#Gold #Dax By most criteria, we should wholeheartedly approve of the games being played with Barclays share price. We’ve circled an area of the chart, one which featured in our report three weeks ago, where we presented a scenario allowing weakness to 134p. The share price actually, following some intraday fun and games, closed at a low of 133.9p, pretty exactly given the number of gaps exhibited by the share price during March and April.

Often, when we come across shares under such tight control by the market, a degree of confidence is allowed for future movement scenario, regardless of the direction being speculated upon.

In the case of Barclays, our inclination is to speculate on the potential of future gains, hopefully the world remaining calmed down by the usual Easter chocolate overdose. Personally, it has been a pleasure this year not feeling the need to loosen my belt, due to stealing grand-children’s easter eggs. This turns out to be a positive side effect of T2 Diabetes and better still, deciding to “fall off the wagon” on Sunday brought a surprise discovery my chocolate cravings had gone and now, I didn’t even like the stuff!

Our hope for Barclays demands the share price closes above 159p as this looks certain to trigger movement to an initial 163p with secondary, if bettered, a visually sane 175p. What’s surprising about our 175 ambition is it collides, almost dangerously accurately, with some share price shenanigans in February this year, when the market opted to gap (manipulate) Barclays share price below the Blue downtrend since 2007.

It’d be fair to suggest we shall be frothing with optimism, if the price manages to regain this Blue downtrend as the market almost managed to issue a Press Release saying it regards it as important. It results in a situation where closure above Blue should be taken as the first solid signal some movement of strength should be expected as our software has designated a future 220 as a significant point of interest.

If everything intends go wrong for Barclays, below 134p shall now prove troublesome, giving an initial expectation of 115 with secondary, if broken, at 99p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 11:23:10PM | BRENT | 84.17 | 83.75 | 83.105 | 82.31 | 84.72 | 85.49 | 85.925 | 86.6 | 84.58 |

| 11:24:44PM | GOLD | 1991.22 | 1996 | |||||||

| 11:27:04PM | FTSE | 7772 | 7757 | |||||||

| 11:28:34PM | STOX50 | 4328.4 | 4311 | |||||||

| 12:03:47AM | GERMANY | 15682 | 15545 | 15497 | 15431 | 15615 | 15697 | 15728 | 15789 | 15624 |

| 12:05:28AM | US500 | 4116.72 | 4102 | |||||||

| 12:07:33AM | DOW | 33609.3 | 33499 | |||||||

| 12:09:05AM | NASDAQ | 13067.29 | 13005 | |||||||

| 12:12:58AM | JAPAN | 27869 | 27820 |

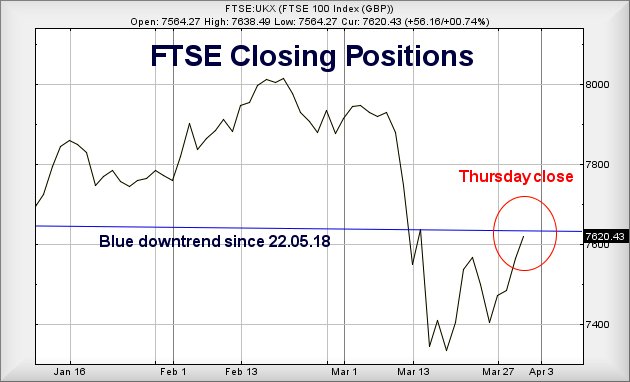

6/04/2023 FTSE Closed at 7741 points. Change of 1.03%. Total value traded through LSE was: £ 4,283,125,901 a change of -14.63%

5/04/2023 FTSE Closed at 7662 points. Change of 0.37%. Total value traded through LSE was: £ 5,017,004,065 a change of -11.84%

4/04/2023 FTSE Closed at 7634 points. Change of -0.51%. Total value traded through LSE was: £ 5,690,797,913 a change of -12.58%

3/04/2023 FTSE Closed at 7673 points. Change of 0.55%. Total value traded through LSE was: £ 6,510,009,325 a change of 8.45%

31/03/2023 FTSE Closed at 7631 points. Change of 0.14%. Total value traded through LSE was: £ 6,002,582,813 a change of 23.52%

30/03/2023 FTSE Closed at 7620 points. Change of 0.74%. Total value traded through LSE was: £ 4,859,647,247 a change of 17.38%

29/03/2023 FTSE Closed at 7564 points. Change of 1.07%. Total value traded through LSE was: £ 4,139,938,147 a change of -38.03%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BLOE Block Energy PLC** **LSE:CASP Caspian** **LSE:CNA Centrica** **LSE:IPF International Personal Finance** **LSE:JET Just Eat** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:QED Quadrise** **

********

Updated charts published on : Astrazeneca, Barclays, Block Energy PLC, Caspian, Centrica, International Personal Finance, Just Eat, Music Magpie, National Glib, Quadrise,

LSE:AZN Astrazeneca. Close Mid-Price: 11700 Percentage Change: + 0.91% Day High: 11734 Day Low: 11594

Further movement against Astrazeneca ABOVE 11734 should improve accelerat ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 151.62 Percentage Change: + 2.64% Day High: 152 Day Low: 148.44

All Barclays needs are mid-price trades ABOVE 152 to improve acceleration ……..

</p

View Previous Barclays & Big Picture ***

LSE:BLOE Block Energy PLC. Close Mid-Price: 1.45 Percentage Change: + 20.83% Day High: 1.55 Day Low: 1.2

Target met. Continued trades against BLOE with a mid-price ABOVE 1.55 sho ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 5.55 Percentage Change: -1.77% Day High: 5.75 Day Low: 5.55

Continued weakness against CASP taking the price below 5.55 calculates as ……..

</p

View Previous Caspian & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 111.35 Percentage Change: + 1.78% Day High: 112.6 Day Low: 109.8

Continued trades against CNA with a mid-price ABOVE 112.6 should improve ……..

</p

View Previous Centrica & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 95.4 Percentage Change: -7.38% Day High: 99.8 Day Low: 93.8

Target met. If International Personal Finance experiences continued weakn ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1329 Percentage Change: -1.77% Day High: 1393 Day Low: 1319

Weakness on Just Eat below 1319 will invariably lead to 1283 with seconda ……..

</p

View Previous Just Eat & Big Picture ***

LSE:MMAG Music Magpie Close Mid-Price: 22 Percentage Change: -4.35% Day High: 23 Day Low: 22

Continued weakness against MMAG taking the price below 22 calculates as l ……..

</p

View Previous Music Magpie & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1140 Percentage Change: + 0.97% Day High: 1151 Day Low: 1127.5

Further movement against National Glib ABOVE 1151 should improve accelera ……..

</p

View Previous National Glib & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 1.3 Percentage Change: + 0.58% Day High: 1.32 Day Low: 1.2

Below 1.2 looks dangerous, now allowing reversal to 0.7 and that’s it. We ……..

</p

View Previous Quadrise & Big Picture ***