#Brent #Dax

Three weeks ago, when we reviewed Natwest, we cynically proposed the market devising an excuse for panic reversal, if only due to the share price heading upward faster than expected. Of course, this unfortunately came to pass, the company announcing serious profits, bunging their CEO a £5 billion bonus for the first time since 2008, and the share price was dropped by 9%…

The reason for reversals came from the small print in their earnings report, an expectation 2023 shall probably be less profitable but shareholders, in the meantime, should anticipate a dividend of 10p per share. With the panic reversal we’d suspected, the share price, despite breaking below Blue during the session, closed the day just above the 280p level. So perhaps all is not lost, the market not making the final commitment to stabbing traders in the back. The Blue downtrend on the chart and insets dates back to the start of 2018 and it appears to be taken seriously.

It’s going to be interesting watching what happens next. The market manipulated NWG’s share price downward at the open, going from last Thursdays closing price of 306p down to a Friday open of 282p, a market service which avoided anyone the distress of actually trading. We wish this drop hadn’t broken the 280p level as the gapped visit to 276p fouled up some of our calculations and optimism. Instead, it has introduced a potential of weakness below 276p promoting reversal to 270p next with our secondary, if broken, at 260p and hopefully a rebound. And worse, if genuine negative news appears, this share price could continue to power downward toward an eventual 237p.

Conversely, to return to illusory safety, the share price needs trade above 300p or, at least close a session above 294p currently as this works out with the potential of a lift to an initial 322p next with our longer term secondary, if exceeded, working out at 396p. Our suspicion, visually, shall be for the markets to invent a reason to gap Natwest back above the immediate Red uptrend. Should this prove to be the case within the next couple of weeks, it sends quite a strong “just go long and wait” signal to traders.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 2:13:10PM | US500 | 4078 | 4056 | |||||||

| 6:55:36PM | DOW | 33800 | 33550 | |||||||

| 6:56:58PM | NASDAQ | 12355 | 12300 | |||||||

| 7:52:24PM | JAPAN | 27516 | 27519 | |||||||

| 7:54:38PM | BRENT | 82.87 | 82.02 | 81.52 | 79.57 | 82.72 | 83.75 | 83.98 | 84.78 | 82.59 |

| 7:56:21PM | GOLD | 1842 | 1831 | |||||||

| 7:58:38PM | FTSE | 8021.37 | 8003 | |||||||

| 8:00:48PM | STOX50 | 4289.8 | 4268 | |||||||

| 8:02:38PM | GERMANY | 15524.27 | 15335 | 15295 | 15182 | 15448 | 15530 | 15627 | 15739 | 15440 |

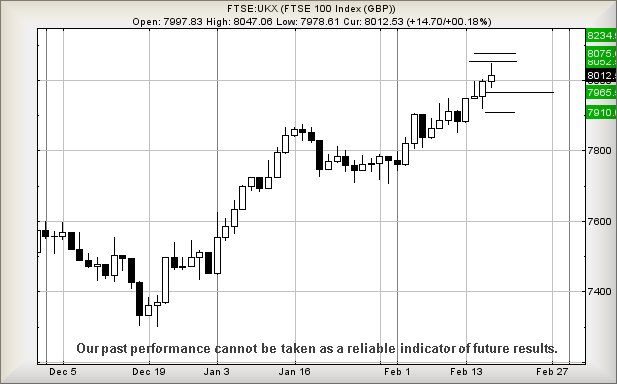

17/02/2023 FTSE Closed at 8004 points. Change of -0.1%. Total value traded through LSE was: £ 7,672,519,841 a change of 57.8%

16/02/2023 FTSE Closed at 8012 points. Change of 0.19%. Total value traded through LSE was: £ 4,862,026,417 a change of -10.79%

15/02/2023 FTSE Closed at 7997 points. Change of 0.55%. Total value traded through LSE was: £ 5,450,342,646 a change of -0.23%

14/02/2023 FTSE Closed at 7953 points. Change of 0.08%. Total value traded through LSE was: £ 5,463,158,317 a change of 17.15%

13/02/2023 FTSE Closed at 7947 points. Change of 0.82%. Total value traded through LSE was: £ 4,663,265,889 a change of -40.31%

11/02/2023 FTSE Closed at 7882 points. Change of 0%. Total value traded through LSE was: £ 7,812,457,009 a change of 15.14%

10/02/2023 FTSE Closed at 7882 points. Change of -0.37%. Total value traded through LSE was: £ 6,785,335,053 a change of -4.85%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CBX Cellular Goods** **LSE:CNA Centrica** **LSE:GENL Genel** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OPG OPG Power Ventures** **

********

Updated charts published on : Asos, Cellular Goods, Centrica, Genel, Hikma, HSBC, National Glib, Natwest, OPG Power Ventures,

LSE:ASC Asos. Close Mid-Price: 834 Percentage Change: + 1.09% Day High: 848 Day Low: 801.5

In the event Asos experiences weakness below 801.5 it calculates with a d ……..

</p

View Previous Asos & Big Picture ***

LSE:CBX Cellular Goods. Close Mid-Price: 0.65 Percentage Change: + 8.33% Day High: 0.65 Day Low: 0.6

Further movement against Cellular Goods ABOVE 0.65 should improve acceler ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 105.05 Percentage Change: + 0.82% Day High: 106.15 Day Low: 102.95

Continued trades against CNA with a mid-price ABOVE 106.15 should improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:GENL Genel Close Mid-Price: 123.2 Percentage Change: -1.12% Day High: 125.6 Day Low: 122.6

If Genel experiences continued weakness below 122.6, it will invariably l ……..

</p

View Previous Genel & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1770.5 Percentage Change: -0.25% Day High: 1787 Day Low: 1763

In the event of Hikma enjoying further trades beyond 1787, the share shou ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 621.1 Percentage Change: + 0.44% Day High: 623.7 Day Low: 614

All HSBC needs are mid-price trades ABOVE 623.7 to improve acceleration t ……..

</p

View Previous HSBC & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1070 Percentage Change: + 2.05% Day High: 1075.5 Day Low: 1046

In the event of National Glib enjoying further trades beyond 1075.5, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 284.6 Percentage Change: -6.87% Day High: 288.5 Day Low: 276.5

Continued weakness against NWG taking the price below 276.5 calculates as ……..

</p

View Previous Natwest & Big Picture ***

LSE:OPG OPG Power Ventures. Close Mid-Price: 8.55 Percentage Change: + 3.01% Day High: 8.9 Day Low: 8.3

Continued trades against OPG with a mid-price ABOVE 8.9 should improve th ……..

</p

View Previous OPG Power Ventures & Big Picture ***