#FTSE #GOLD At Trends and Targets, we’re often asked how we produce our target levels, hopefully due to our often devastating accuracy. For commercial reasons, we’re forced to be vague but there’s another reality in play. Very rarely do we apply just one set of formula to a potential movement. Instead, we’ll look at near term potentials based on market movements during the most recent month. Then we’ll zoom out and look at what’s been happening during the period since the last cataclysm (think Covid-19 hitting), and finally take a glance at really big picture potentials, sometimes since the beginning of time. As part of this exercise, we question if a price is trading higher (or lower) than any previous highs, along with looking for visual cues on a chart.

At this point, beside boring the reader, there’s another factor which requires satisfied. We’ve got to question whether recent minute by minute movements are tending to reach targets or fizzle out, before target levels are achieved. This is an attempt to ascertain whether a market is showing any particular strength, in any particular direction.

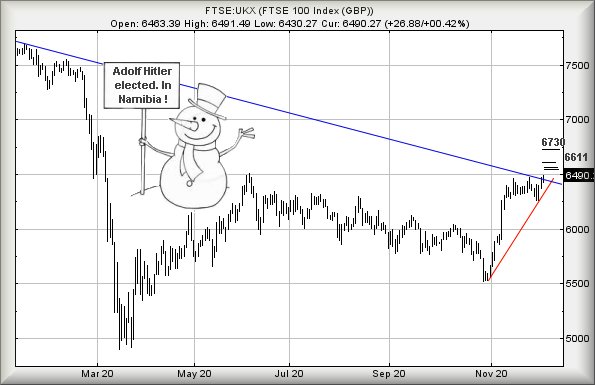

Sometimes, the result of all this focus on numbers is a need to just walk away and admit we don’t have a blooming clue! Other times, such as with the FTSE at present, we start to find hints of direction and will bias our thinking accordingly.

In this report, the bias is toward potential gains on the UK market, at least until 6730 makes a guest appearance. At such a level, we believe the FTSE may pause for breath, especially as our next major point of interest is around 600 points higher.

For the immediate future, our inclination is to “play it safe” with the FTSE, demanding the index next trade above 6505 points to enter a cycle toward an initial 6543 points. If exceeded, our secondary calculates at 6560 points. In fact, the index could easily find itself accelerating toward 6611 points.

If triggered, the tightest stop loss level looks like a reasonable 6450 points. It’s fingers crossed time, especially as the market now needs below 6383 to suggest our optimism is misplaced.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:27:20PM | BRENT | 48.79 | 47.64 | 47.265 | 48.45 | 48.84 | 48.96 | 48.14 | Sorry | ||

| 10:28:46PM | GOLD | 1841.32 | 1823 | 1815.5 | 1838 | 1844 | 1847 | 1834 | ‘cess | ||

| 10:31:25PM | FTSE | 6489.77 | 6421 | 6394 | 6479 | 6512 | 6546 | 6450 | ‘cess | ||

| 10:32:57PM | FRANCE | 5549.9 | 5542 | 5529.5 | 5577 | 5586 | 5601.5 | 5553 | |||

| 10:36:19PM | GERMANY | 13213.87 | 13198 | 13171 | 13232 | 13276 | 13318 | 13230 | Success | ||

| 10:37:51PM | US500 | 3668 | 3655 | 3644.5 | 3675 | 3682 | 3691.5 | 3664 | ‘cess | ||

| 10:40:35PM | DOW | 29958 | 29769 | 29700.5 | 29915 | 30073 | 30129.5 | 29951 | Success | ||

| 10:42:03PM | NASDAQ | 12484 | 12440 | 12411 | 12492 | 12540 | 12563 | 12464 | |||

| 10:43:53PM | JAPAN | 26733 | 26672 | 26620.5 | 26767 | 26840 | 26894 | 26759 |