#Brent #Stoxx50 Champagne is getting expensive! This weekend brought an important milestone, our 30th wedding anniversary, and once again we marked the date with a bottle of “decent” champagne. It’s one of these ridiculous traditions some couples embrace, we buy a bottle of the stuff every year, don’t open it, and place it in a wine rack. The rack provides an easy method of telling how long we’ve been married and we’ve been keeping the champagne for a “special occasion”, neither my wife or I being particularly fond of the fizzy stuff. Our current suspicion is we’ll end up loading it into a wheelbarrow and giving it to whatever grand-daughter gets married first. The only thing certain since the tradition started; champagne never, ever, gets cheaper, regardless the state of the wider economy!

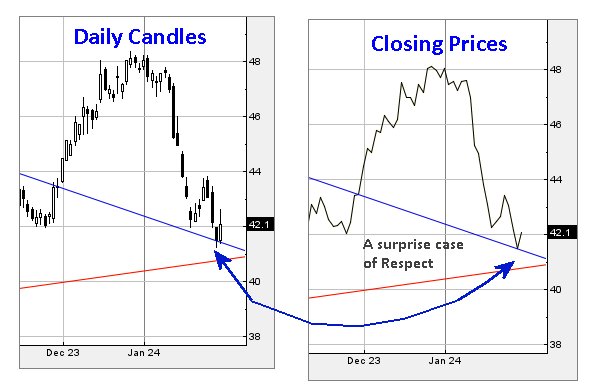

Once again, it is time to try and make sense of a retail banking share and unusually, there’s a vague chance Lloyds has delivered some sort of signal. The Blue line on the chart, the downtrend since February last year, hasn’t appeared particularly important until last Thursday. Then, for some reason, the market took exquisite care NOT to let the share price close below Blue. Perhaps we’re clutching at straws, perhaps not, but the immediate implication calculates with the risk of weakness below 41.4 heading down to an initial 40.9 with secondary, if broken, a bounce point now at 38.4p.

However, if the market indeed intends make an effort to stop Blue breaking, and instead, we should now search for movements which will give notice of surprise recovery for Lloyds.

Should this turn out to be the case, a slightly interesting early warning will come if the share price movements above 43.1p as this is supposed to trigger an initial surge to a useless 43.67p. Our inclination is to regard 43.67p as a viable trigger level, one which if exceeded should next promote the concept of a visit to 45.4p initially with secondary, if exceeded, a future 47.3p. Visually, it appears very possible there shall be some hesitation at the 47.3p level, should the price discover a path to such a target.

Who knows, perhaps Lloyds shall finally prove worth keeping an eye on.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 6:17:08PM | BRENT | 8314.3 | 8079 | 7985 | 7875 | 8142 | 8317 | 8354 | 8640 | 7853 |

| 6:29:19PM | GOLD | 2018 | ||||||||

| 6:32:01PM | FTSE | 7616 | ||||||||

| 6:34:13PM | STOX50 | 4633.3 | 4578 | 4554 | 4526 | 4604 | 4639 | 4659 | 4752 | 4623 |

| 6:36:41PM | GERMANY | |||||||||

| 6:40:14PM | US500 | |||||||||

| 6:42:46PM | DOW | |||||||||

| 6:44:40PM | NASDAQ | |||||||||

| 6:46:42PM | JAPAN |

28/01/2024 FTSE Closed at 7635 points. Change of 1.41%. Total value traded through LSE was: £ 6,560,613,072 a change of 58.4%

25/01/2024 FTSE Closed at 7529 points. Change of 0.03%. Total value traded through LSE was: £ 4,141,889,174 a change of -12.43%

24/01/2024 FTSE Closed at 7527 points. Change of 0.55%. Total value traded through LSE was: £ 4,729,886,078 a change of -8.08%

23/01/2024 FTSE Closed at 7486 points. Change of -0.01%. Total value traded through LSE was: £ 5,145,475,949 a change of 1.4%

22/01/2024 FTSE Closed at 7487 points. Change of 0.35%. Total value traded through LSE was: £ 5,074,323,347 a change of -15.67%

19/01/2024 FTSE Closed at 7461 points. Change of 0.03%. Total value traded through LSE was: £ 6,017,076,844 a change of 5.37%

18/01/2024 FTSE Closed at 7459 points. Change of 0.17%. Total value traded through LSE was: £ 5,710,434,313 a change of 4.63%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:EXPN Experian** **LSE:IPF International Personal Finance** **LSE:ITRK Intertek** **LSE:SRP Serco** **

********

Updated charts published on : Experian, International Personal Finance, Intertek, Serco,

LSE:EXPN Experian. Close Mid-Price: 3258 Percentage Change: + 0.52% Day High: 3270 Day Low: 3229

Target met. All Experian needs are mid-price trades ABOVE 3270 to improve ……..

</p

View Previous Experian & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 120 Percentage Change: + 0.42% Day High: 121.5 Day Low: 116

In the event of International Personal Finance enjoying further trades be ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 4458 Percentage Change: + 1.69% Day High: 4476 Day Low: 4384

Target met. Continued trades against ITRK with a mid-price ABOVE 4476 sho ……..

</p

View Previous Intertek & Big Picture ***

LSE:SRP Serco Close Mid-Price: 174 Percentage Change: -0.57% Day High: 188.2 Day Low: 164.8

Further movement against Serco ABOVE 188.2 should improve acceleration to ……..

</p

View Previous Serco & Big Picture ***