 | |

| 9:40:13PM | GERMANY | 15860.99 | 15792 | 15757 | 15684 | 15885 | 15970 | 15997 | 16064 | 15858 | |

| 9:47:28PM | US500 | 4780.87 | 4776 | 4771 | 4759 | 4786 | 4807 | 4814 | 4828 | 4777 | |

| 10:06:41PM | DOW | 36400 | 36368 | 36307 | 36179 | 36471 | 36599 | 36628 | 36715 | 36468 | |

| 10:08:19PM | NASDAQ | 16433 | 16411 | 16389 | 16329 | 16496 | 16569 | 16618 | 16685 | 16452 | |

| 10:12:44PM | JAPAN | 28872 | 28798 | 28756 | 28684 | 28916 | 28966 | 28978 | 29109 | 28901 |

30/12/2021 FTSE Closed at 7403 points. Change of -0.23%. Total value traded through LSE was: £ 2,306,886,388 a change of -39.99%

29/12/2021 FTSE Closed at 7420 points. Change of 0.64%. Total value traded through LSE was: £ 3,844,071,499 a change of 12.08%

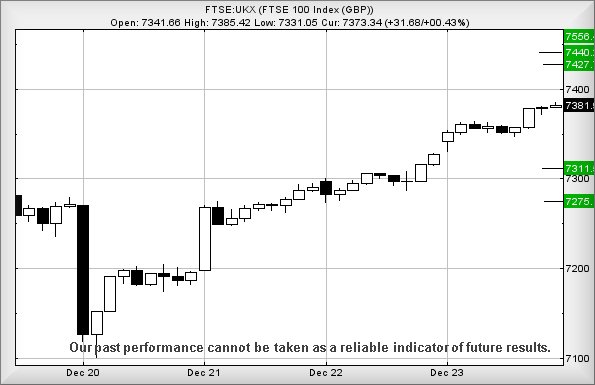

23/12/2021 FTSE Closed at 7373 points. Change of 0.44%. Total value traded through LSE was: £ 3,429,761,214 a change of -22.36%

22/12/2021 FTSE Closed at 7341 points. Change of 0.6%. Total value traded through LSE was: £ 4,417,772,606 a change of -20.48%

21/12/2021 FTSE Closed at 7297 points. Change of -100%. Total value traded through LSE was: £ 5,555,401,277 a change of 0%

20/12/2021 FTSE Closed at 7198 points. Change of 0%. Total value traded through LSE was: £ 5,725,360,926 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BDEV Barrett Devs** **LSE:EXPN Experian** **LSE:IGG IG Group** **LSE:OXIG Oxford Instruments** **LSE:PPC President Energy** **LSE:RKH Rockhopper** **

********

Updated charts published on : Barrett Devs, Experian, IG Group, Oxford Instruments, President Energy, Rockhopper,

LSE:BDEV Barrett Devs Close Mid-Price: 745 Percentage Change: -0.56% Day High: 752.4 Day Low: 746.8

Further movement against Barrett Devs ABOVE 752.4 should improve accelera ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 3634 Percentage Change: -0.90% Day High: 3689 Day Low: 3644

Continued trades against EXPN with a mid-price ABOVE 3689 should improve ……..

</p

View Previous Experian & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 819 Percentage Change: + 0.06% Day High: 823.5 Day Low: 816.5

Further movement against IG Group ABOVE 823.5 should improve acceleration ……..

</p

View Previous IG Group & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2645 Percentage Change: -0.56% Day High: 2765 Day Low: 2620

In the event of Oxford Instruments enjoying further trades beyond 2765, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 2.02 Percentage Change: -19.00% Day High: 2.5 Day Low: 2.02

Below 2p now suggests weakness to an initial 1.75 with secondary, if broke ……..

</p

View Previous President Energy & Big Picture ***

LSE:RKH Rockhopper Close Mid-Price: 7.75 Percentage Change: -0.90% Day High: 8.53 Day Low: 7.04

All Rockhopper needs are mid-price trades ABOVE 8.53 to improve accelerat ……..

</p

View Previous Rockhopper & Big Picture ***