#FTSE #Gold In common, probably, with most households, my wife feels the need to supervise when “we” emplace Christmas lights at the front of our home. The back garden, however, is mine and I’m restricted to a long string of Led lights. This year, opting for something new, a bunch of nails were hammered into the big beech tree at the top of the garden, a thing about 60 feet tall with a trunk around 2 metres. The cunning plan was to create the outline of a traditional fir tree but when doing this job in daylight, it can be fairly difficult to be sure what the illuminated result shall be like.

We were sitting at dinner, when the timer clicked on. “What is that supposed to be?”, she asked. “Either a Christmas Tadpole (our grandchildren grow them to frogs every year) or perhaps a creative Christmas Sperm…” I replied. Apparently I’ve agreed to go up with step ladders and change the route of the lights. However, the results are shown below from a dodgy mobile phone snapshot.

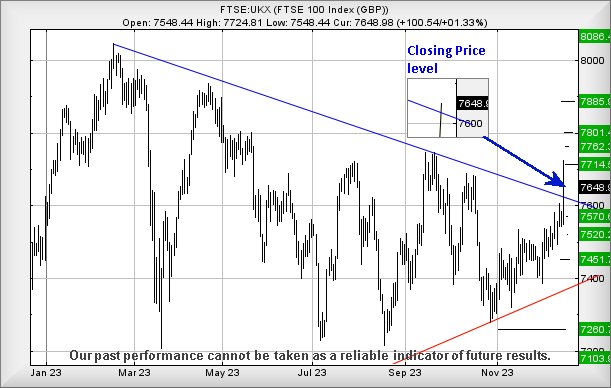

Similar to my Christmas lights, the FTSE opted to spend Thursday exploring an entirely new route in life, barging through the 2023 downtrend as if it didn’t know it was there. The index even contrived to spend a couple of hours above the prior high from October, giving some hope the rise would prove genuine and stay around for a while. Alas, this wasn’t to be but by closing the day at 7644 points, it successfully exceeded the trend break point of 7620 and gives a degree of hope for the future. Our attitude with this sort of thing is pretty basic, unless a market price actually closes a session above a prior number, what we’re looking at isn’t an official “higher high” and thus, we’re forced to curb our enthusiasm.

Something is certainly bothering us about the retreat from the day highs as the FTSE reversed quite a bit further than our intraday calculations allowed. In theory, the market should have bounced from around 7625 points but instead, the FTSE chose to plummet to 7606 points. This carries a threat of implicit weakness, creating a scenario where below 7606 risks triggering reversal to an initial 7570 with secondary, if broken, at 7520 and hopefully a bottom.

If triggered, the tightest stop looks like 7650 points.

As always, there’s a strong chance we’re fooling ourselves by falling into the mindset of always expecting the worst from the FTSE 100. This being the case, the index should only need exceed 7688 points to hopefully trigger a near term gain to an initial modest 7714 points. If bettered, our secondary calculates at 7762 points but importantly, in this instance there’s a very strong chance of a visit to a third level of 7801 points, a point where we anticipate some hesitation.

Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:12:57PM | BRENT | 7676 | 7547 | 7465 | 7707 | 7744 | 7765 | 7641 | Success | ||

| 9:22:12PM | GOLD | 2035.71 | 2028 | 2021 | 2039 | 2048 | 2058 | 2028 | Success | ||

| 9:25:01PM | FTSE | 7633.1 | 7608 | 7573 | 7657 | 7669 | 7687 | 7642 | Success | ||

| 9:36:48PM | STOX50 | 4533.7 | 4514 | 4488 | 4552 | 4556 | 4568 | 4536 | Success | ||

| 9:39:48PM | GERMANY | 16714.5 | 16659 | 16604 | 16760 | 16814 | 16856 | 16740 | |||

| 9:43:45PM | US500 | 7633.3 | 4683 | 4668 | 4712 | 4737 | 4752 | 4714 | |||

| 9:48:22PM | DOW | 37232 | 37046 | 36993 | 37226 | 37328 | 37882 | 37113 | ‘cess | ||

| 9:51:02PM | NASDAQ | 16526 | 16457 | 16415 | 16553 | 16670 | 16744 | 16574 | |||

| 9:53:23PM | JAPAN | 32665 | 32513 | 32504 | 32698 | 32884 | 32969 | 32711 | ‘cess |

14/12/2023 FTSE Closed at 7648 points. Change of 1.32%. Total value traded through LSE was: £ 8,088,595,771 a change of 41.45%

13/12/2023 FTSE Closed at 7548 points. Change of 0.08%. Total value traded through LSE was: £ 5,718,449,628 a change of 4.86%

12/12/2023 FTSE Closed at 7542 points. Change of -0.03%. Total value traded through LSE was: £ 5,453,180,069 a change of 16.03%

11/12/2023 FTSE Closed at 7544 points. Change of -0.13%. Total value traded through LSE was: £ 4,699,736,729 a change of -1.07%

8/12/2023 FTSE Closed at 7554 points. Change of 0.55%. Total value traded through LSE was: £ 4,750,603,507 a change of -16.53%

7/12/2023 FTSE Closed at 7513 points. Change of -0.03%. Total value traded through LSE was: £ 5,691,416,870 a change of -34.9%

