Thursday sure as heck didn’t go entirely as expected. As expected, the FTSE managed to trigger a drop then behaved with the braincell of a cat staring at a wall, doing very little for the rest of the day! In other words, standard festive fare but perhaps showing the market still intends further recovery. Should this be the case, above 7733 remains with the potential of a visit to 7778 points. Our alternate scenario remains viable, movement continuing below 7668 still expecting a visit to 7620 and hopefully a bounce. We suspect it shall be naïve to anticipate this sort of movement on Xmas eve.

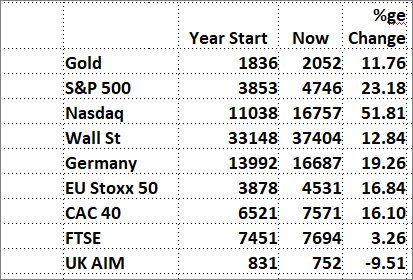

As promised, we’ve taken a look at the wider markets and can report how the UK has performed as against everyone else. Unfortunately, the picture isn’t great. The USA, now trading at all times highs, looks quite encouraging and next week, we shall produce some Big Picture outlooks for the future. The problem we see for the UK comes, should other markets discover an excuse to suffer trauma next year. The UK’s failure to express any form of reasonable gain, or in the case of the AIM market, actually declined in value creates a problem.

With no “fat under the belt”, a problem hurting other world markets is liable to prove extremely painful for the FTSE. It creates a situation where we’re nervous of any suggestion a share price may be “cheap” as things could go badly wrong very quickly.

To sum up each markets current prospects, France looks capable of positive movement of some strength and Germany echoes its position. The Nasdaq looks extremely poised to experience some sort of reversal hiccups. Wall St and the S&P appear to be in a similar zone, prices already stuttering at a logical high.

When we look at Gold, we suspect it shall mess around for a while in the 2000 to 2100 dollar zone. This will doubtless prove good news for the miners from Discovery’s Gold Rush!

And then, we have the FTSE. It is supposed to be in a zone where around 400 points of growth could be expected. But the continued lack of performance is proving a worry and as a result, we shall include it with next weeks Big Picture reports. In many respects, the struggling AIM market is taking an identical stance to the FTSE and perhaps some hope shall be evident for the near future. We shall obviously keep an eye on it.

And finally, have a pleasant festive break.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:00:17PM | BRENT | 7918.3 | 7834 | 7766 | 7700 | 7930 | 7937 | 7983 | 8050 | 7840 | ‘cess |

| 10:03:56PM | GOLD | 2045.76 | 2033 | 2029 | 2023 | 2044 | 2047 | 2051 | 2059 | 2039 | |

| 10:09:45PM | FTSE | 7695.1 | 7654 | 7615 | 7564 | 7682 | 7713 | 7720 | 7742 | 7676 | |

| 10:12:56PM | STOX50 | 4535 | 4511 | 4485 | 4449 | 4530 | 4531 | 4543 | 4560 | 4510 | |

| 10:16:09PM | GERMANY | 16728 | 16595 | 16563 | 16502 | 16678 | 16767 | 16807 | 16868 | 16690 | |

| 10:18:15PM | US500 | 4746 | 4707 | 4687 | 4657 | 4727 | 4749 | 4756 | 4777 | 4719 | |

| 10:21:22PM | DOW | 37369 | 37081 | 37011 | 36873 | 37188 | 37423 | 37476 | 37626 | 37325 | ‘cess |

| 10:23:45PM | NASDAQ | 16749 | 16618 | 16575 | 16511 | 16697 | 16771 | 16834 | 16928 | 16714 | Success |

| 10:26:18PM | JAPAN | 33316 | 33097 | 32999 | 32875 | 33218 | 33368 | 33399 | 33507 | 33234 |

21/12/2023 FTSE Closed at 7694 points. Change of -0.27%. Total value traded through LSE was: £ 4,049,214,798 a change of -30.21%

20/12/2023 FTSE Closed at 7715 points. Change of 1.01%. Total value traded through LSE was: £ 5,802,090,818 a change of -19.89%

19/12/2023 FTSE Closed at 7638 points. Change of 0.32%. Total value traded through LSE was: £ 7,242,394,350 a change of 68.88%

18/12/2023 FTSE Closed at 7614 points. Change of 0.5%. Total value traded through LSE was: £ 4,288,360,200 a change of -64.11%

15/12/2023 FTSE Closed at 7576 points. Change of -0.94%. Total value traded through LSE was: £ 11,949,408,359 a change of 47.73%

14/12/2023 FTSE Closed at 7648 points. Change of 1.32%. Total value traded through LSE was: £ 8,088,595,771 a change of 41.45%

13/12/2023 FTSE Closed at 7548 points. Change of 0.08%. Total value traded through LSE was: £ 5,718,449,628 a change of 4.86%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share:

********

Updated charts published on :