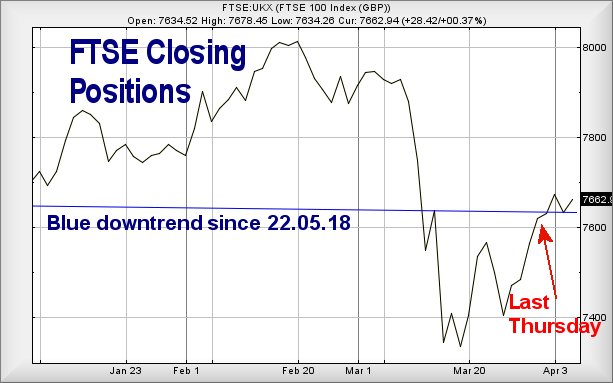

#FTSE #Gold As the markets wind down for the Easter Weekend, we were struck by how important our Blue downtrend featured in last Fridays article has proven. Last Thursday, we’d speculated whether the markets failure to close above the downtrend was significant and now, it appears to be the case, only in a way we hadn’t entirely anticipated.

This week has seen the index close above the trend, retreat slightly to close exactly on the trend, and now, is making slight upward nudges. It’s certainly creating a visual picture of strength and, if it were a share, we’d be quite comfortable speculating on the potentials for continued growth. A tiny little fly landed in the ointment when the FTSE closed 10 points below the previous high this week, the lower high implying a risk of slower movement.

However, as it’s Easter and the annual chocolate binge for everyone except me (T2 Diabetes), about the best scenario we dare give is the potential of movement next above 7679 triggering growth toward 7751 next. Our secondary, should such a level be exceeded, now calculates at 7932 points and the potential for a stutter in the cycle. The reasons behind this risk are pretty obvious from the chart below, the market previously opting to stall at such a level at the start of March. In-house, when we come across these “stalls” on the way up, we’ve tended to settle on them simply ensuring a delay in any rising cycle, rather than a solid ceiling level.

Who knows, perhaps the FTSE still intends a visit to the 8200 level eventually.

Our alternate scenario, if everything intends fall apart, comes should the FTSE discover sufficient excuse to slither below 7630 points, such a calamity calculating with an initial drop potential at 7581 and hopefully a bounce as it meets the historic downtrend. Our secondary, if broken, is at 7532 and a bit problematic, risking the index vanishing down faster than Scotlands Nicola Sturgeon avoiding TV crews, should this level also break.

We can provide 7144 as a potential bottom level but realistically, the FTSE could find itself at 6800 faster than Ms Sturgeon will doubtless say; “Who’s this Peter Murrell person? I’ve no recollection of marrying him… I’ll need to check my diary as we never talked!”

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:32:42PM | BRENT | 84.74 | 83.71 | 83.14 | 85.12 | 85.91 | 86.36 | 84.93 | |||

| 9:34:45PM | GOLD | 2021.06 | 2010 | 2006 | 2020 | 2024 | 2028 | 2018 | ‘cess | ||

| 9:36:27PM | FTSE | 7673 | 7631 | 7626 | 7651 | 7682 | 7697 | 7663 | |||

| 9:39:06PM | STOX50 | 4304.3 | 4289 | 4277 | 4305 | 4327 | 4336 | 4307 | ‘cess | ||

| 9:51:23PM | GERMANY | 15531 | 15472 | 15373 | 15574 | 15621 | 15637 | 15577 | ‘cess | ||

| 10:19:56PM | US500 | 4088.27 | 4072 | 4060 | 4095 | 4108 | 4117 | 4088 | ‘cess | ||

| 10:21:39PM | DOW | 33474.5 | 33318 | 33274 | 33440 | 33538 | 33586 | 33446 | |||

| 10:24:00PM | NASDAQ | 12961.44 | 12898 | 12807 | 12985 | 13132 | 13216 | 13062 | Success | ||

| 10:26:36PM | JAPAN | 27673 | 27552 | 27494 | 27653 | 27856 | 28007 | 27723 | Success |

5/04/2023 FTSE Closed at 7662 points. Change of 0.37%. Total value traded through LSE was: £ 5,017,004,065 a change of -11.84%

4/04/2023 FTSE Closed at 7634 points. Change of -0.51%. Total value traded through LSE was: £ 5,690,797,913 a change of -12.58%

3/04/2023 FTSE Closed at 7673 points. Change of 0.55%. Total value traded through LSE was: £ 6,510,009,325 a change of 8.45%

31/03/2023 FTSE Closed at 7631 points. Change of 0.14%. Total value traded through LSE was: £ 6,002,582,813 a change of 23.52%

30/03/2023 FTSE Closed at 7620 points. Change of 0.74%. Total value traded through LSE was: £ 4,859,647,247 a change of 17.38%

29/03/2023 FTSE Closed at 7564 points. Change of 1.07%. Total value traded through LSE was: £ 4,139,938,147 a change of -38.03%

28/03/2023 FTSE Closed at 7484 points. Change of 0.17%. Total value traded through LSE was: £ 6,680,856,903 a change of 37.06%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BARC Barclays** **LSE:CNA Centrica** **LSE:JET Just Eat** **LSE:NG. National Glib** **LSE:PMG Parkmead** **LSE:SDY Speedyhire** **LSE:TRN The Trainline** **

********

Updated charts published on : Aston Martin, Barclays, Centrica, Just Eat, National Glib, Parkmead, Speedyhire, The Trainline,

LSE:AML Aston Martin Close Mid-Price: 213 Percentage Change: -4.23% Day High: 234.4 Day Low: 209.2

This is getting a little dodgy, perhaps their method of cheating in Formul ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 147.72 Percentage Change: + 0.83% Day High: 150.22 Day Low: 147.22

Continued trades against BARC with a mid-price ABOVE 150.22 should improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 109.4 Percentage Change: + 1.67% Day High: 111.05 Day Low: 107.75

Target met. All Centrica needs are mid-price trades ABOVE 111.05 to impro ……..

</p

View Previous Centrica & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1353 Percentage Change: -6.24% Day High: 1479 Day Low: 1336

If Just Eat experiences continued weakness below 1336, it will invariably ……..

</p

View Previous Just Eat & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1129 Percentage Change: + 2.36% Day High: 1130.5 Day Low: 1106

Target met. In the event of National Glib enjoying further trades beyond ……..

</p

View Previous National Glib & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 25.25 Percentage Change: -4.54% Day High: 26.4 Day Low: 23.5

In the event Parkmead experiences weakness below 22 it calculates with a d ……..

</p

View Previous Parkmead & Big Picture ***

LSE:SDY Speedyhire Close Mid-Price: 30.5 Percentage Change: -5.72% Day High: 32.35 Day Low: 30.5

Target met. Continued weakness against SDY taking the price below 30.5 ca ……..

</p

View Previous Speedyhire & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 236.2 Percentage Change: -2.56% Day High: 242.4 Day Low: 232.6

Target met. In the event The Trainline experiences weakness below 232.6 i ……..

</p

View Previous The Trainline & Big Picture ***