6/12/2023 FTSE Closed at 7515 points. Change of 0.35%. Total value traded through LSE was: £ 8,742,933,283 a change of 113.36%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BDEV Barrett Devs** **LSE:CCL Carnival** **LSE:ECO ECO (Atlantic) O & G** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:IDS International Distribution** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:JET Just Eat** **LSE:MKS Marks and Spencer** **LSE:NG. National Glib** **LSE:OCDO Ocado Plc** **LSE:OXIG Oxford Instruments** **LSE:SBRY Sainsbury** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SPT Spirent Comms** **LSE:SRP Serco** **LSE:TSCO Tesco** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : AFC Energy, Asos, Aviva, Avacta, Barclays, Barrett Devs, Carnival, ECO (Atlantic) O & G, Experian, EasyJet, Fresnillo, Genel, International Distribution, IG Group, Intercontinental Hotels Group, Just Eat, Marks and Spencer, National Glib, Ocado Plc, Oxford Instruments, Sainsbury, Scottish Mortgage Investment Trust, Spirent Comms, Serco, Tesco, Taylor Wimpey,

LSE:AFC AFC Energy. Close Mid-Price: 21.05 Percentage Change: + 3.95% Day High: 22 Day Low: 20.25

In the event of AFC Energy enjoying further trades beyond 22, the share s ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:ASC Asos. Close Mid-Price: 401.1 Percentage Change: + 2.40% Day High: 414 Day Low: 396.5

In the event of Asos enjoying further trades beyond 414, the share should ……..

</p

View Previous Asos & Big Picture ***

LSE:AV. Aviva. Close Mid-Price: 431.1 Percentage Change: + 0.02% Day High: 440.5 Day Low: 428.6

In the event of Aviva enjoying further trades beyond 440.5, the share sho ……..

</p

View Previous Aviva & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 118.2 Percentage Change: -0.67% Day High: 121 Day Low: 111

Target met. Continued weakness against AVCT taking the price below 111 ca ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 10468 Percentage Change: + 0.75% Day High: 10690 Day Low: 10376

Continued trades against AZN with a mid-price ABOVE 10690 should improve ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 150 Percentage Change: + 6.32% Day High: 150.6 Day Low: 143.58

Further movement against Barclays ABOVE 150.6 should improve acceleration ……..

</p

View Previous Barclays & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 561.8 Percentage Change: + 3.58% Day High: 565 Day Low: 550.8

Target met. Continued trades against BDEV with a mid-price ABOVE 565 shou ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1341.5 Percentage Change: + 5.05% Day High: 1342 Day Low: 1300

Target met. In the event of Carnival enjoying further trades beyond 1342, ……..

</p

View Previous Carnival & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 9.35 Percentage Change: + 3.89% Day High: 9.35 Day Low: 9.05

If ECO (Atlantic) O & G experiences continued weakness below 9.05, it wil ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3229 Percentage Change: + 2.87% Day High: 3241 Day Low: 3178

Continued trades against EXPN with a mid-price ABOVE 3241 should improve ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 502.6 Percentage Change: + 2.43% Day High: 507.4 Day Low: 497.3

Further movement against EasyJet ABOVE 507.4 should improve acceleration ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 591 Percentage Change: + 3.94% Day High: 611 Day Low: 588

Target met. In the event of Fresnillo enjoying further trades beyond 611, ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 68.4 Percentage Change: + 5.39% Day High: 70.4 Day Low: 64.9

If Genel experiences continued weakness below 64.9, it will invariably le ……..

</p

View Previous Genel & Big Picture ***

LSE:IDS International Distribution. Close Mid-Price: 277.6 Percentage Change: + 3.27% Day High: 284.6 Day Low: 272.8

Target met. Continued trades against IDS with a mid-price ABOVE 284.6 sho ……..

</p

View Previous International Distribution & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 747.5 Percentage Change: -0.13% Day High: 766.5 Day Low: 749

Continued trades against IGG with a mid-price ABOVE 766.5 should improve ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 7076 Percentage Change: + 2.58% Day High: 7082 Day Low: 6970

All Intercontinental Hotels Group needs are mid-price trades ABOVE 7082 t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1339 Percentage Change: + 6.02% Day High: 1363 Day Low: 1308

Target met. All Just Eat needs are mid-price trades ABOVE 1363 to improve ……..

</p

View Previous Just Eat & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 265.3 Percentage Change: + 0.26% Day High: 268.3 Day Low: 264.1

All Marks and Spencer needs are mid-price trades ABOVE 268.3 to improve a ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1079.5 Percentage Change: + 0.56% Day High: 1100 Day Low: 1079.5

Target met. Continued trades against NG. with a mid-price ABOVE 1100 shou ……..

</p

View Previous National Glib & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 718.6 Percentage Change: + 11.62% Day High: 720 Day Low: 661.2

Target met. In the event of Ocado Plc enjoying further trades beyond 720, ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2285 Percentage Change: + 4.34% Day High: 2295 Day Low: 2220

Further movement against Oxford Instruments ABOVE 2295 should improve acc ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 300.3 Percentage Change: + 1.11% Day High: 304.7 Day Low: 299.4

Continued trades against SBRY with a mid-price ABOVE 304.7 should improve ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 776 Percentage Change: + 3.60% Day High: 779.4 Day Low: 765.4

Target met. All Scottish Mortgage Investment Trust needs are mid-price tr ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:SPT Spirent Comms. Close Mid-Price: 119.1 Percentage Change: + 3.21% Day High: 120.3 Day Low: 116.9

Continued trades against SPT with a mid-price ABOVE 120.3 should improve ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 162 Percentage Change: + 4.31% Day High: 164.2 Day Low: 157.8

In the event of Serco enjoying further trades beyond 164.2, the share sho ……..

</p

View Previous Serco & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 288.1 Percentage Change: -0.31% Day High: 293.5 Day Low: 287

Continued trades against TSCO with a mid-price ABOVE 293.5 should improve ……..

</p

View Previous Tesco & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 142.4 Percentage Change: + 3.60% Day High: 144.65 Day Low: 140.2

Target met. Continued trades against TW. with a mid-price ABOVE 144.65 sh ……..

</p

View Previous Taylor Wimpey & Big Picture ***