#FTSE #Stoxx50 There’s just 3 weeks until the first Formula 1 show of 2024, taking place in Bahrain and starring the usual crew who, it appears, all seem to expect a season just like last years. In other words, fairly boring and predictable. Maybe Alonso, driving for Aston Martin, shall claim something outrageous, generating some airtime or perhaps his team-mate Stroll will show he’s learned how to drive but unfortunately, in pre-season gossip, it looks like more of the same is expected.

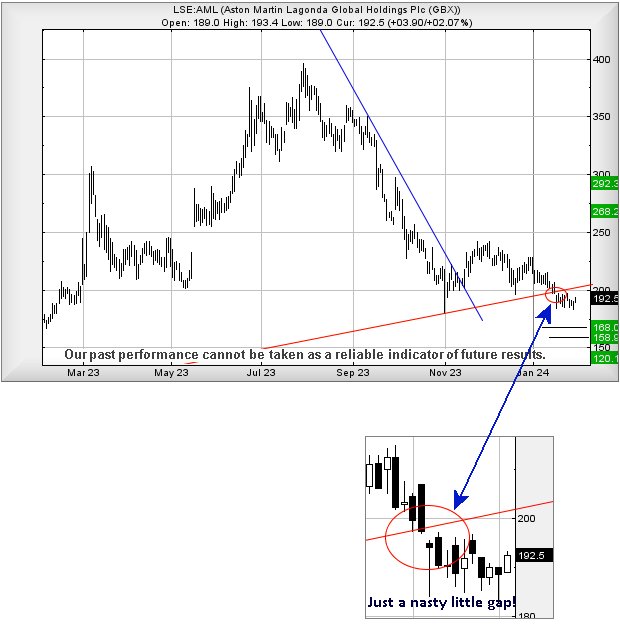

Unfortunately, with regard Aston Martins share price, “more of the same” feels like the ruling sentiment also. We’re pretty confident their share price is destined to visit 168p, maybe even 158p and a level by which we’d hope for a realistic rebound. Why are we primed with misery for the share?

It all dates back to January 17th of this year, a session which opened with the share price being gapped below the Red uptrend on the chart. This gave a pretty convincing clue the market has a cunning plan and due to share price movements since the event, some care has been taken to ensure no arguments for immediate recovery exist. Quite the converse. It now looks very like movement below 183p shall serve to trigger the next reversal cycle, hopefully one which indeed finds a bottom waiting before 158p. There is a larger danger, one which shall doubtless require a serious faux pas, as should 158p break, our next bottom level is a silly looking 120p. At least, it would be silly, if it were not indicative of a return to price levels at the end of 2022.

Of course, with the racing season about to start, maybe Aston Martin shall produce a Duracell rabbit capable of boosting the teams fortunes. The earliest indication of such an epiphany would be the share price closing a session above 205p, above the level of trend break. We’d regard this with some considerable hope as it’d be the first step in an acceleration curve toward an initial 268p with secondary, if bettered, at a longer term 292p. The only problem, we can do the sums and produce the numbers but, don’t quite believe them.

There’s another feature worthy of consideration. Here in Argyll we tend get overloaded with supercars, the roads presenting their own set of unique challenges. Quite genuinely, I cannot recall when I last noticed an Aston Martin…

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 8:50:36PM | BRENT | 8245.3 | |||||||||

| 8:52:42PM | GOLD | 2035.82 | ‘cess | ||||||||

| 10:08:45PM | FTSE | 7660 | 7643 | 7626 | 7606 | 7683 | 7686 | 7696 | 7714 | 7669 | ‘cess |

| 10:11:12PM | STOX50 | 4651.2 | 4652 | 4646 | 4638 | 4662 | 4670 | 4709 | 4756 | 4654 | |

| 10:13:47PM | GERMANY | 16928.5 | ‘cess | ||||||||

| 10:16:45PM | US500 | 4908.1 | |||||||||

| 10:19:25PM | DOW | 38456 | |||||||||

| 10:21:43PM | NASDAQ | 17361 | ‘cess | ||||||||

| 10:24:34PM | JAPAN | 35749 |

30/01/2024 FTSE Closed at 7666 points. Change of 0.45%. Total value traded through LSE was: £ 4,778,161,303 a change of -12.39%

29/01/2024 FTSE Closed at 7632 points. Change of -0.04%. Total value traded through LSE was: £ 5,453,884,268 a change of -16.87%

28/01/2024 FTSE Closed at 7635 points. Change of 1.41%. Total value traded through LSE was: £ 6,560,613,072 a change of 58.4%

25/01/2024 FTSE Closed at 7529 points. Change of 0.03%. Total value traded through LSE was: £ 4,141,889,174 a change of -12.43%

24/01/2024 FTSE Closed at 7527 points. Change of 0.55%. Total value traded through LSE was: £ 4,729,886,078 a change of -8.08%

23/01/2024 FTSE Closed at 7486 points. Change of -0.01%. Total value traded through LSE was: £ 5,145,475,949 a change of 1.4%

22/01/2024 FTSE Closed at 7487 points. Change of 0.35%. Total value traded through LSE was: £ 5,074,323,347 a change of -15.67%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:EME Empyrean** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:IHG Intercontinental Hotels Group** **LSE:ITRK Intertek** **LSE:MMAG Music Magpie** **LSE:SDY Speedyhire** **

********

Updated charts published on : Empyrean, Experian, EasyJet, Intercontinental Hotels Group, Intertek, Music Magpie, Speedyhire,

LSE:EME Empyrean Close Mid-Price: 0.38 Percentage Change: -11.76% Day High: 0.38 Day Low: 0.35

In the event Empyrean experiences weakness below 0.35 it calculates with a ……..

</p

View Previous Empyrean & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3313 Percentage Change: + 1.72% Day High: 3315 Day Low: 3268

Target met. Further movement against Experian ABOVE 3315 should improve a ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 554.2 Percentage Change: + 1.28% Day High: 559.4 Day Low: 547

Further movement against EasyJet ABOVE 559.4 should improve acceleration ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 7580 Percentage Change: + 1.66% Day High: 7618 Day Low: 7482

Target met. All Intercontinental Hotels Group needs are mid-price trades ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 4506 Percentage Change: + 0.63% Day High: 4539 Day Low: 4504

In the event of Intertek enjoying further trades beyond 4539, the share s ……..

</p

View Previous Intertek & Big Picture ***

LSE:MMAG Music Magpie Close Mid-Price: 9.5 Percentage Change: -5.00% Day High: 10 Day Low: 8.75

Target met. In the event Music Magpie experiences weakness below 8.75 it ……..

</p

View Previous Music Magpie & Big Picture ***

LSE:SDY Speedyhire Close Mid-Price: 29.5 Percentage Change: -18.06% Day High: 31.25 Day Low: 28.7

If Speedyhire experiences continued weakness below 28.7, it will invariab ……..

</p

View Previous Speedyhire & Big Picture ***